S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Dec, 2022

By Joyce Guevarra and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

Manhattan, N.Y., is home to more than 170 million square feet of office space with Leadership in Energy and Energy Design certification, a widely adopted green building rating system awarded by the U.S. Green Building Council.

The LEED-certified office stock comprises nearly 40% of the total office inventory of the island, according to CBRE. These green buildings include new properties, such as SL Green Realty Corp.'s 1 Vanderbilt Ave. tower. Older ones including the Empire State and Chrysler buildings have also received certifications. Almost 90% of LEED square footage is over two decades old, and the average construction date for certified buildings is 1960.

New York City could see further growth in the number of green-certified office buildings. The city has passed local laws that encourage reducing emissions and improving energy efficiency in buildings from as early as 2009 and has revised its LEED scorecard to ensure that even the oldest buildings gain some level of certification, according to CBRE.

On top of that, there are financial benefits to investing in sustainable buildings. LEED-certified properties can command at least 2.1% of rent premium versus non-certified buildings. This premium could grow up to 13.6% as the age of the building increases, according to CBRE's analysis.

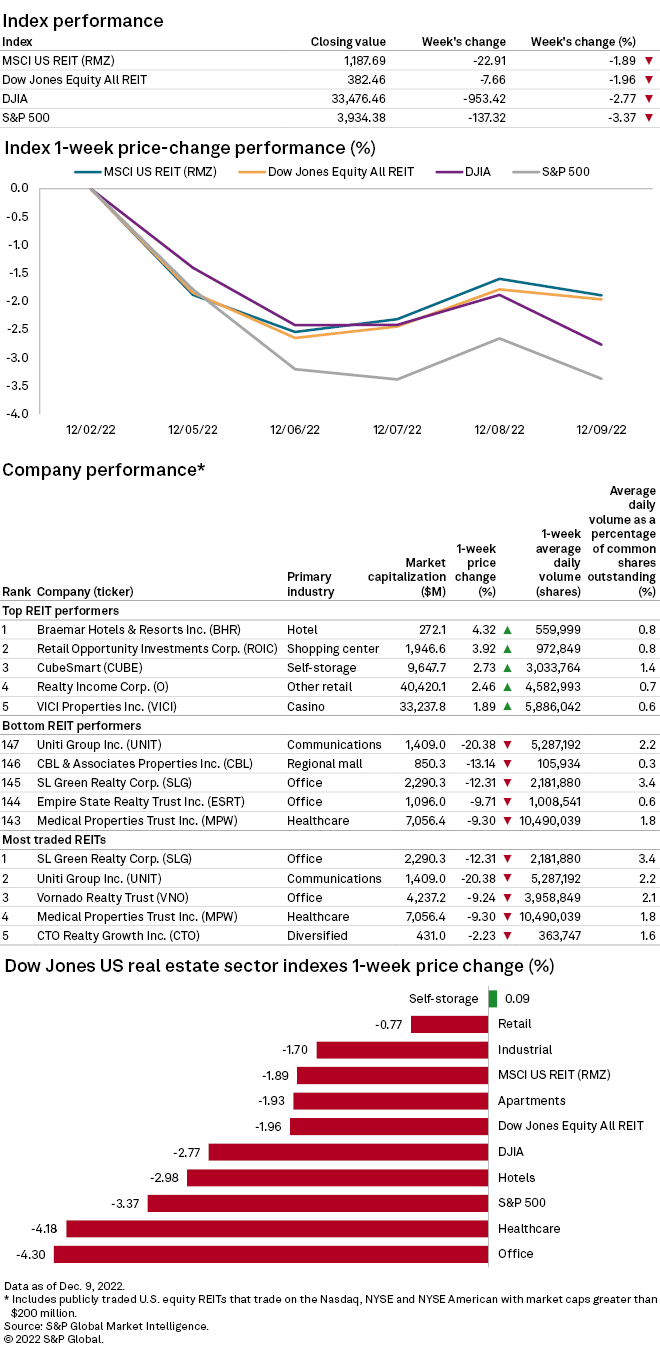

CHART OF THE WEEK: REIT share prices down in week ended Dec. 9

⮞

⮞

⮞

M&A

* The Real Brokerage Inc. finalized its acquisition of home loan platform LemonBrew Lending Corp.

Property transactions

* Oxford Properties Group Inc. sold the 40-story Kiara luxury apartment building in Seattle to an affiliate of Spanish real estate investment firm Ponte Gadea SL for $322.7 million, the Puget Sound Business Journal reported, citing a deed.

* A joint venture between Maya Capital Partners LLC and Artemis Real Estate Partners LLC seeks to invest $300 million in self-storage properties across the Northeast U.S. The joint venture was seeded by the purchase of a 1,120-unit class A self-storage asset in New Rochelle, N.Y.

Loans

* Eagle Rock Properties secured a $323 million debt package from Capital One and New York Community Bank for the acquisition of five multifamily properties across Massachusetts and New Hampshire, Commercial Observer reported. The portfolio comprises 1,314 units.

* Boardwalk Investments Group secured $245 million for the refinancing of a six-property mixed-use portfolio in California. The assets are in Yountville, Laguna Beach, Del Mar, Newport Beach and San Diego.

Data Dispatch: 8 US REITs, 5 Canadian REITs announce higher dividends in November

US housing market chills as home sales drop at unprecedented rate