S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Oct, 2021

| Public Service Enterprise Group's Hope Creek facility in New Jersey is one of several U.S. nuclear plants receiving state-issued zero-emission credits as Congress mulls federal tax incentives for existing nuclear plants. |

The U.S. nuclear energy sector is pushing for a proposed tax credit for existing plants to relieve financial pressure on the industry as it struggles to compete against abundant natural gas-fired generation and growing renewable output. But if that effort fails, a broad infrastructure bill in Congress includes what industry members see as more modest support for struggling nuclear plants.

A proposed production tax credit, or PTC, for nuclear plants was included in the budget reconciliation package that Democrats in the U.S. House of Representatives have crafted to help carry out President Joe Biden's Build Back Better agenda. The bill would provide a base credit rate of 0.3 cents/kWh and a bonus credit rate of 1.5 cents/kWh for electricity produced from a qualifying nuclear facility, with the credit reduced as the sales price of power from that plant rises.

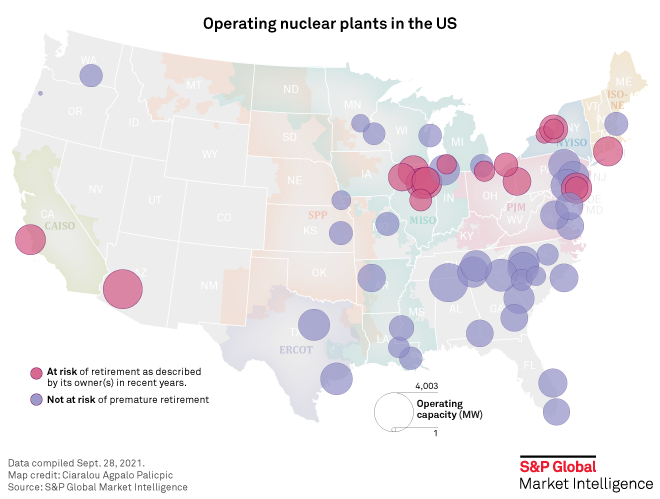

Issuance of the PTC could provide vital financial support to the nuclear fleet, which provides around 20% of total U.S. electric output and more than half the country's carbon-free generation. Despite a push from the Biden administration and some states to decarbonize the power sector, about 31.8 GW of nuclear capacity is at risk of premature retirement or planned for closure in the coming years, according to statements from plant owners compiled by S&P Global Market Intelligence.

"The most impactful thing Congress can do to help ensure the existing nuclear fleet can survive is to enact the production tax credit," Public Service Enterprise Group Inc. Chairman and CEO Ralph Izzo said in an emailed statement.

A combination of high operating costs, depressed power prices in wholesale markets and competition from gas-fired and renewable generation have weighed on the economics of nuclear power. Plant owners have also blamed absent or inadequate policies to reward zero-carbon energy for undervaluing the benefits of nuclear power.

David Brown, senior vice president of government affairs and public policy for Exelon Corp., said the PTC "really provides the long-term certainty that is needed to keep these plants operating." In terms of policies before Congress, "the PTC has really been the industry's focus and what we're most excited about," Brown said.

PSEG owns the 1,172-MW Hope Creek nuclear plant in New Jersey, and along with Exelon, co-owns units 1 and 2 of the 2,295-MW Salem facility in the state. In April, the New Jersey Board of Public Utilities voted to extend the state's zero-emission certificate subsidies for Hope Creek and Salem, without which PSEG said both plants would need to shut down.

Infrastructure bill could be 'safety valve'

Enactment of the reconciliation bill is far from assured. Progressive and moderate Democrats are at odds over the total price tag for the legislation, as well as its energy provisions. The fight over the reconciliation package is also holding up a separate infrastructure bill that the Senate passed in August with bipartisan support.

If the reconciliation package fails but the infrastructure legislation manages to pass the House, a nuclear energy incentives program contained in the infrastructure bill could offer some aid to vulnerable plants. The infrastructure legislation includes a $6 billion program for nuclear units in merchant power markets at risk of closure. The credits would be allocated across a four-year period and cannot exceed a qualifying plant's average projected annual operating loss in dollars per megawatt-hour.

The program was modeled after legislation that U.S. Sen. John Barrasso, R-Wyo., introduced last Congress as chair of the Senate Environment and Public Works Committee, according to Brown. That bill, which passed the committee with bipartisan support, would direct the U.S. Environmental Protection Agency to establish a credit program for nuclear reactors at risk of closure due to economic factors.

Sen. Joe Manchin, D-W.Va., who chairs the Senate Energy and Natural Resources Committee, has previously co-sponsored legislation to create a nuclear PTC. But the Senate energy committee does not have jurisdiction over the EPA and tax-related policies, so Manchin included a nuclear credit program in the infrastructure bill that was similar to Barrasso's proposal but ran by the U.S. Energy Department, according to Brown.

By adding that proposal to the infrastructure bill, Manchin created a "safety valve" for the nuclear industry if the reconciliation package stalls, Brown said.

The federal credits could be used to reduce payments to nuclear plants under state zero-emission credit programs or other state-based clean energy initiatives. As a result, the program "may take some of the pressure off the states" subsidizing nuclear power and "really socializes the cost of keeping nuclear online," said Lillian Federico, research director for energy for Regulatory Research Associates, a group within S&P Global Market Intelligence.

If enacted, the infrastructure legislation could also support two nuclear plants in Ohio that had been set to receive $150 million in subsidies under a now-repealed state nuclear credit program, according to Federico. At the end of March, Ohio Gov. Mike DeWine signed a bill that ended the $9/MWh credit paid to the 908-MW Davis-Besse and 1,268-MW Perry nuclear plants in response to an alleged bribery scheme behind the passage of the state subsidies law.

Nuclear plant operators in Maryland and Pennsylvania may also be interested in the infrastructure bill's credit program, with those two states lacking subsidy programs for nuclear energy facilities, Federico said.

Production tax credit still the focus

Despite potential relief from the infrastructure bill, Brown said Exelon was "not as excited" with that legislation compared to the proposed PTC in the reconciliation package. Illinois' governor recently signed a bill providing $700 million in subsidies over five years to Exelon's 2,346-MW Byron, 1,805-MW Dresden and 2,384-MW Braidwood nuclear plants in Illinois. Had the state not done so, Exelon said the infrastructure package's credit program would not be enough to save the Byron and Dresden plants.

"I think the nuclear grant program [in the infrastructure bill] is very well-intentioned but kind of falls short of what the industry needs to support the existing fleet," Brown said.

The Nuclear Energy Institute said the infrastructure bill extends support to nuclear in several areas, including by providing funding for the DOE's advanced reactor demonstration program and hydrogen demonstration projects that could take place at nuclear facilities. But the group still sees a nuclear PTC as the bigger priority.

"While the Senate infrastructure package is a welcome step forward, additional action must be taken through the reconciliation bill's nuclear production tax credit that will go even further to retain our existing nuclear fleet and effectively address the economic hurdles our carbon-free nuclear plants are facing," said John Kotek, Nuclear Energy Institute's senior vice president of policy development and public affairs.