S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Aug, 2021

By Peter Brennan and Stefen Joshua Rasay

The near-record pace of deal-making in North America is likely to continue as cash-rich companies, fueled by low borrowing costs, look to expand during the economic rebound, experts say.

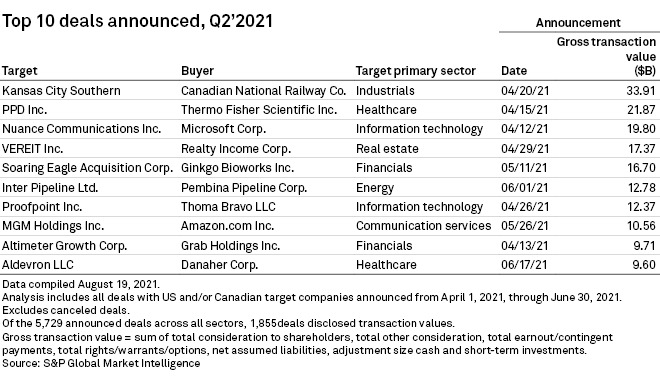

During the second quarter, companies announced 5,712 deals with targets in the U.S. or Canada at a combined disclosed value of $604.52 billion, according to S&P Global Market Intelligence data. The number of deals was only slightly lower than the 5,808 announced in the first quarter of the year, which was the highest quarterly total this century.

Acquisitive companies have been on a tear of purchases since September 2020 as government spending and supportive monetary policy removed the risk of mass defaults. Even as U.S. President Joe Biden's administration targets greater scrutiny of alleged anticompetitive activity, the conditions supporting the breakneck pace of deal-making appear primed to last, experts say.

"There is an incredible, massive merger wave," Robyn Shapiro, communications director at the American Economic Liberties Project, an anti-monopolist organization, said in an interview. "Based on what we're seeing, 2021 is on track to be an unprecedented year for acquisitions."

Bouncing back from the COVID-19 slump

In the first six months of 2021, the disclosed value of M&A deals totaled $1.2 trillion, compared to just $287.50 billion in the first half of the pandemic-affected 2020.

M&A activity slumped in early 2020 as COVID-19 spread into North America and companies prioritized building cash buffers over investment. But as the economy began to recover, companies found themselves with extra money to burn.

"There is a lot of excess cash on the balance sheet. Some have used that money to delever and pay down their debts, others have used that money to acquire or consolidate," Ramki Muthukrishnan, senior director and head of leveraged finance at S&P Global Ratings, said in an interview.

Companies borrowed from bond markets at record amounts in 2020 to improve their liquidity. Bond issuance remains strong in 2021 as companies look to borrow at low levels, but now they are refinancing existing debts at lower rates or using cash to expand.

M&A-related issuance by U.S. investment-grade rated companies surged 50% in the first half of 2020 to $115.48 billion, according to data from LCD.

Private equity is also awash with cash, while the rise of special purpose acquisition companies — shell companies created to raise capital through an IPO to take a company public — contributed to the surge in M&A with $91.37 billion in deals in the first three months of the year. The value of U.S. SPAC deals fell to $11.70 billion in the second quarter as the SEC decided to take a closer look at the accounting practices of the red-hot asset class.

Biden beefs up regulators

Deals are surging as the Biden administration readies a regulatory push aimed at avoiding anticompetitive mega-mergers.

Sens. Elizabeth Warren and Bernie Sanders attacked monopolistic power in sectors including tech and pharma long before Biden's election.

Biden responded by signing an executive order July 9 to promote competition, while his appointment of Lina Khan as chair of the Federal Trade Commission was seen as a statement of intent. Khan is a critic of Amazon.com Inc. and wrote an academic paper arguing for the company to split while she studied at Yale Law School.

Biden's nomination of Jonathan Kanter to head the U.S. Department of Justice's antitrust division was seen as a similarly pro-competition move.

Amazon and fellow tech company Microsoft Corp. feature in the top 10 announced in the second quarter, with deals for MGM Holdings Inc. and Nuance Communications Inc., respectively.

M&A has been largely waved through by regulators in the last 40 years with the Justice Department investigating just 2.4% of the mergers reported to it on antitrust grounds in 2018, compared to 13.6% in 1978.

"Corporate concentration has shifted the way the economy works from everything from tech to farming to cheerleading," Shapiro of the American Economic Liberties Project said. "The FTC has not done its job for 40 years, the fact that it's interested in doing so now is an incredible development, so we'll see just how much power the agency will exert."

Credit spreads under control

More assertive regulators may target anticompetitive practices by the largest companies, but that will not prevent continued M&A among smaller groups, said Muthukrishnan of Ratings. For now, low borrowing costs and the liquidity available in the debt markets will continue to encourage mergers and acquisitions.

Bond yields have crept up in recent weeks over worries of an economic slowdown and the potential for the Federal Reserve to use its annual economic symposium to outline its plan to taper its quantitative easing program, which provides $120 billion per month in combined liquidity to Treasury- and mortgage-backed security markets. Rising yields mean companies may pay more to tap the corporate bond market.

The yield on the S&P U.S. Investment Grade Corporate Bond Index was 1.88% as of Aug. 24, higher than the low point of 1.64% at the start of the year. But this remains historically low and far below the pre-pandemic level of 2.4%, meaning companies are still paying less to issue new debt.

"When the tapering takes place there will be a reaction and there will be volatility, but companies are absolutely right to reinvest and where there are M&A opportunities, they are right to take on leverage," Christopher Rossbach, portfolio manager of the J. Stern & Co. World Stars Global Equity Fund, said in an interview.

LCD is an offering of S&P Global Market Intelligence.