S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Feb, 2022

By Eric Oak

U.S. seaborne imports fell to 2,669,536 twenty-foot equivalent units in January, down 0.2% from the month before. Panjiva's preliminary data shows that this is 1.4% lower than January 2021 and continues what could be described as a post-holiday shipping hangover as carriers and ports continue to process backlogs. Shipments were also smaller in January, despite being up 12.1% year over year, likely representing less than container load volumes and fragmented logistics for shippers when compared with the relatively static TEU numbers.

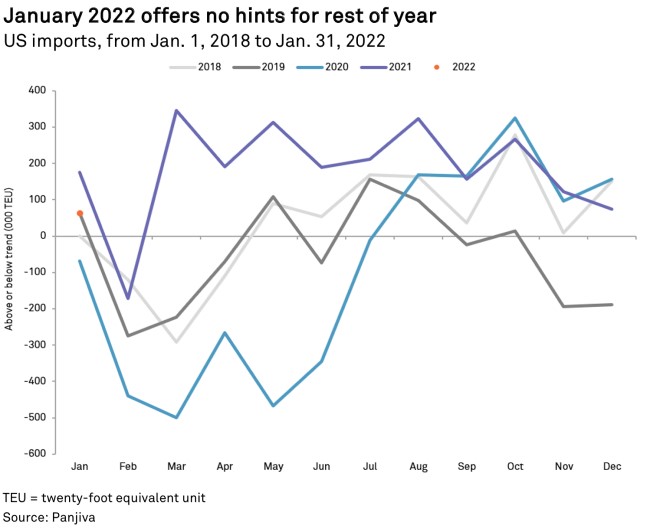

Panjiva data has not yet given any hints on where the remainder of the year will go, however, with imports falling squarely within the expected range. The trend in U.S. imports from 2010 to the end of 2021 was calculated, and January 2022 was 63,400 TEU above the trend line, comparable to the level recorded in 2019 (63,000 TEU above the trend). This is lower than 2021, when January imports were 176,200 TEU above the trend line. But a better guide to the direction of 2022 will likely come with the March numbers, given that February is impacted by Lunar New Year disruption. If 2022 diverges from the rapid increase in imports seen in March 2021, there may be cause for optimism from shippers.

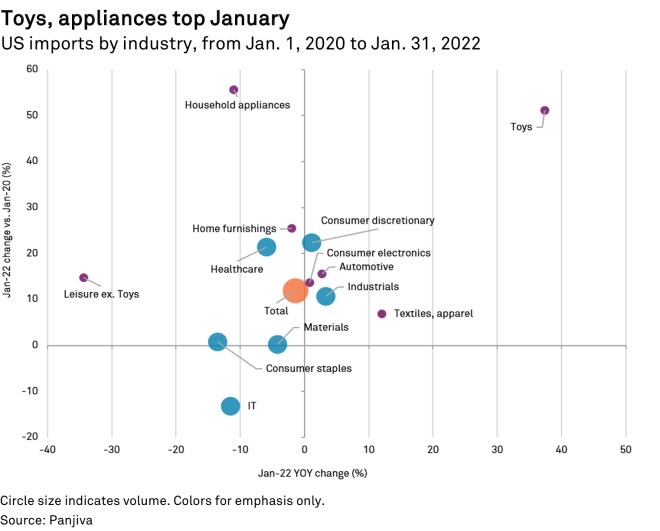

Breaking out Panjiva data by industry shows the shipping hangover in action. Imports of toys in January increased 37.4% year over year and 51.1% from 2020, with both data points indicating that January is a light month for such seasonal imports. One of the trends of the pandemic was a consumer shift to purchasing durable goods for use at home, although most of these were one-time purchases. This was evident in January imports of other leisure products, which fell 34.4% year over year.

Another standout is the household appliances industry, imports of which increased 55.6% from 2020 but fell 11.0% year over year, likely driven by the same factors. Small electrical appliances such as coffee makers, hairdryers and toasters are more frequent purchases for many consumers spending more time at home and could be more "fad-driven" than larger appliances. This may have kept imports from falling as much as leisure products year over year.

On the other end, IT imports continue to fall, down 11.6% year over year in January. This is the much-discussed chip shortage, impacting companies that use semiconductors, microcontrollers and, even, solder. Consumer staples and materials imports also declined in January, down 13.5% and 4.2% year over year, respectively, while relatively close to 2020 levels. These sectors are likely impacted by the same factors and are experiencing a fall from pandemic-related demand.

Household appliance producers showed different outcomes among common threads. Imports linked to AB Electrolux grew 23.8% year over year in January after a 19.0% increase in the fourth quarter of 2021, likely breaking through some of the challenges it predicted last year. CFO Therese Friberg said on a Jan. 28 earnings call that difficulties remained, noting that "supply chain constraints resulted in production inefficiencies due to low planning visibility as well as increased cost for logistics and electronic components." This indicates that the company was not able to produce as many end units as desired.

Imports linked to LG Electronics Inc. were up 21.6% year over year in January after falling 7.8% in the fourth quarter of 2021. The January increase is much lower than the large, likely pandemic-driven growth recorded by the company in previous quarters and could be related to some of the measures it took to mitigate the impact of logistics disruptions and the rise of raw material prices. Home appliance and air solution officer I-Kueon Kim said on the company's Jan. 27 conference call that they are "fostering key makers in each region and making various efforts such as multisourcing and SCM optimization." Kim also talked about the company's projections, saying, "[U]ntil the current COVID situation subsides, we believe the demand for durable goods will remain largely flat versus last year."

Samsung Electronics Co. Ltd. and Conair Corp.'s associated imports continued to decline, down 14.3% and 46.3% year over year respectively in January after dropping 26.2% and 28.3%, respectively, in the fourth quarter of 2021. Samsung echoed many of the challenges noted by LG, with Vice President of Digital Appliances S.T. Chung saying on the Jan. 27 call that "market growth was slow due to diminishing impact of the pent-up demand and material and logistical [issues]." Samsung was less optimistic than its peer, however, as Chung added that they expect "demand for home appliances to decline slightly year on year," and logistics and material costs to keep rising.

Eric Oak is a researcher at Panjiva, a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.

The S&P Capital IQ Pro and S&P Capital IQ platforms are owned by S&P Global Market Intelligence.