S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Sep, 2022

By Allison Good

Nuclear plant owners already looking at a tax credit in the recently passed U.S. federal climate package derive additional benefits by supplying electricity to hydrogen producers, according to industry analysts.

Constellation Energy Corp., with a nuclear generation fleet of more than 21,600 MW, in particular, would benefit from unlocking "new potential opportunities for merchant nuclear plants and attractive returns for hydrogen facilities," Morgan Stanley told clients in a Sept. 12 report.

Dedicating 5% of that nuclear capacity, about 1,000 MW, to clean hydrogen production would increase annual EBITDA by $300 million to $350 million, which would account for 10% of Constellation's total EBITDA, according to Morgan Stanley, and "could crystallize in the 2026 time frame," with the potential for some contributions in 2025.

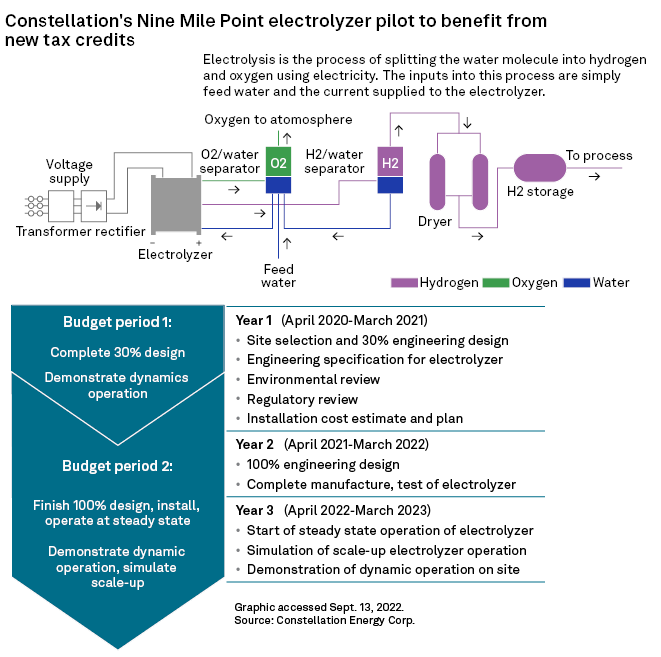

Constellation is already incorporating clean hydrogen conversion into its existing fleet, having been awarded a grant by the U.S. Department of Energy in partnership with Nel Hydrogen Inc. and three national laboratories to start hydrogen production this year from a 1-MW electrolyzer powered by its Nine Mile Point nuclear plant in New York.

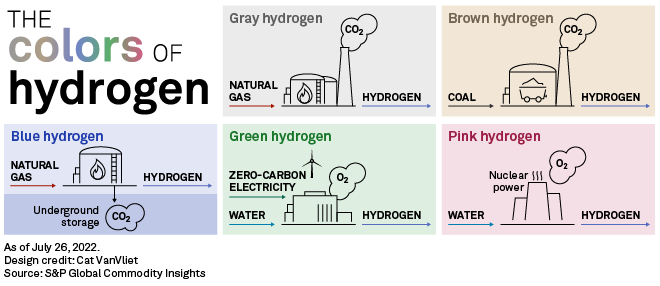

Among the provisions in the Inflation Reduction Act, signed into law by President Joe Biden Aug. 16, are a $3/kg tax credit for hydrogen produced by non-carbon emitting power sources like nuclear. The climate package also includes a production tax credit, or PTC, for nuclear, with floor pricing of $40/MWh to $44/MWh.

These benefits represent a "gamechanger" for merchant nuclear plants, S&P Global Ratings said in a Sept. 8 commentary, noting that in recent years these "beleaguered" assets have been retiring or seeking state assistance to continue operating. "The PTCs change the model for unregulated nuclear power generators from a merchant business to a nine-year contracted business," Ratings analysts wrote.

The new law could also "make green hydrogen economical today, a decade sooner than expected," S&P Global Ratings added.

During an August earnings call, Constellation President and CEO Joseph Dominguez said the Inflation Reduction Act's provisions "concerning clean hydrogen and, specifically, the ability of nuclear plants that earn both the nuclear PTC and the hydrogen PTC means that nuclear plants will become a key cog in clean hydrogen and sustainable fuels."

Constellation shares have soared nearly 60% since the surprise budget reconciliation agreement between Sen. Joe Manchin, D-W.Va., and Senate Majority Leader Chuck Schumer, D-N.Y., was announced July 27, settling at $88.13 on Sept. 12.

Xcel Energy Inc. will also start producing green hydrogen at its Prairie Island nuclear plant in Minnesota beginning in 2024 that will have a full capacity of about 90 kg of hydrogen per day. The DOE awarded the company $10 million for the $12 million pilot, which will use high-temperature electrolysis to separate the hydrogen and oxygen in water "compared to traditional low-temperature electrolysis methods."

The DOE on Sept. 1 announced it is looking for applicants who want to fund similar projects, with bids due in October.

Energy Harbor Corp. "is also in a good position to benefit from" the green hydrogen tax credit, while Vistra Corp. and NRG Energy Inc. will not see any shorter-term cash flow increases, S&P Global Ratings wrote.

Public Service Enterprise Group Inc.'s 3.8-GW merchant power arm, meanwhile, may also see better returns if the New Jersey state zero-emission credits are replaced by the nuclear production tax credit, which is more valuable than the local $10/MWh credit in place, S&P Global Ratings noted.

Nuclear and green hydrogen are a particularly symbiotic pairing, Morgan Stanley noted, because "electrolyzers benefit from running constantly rather than ramping up and down in utilization." Wind and solar power cannot provide that round-the-clock power source.

Transportation of hydrogen remains a financial obstacle, but reaching potential end-use customers within about a 100-mile radius of a production facility should be feasible, Morgan Stanley added. Within that range, hydrogen can be kept in a gaseous state, which would be less expensive to transport.

The pool of potential nuclear plants that could be interested in making green hydrogen may also grow as companies like PG&E Corp. and Holtec International Inc. apply for funds from DOE to rescue financially struggling nuclear plants due for retirement.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.