S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 May, 2021

By Jon Rees and Francis Garrido

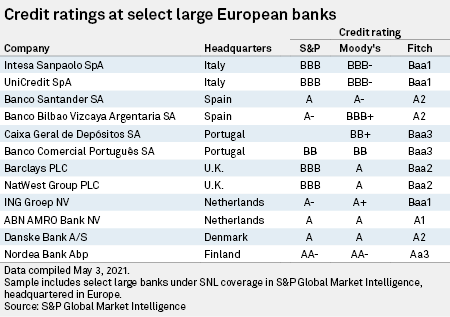

Banks in northern Europe have begun to make impairment releases after front-loading loan loss provisions in 2020 due to the COVID-19 pandemic, but the same is unlikely to happen soon with southern European banks, analysts said.

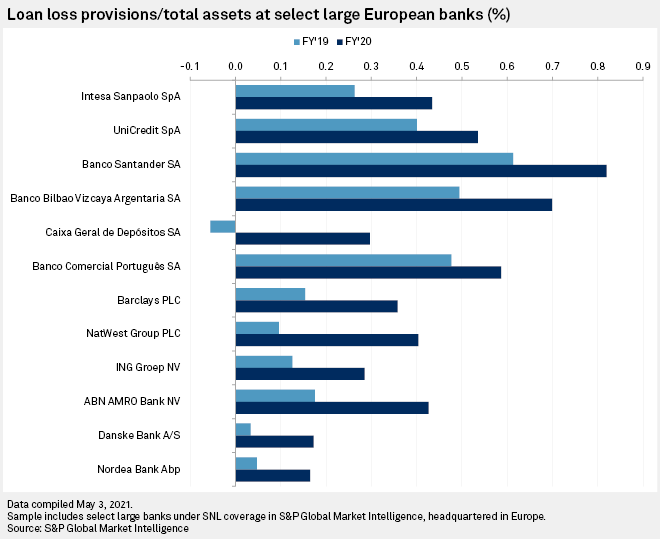

Northern European banks increased their loan loss provisions in their year-end results 2020, said Osman Sattar, analyst at S&P Global Ratings. "We saw at the year-end that the uptick in provisions were higher particularly in U.K., Ireland and Netherlands' banks and not as high in some of the Italian and Spanish banks," he said.

Sattar's base-case scenario of widespread vaccine take-up by the third quarter of 2021, along with the assumption that variants of the COVID-19 virus do not derail the gradual lifting of lockdown measures, could see further provision releases in northern European banks.

"Whereas in some of the southern European banks that we cover that may not happen because they may not have taken the provisions that the other banks had," he said.

NatWest Group PLC, for instance, joined Lloyds Banking Group PLC and HSBC Holdings PLC in announcing an impairment release when it unveiled its first-quarter 2021 results. Barclays PLC took a sharply reduced impairment charge of £55 million, down 97% from £2.1 billion in the first quarter of 2020.

Nordic banks Danske Bank A/S and Nordea Bank Abp made among the sharpest increases in provisions for 2020 versus 2019, though neither bank has yet followed their U.K. peers and released provisions on the expectation of better times ahead.

"We see a limited credit deterioration, much in line with what we also saw before the pandemic in terms of run-rate, if you will. We remain cautious," said Carsten Egeriis, Danske's new CEO, on a call with analysts following its first-quarter earnings report.

ABN AMRO Bank NV CEO Robert Swaak said at full-year results that the bank expects impairments in 2021 to be below 2020 and analysts at Rabobank Research said they expect large loan loss provisions to be released.

Spain's Banco Bilbao Vizcaya Argentaria SA increased its provisions less sharply than NatWest, for instance, but CEO Onur Genç said the €2.2 billion in provisions would not be released until the economic situation was clearer.

Banco Santander SA CEO José Antonio Álvarez said the bank had "barely used" last year's provisions but there remained "significant uncertainties" in small and medium-sized enterprise and corporate loan books, so the bank would not release provisions this quarter.

Banco Comercial Português SA said at its full-year results that it considers its level of provisions to be adequate.

Banks' provisioning charges are likely to remain elevated in 2021, said Sattar, before reducing more significantly in 2022.

Italian banks were more gradual in provisioning throughout 2020, though UniCredit was an exception since it front-loaded relatively high loan loss provisions in the first quarter, Fitch analyst Francesca Vasciminno said.

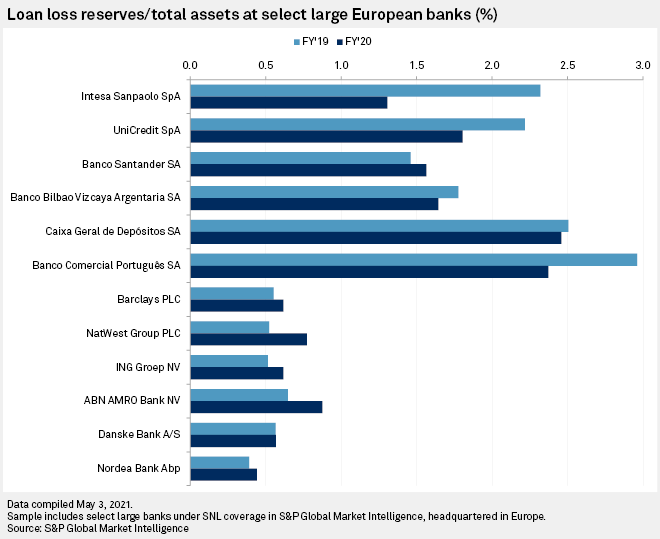

Italian banks are generally guiding toward lower impairment charges in 2021 compared to 2020, Vasciminno said, but they are likely to remain sizeable in 2021 and close to prior-year levels. At the same time, Fitch expects Italian lenders to try to keep their nonperforming loan levels under control through disposals, as banks did throughout 2020.

"As well as continuing to provision for the higher flows of impairments, they will provision to continue to dispose of the legacy loans. So that's why we expect loan impairment charges for 2021 not to be very dissimilar to 2020," Vasciminno said.

Asset quality

The contrast between northern and southern European banks is not necessarily because of a difference in the provision of state-guaranteed loans in the face of the pandemic.

"The uptake of loans guaranteed by the state has varied across jurisdictions, so I don't think that's the cause. The provisions on the existing loan book are by far the biggest weight," said Sattar.

Indeed, the provision of state-backed loans is so far concentrated in six countries spread across Europe, said Sattar. These are Spain, Italy, Poland, France, Portugal and the U.K., and the average volume of such loans is 1.25% of GDP, though both Spain and Italy are at a much higher percentage than, say, the U.K.

Sattar said if the vaccine rollout does not go as planned, that could expose weaknesses in banks.

"There may be areas of risk in loan books that are not yet covered by provisions because of the support that's been in place that then come to light, and there might be a small uptick in provisions as a result," he said.

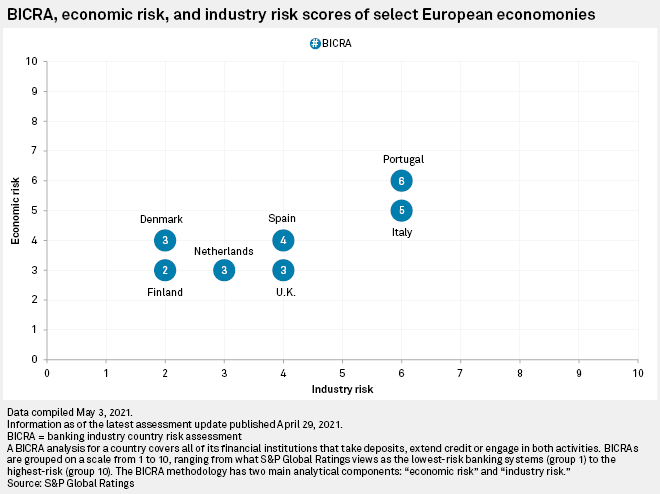

Asset quality tends to be stronger in northern European countries compared with southern countries, too, Fitch analyst Cristina Torrella told S&P Global Market Intelligence.

"That element on its own explains the higher cost of risk of the southern European banks. We expect northern European countries to stabilize a bit faster than those in the south because they have stronger economies. It is plausible to think that, from a cost of risk perspective, they should also benefit from that," said Torrella. The cost of risk refers to credit losses as a proportion of customer loans.

Jefferies' analyst Benjie Creelan-Sandford said the level of state-backed policy support, including state-guaranteed loans and loan moratoriums, made the pandemic different from other financial crises.

"In southern Europe, particularly a country like Spain, for instance, given the importance of the tourism sector, the pace of reopening the economy will have some knock-on to the provisions outlook," he said.

Banks across Europe had booked considerable levels of provisions and the risks should be more than manageable, Creelan-Sandford said. He noted that Bankinter SA's latest results saw it improve its cost of risk outlook for this year as the lender said it does not plan to set aside more provisions against bad loans, though he said the Spanish bank's assets were regarded more favorably than some of its peers.