S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Sep, 2021

By Bill Holland

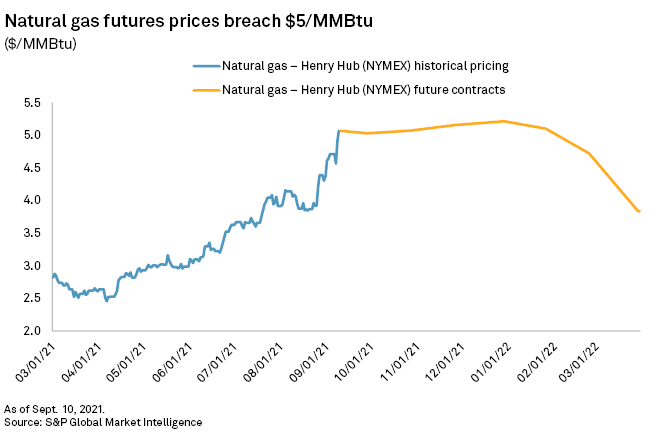

A combination of flat production and steady LNG export demand pushed NYMEX natural gas futures prices for the next five months higher Sept. 9, with the contract for October delivery hitting a seven-year high of $5.031/MMBtu.

Prompt month futures contracts have gained 94% in value since the April start of the storage season, and consumers and analysts are concerned that a cold snap this winter could push contract prices past the $10/MMBtu mark.

"Asian and Euro Zone storage operators are battling each other to grab every last molecule [to] fill storage, Russia is most likely holding back on some flow, temps are roasting [in] large swaths of the western U.S., and around 2% of production is down in the U.S. Gulf of Mexico" in the wake of Hurricane Ida, Mizuho Securities LLC director of energy futures Robert Yawger told clients Sept. 8. "Very little has to do with Henry Hub natural gas."

Analysts at energy investment bank Tudor Pickering Holt & Co., or TPH, pointed to anxiety over winter gas storage levels as one factor driving a price run-up that seems to be limited to contracts for winter 2022.

"Most of the move was concentrated heavily in the October '21 to February '22 curve up 7% with significant volume trading in the front-month contract while March '22 through December '22 only rose 3%," TPH said Sept. 9. "Clients we've spoken with over the last few weeks have become increasingly bullish on the winter set-up as sky-high global prices and low U.S. inventories open the door for upside if the weather cards fall favorably."

Goldman Sachs commodities analyst Samantha Dart said if the coming winter is colder than normal, natural gas prices could shoot past $10/MMBtu and threaten the LNG arbitrage between the cheaper Henry Hub in Louisiana and pricier markets in Europe and Asia.

"While a small colder deviation from average would likely be solved through gas-to-coal substitution against Appalachia coal in a $5-$6.50/MMBtu gas price range, anything close to a full standard-deviation from average would likely trigger a price spike to cause demand destruction with gas above $10/MMBtu," Dart said. In that case, Dart said, Henry Hub prices would need to rise to $15/MMBtu to shut the U.S. LNG export arbitrage.

Because the shale revolution shifted most U.S. gas production onshore, it has been a decade since hurricane-related shutdowns moved the gas markets. However, the U.S. gas market is so tightly strung that the roughly 2 Bcf/d lost to Hurricane Ida may have been the straw that broke the camel's back, energy research firm RBN Energy analyst Sheetal Nasta told clients.

"Given the precarious storage situation and lethargic production response thus far this year, it's no wonder that the market is supercharged and primed to pounce on even the slightest bullish indicator," Nasta said. "At this late stage in the injection season and with heating demand around the corner, it certainly seems like [the Sept. 8] price action above $5/MMBtu was just the tip of the iceberg."

Shale gas producers as a group will not share in the price run-up, analysts said, as most have hedged much of their remaining 2021 and early 2022 sales at prices nearer to $3/MMBtu and have shown little motivation to add more rigs and wells to capture what they see as a temporary move up in the price curve.

"For those looking to play upside to winter pricing, Chesapeake Energy Corp. remains the least hedged over the next few quarters," TPH said. "We think folks should be giving names north of the border a look as Tourmaline Oil Corp., ARC Resources Ltd. and Advantage Energy Ltd. have hedge books with significantly less coverage than their U.S. counterparts. Overall, while gas equities have had a nice run, we would continue to add exposure to our top picks Antero Resources Corp., Chesapeake, Tourmaline Oil and ARC Resources for those looking to own stocks over the next twelve months."

Buyer interest in the prompt month October contract cooled slightly near noon on Sept. 10, with a price of $4.955/MMBtu for the October contract, although prices for the winter 2022 months November through February were still above $5/MMBtu, according to market operator CME Group Inc.