Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Apr, 2022

Welcome to The Daily Intel, a roundup of exclusive news and analysis from S&P Global Market Intelligence, curated by our journalists.

Editor's Pick

Inflation puts dent in M&A after white-hot 2021

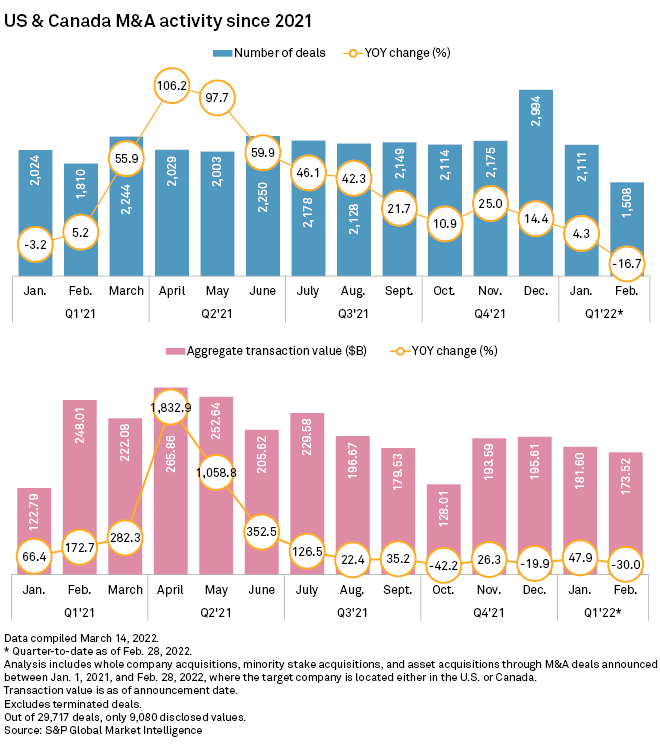

After a record-breaking 2021, North American deal-making has slowed down this year amid skyrocketing U.S. inflation and prospects of interest rate hikes.

The number of M&A deals in the U.S. and Canada fell 16.7% year over year in February, while the value of those deals dropped 30% over the same month in 2021, according to S&P Global Market Intelligence data. The financial sector saw the biggest decline in M&A deal value in February with a 74.4% drop-off year over year.

"As rates rise, the cost of financing transactions increases, potentially preventing certain companies from pursuing M&A deals that they might otherwise have undertaken," said Emilie Feldman, a professor at the University of Pennsylvania's Wharton School.

Credit and Markets

Default risk rises across most US sectors in Q1

Healthcare carried the highest risk of defaults as of March 31, according to S&P Global Market Intelligence probability of default data.

Wider credit spreads unlikely to spook Fed on rates

Widening corporate credit spreads have given the Federal Reserve pause for thought in previous rate hiking cycles, but healthy balance sheets could lead the Fed to prioritize tackling runaway inflation this time.

Financials

Multiple newly public US financial stocks post big losses in March

Five U.S. financial stocks that have started trading since 2020 dipped to all-time lows in March.

Trade finance turns corner amid revenue rebound, bright 2022 outlook

Trade finance revenues stand to receive a boost in 2022 from record-high commodity prices and higher interest rates.

Insurance

Market caps of 10 largest listed European insurers decline in Q1

Allianz remained well ahead of its peers as its market capitalization rose 4.0% quarter over quarter to €88.20 billion.

Technology, Media and Telecommunications

Technology M&A values dive in Q1 even as volumes hit record

The prospect of higher interest rates hit equity markets hard in the first quarter and translated to a dip in M&A valuations. But deal volumes remained at a record high, and analysts expect acquirers to buy into the dip.

Energy and Utilities

Utilities, energy outperform other S&P 500 sectors in March

Still reaping the benefits of rising crude and natural gas prices, the S&P 500 Energy Index saw a total return of 9.0% in March.

Private Equity

Cryptocurrency demand fuels record level of PE blockchain investment

Multiple return potential and increasing regulatory clarity are also attracting private capital to the technology.

Real Estate

US REIT stocks down overall in Q1; hotel, healthcare stocks log positive growth

On a one-year basis, real estate investment trusts' share prices outperformed the broader market, with the Dow Jones Equity All REIT index generating a 23.5% return, compared with a 15.6% return for the S&P 500.

Want more sector-focused news?

Read our in-depth coverage of Financials, Real Estate, Energy & Utilities, Materials, Healthcare and TMT on the S&P Capital IQ Pro platform.