S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Dec, 2021

By Mary Christine Joy and Cheska Lozano

Nordic banks saw a year-over-year decline in their loan-to-deposit ratios in the third quarter but remained the highest among large European lenders in the period, S&P Global Market Intelligence data shows.

Sweden's Svenska Handelsbanken AB (publ) topped the ranking with a loan-to-deposit ratio — a key metric to assess a bank's liquidity — of 162.9% at the end of September despite seeing a steady year-over-year decline since 2018. Finland-based Nordea Bank Abp placed second with a ratio of 162.5%, compared to 168.7% a year ago, followed by Denmark's Danske Bank A/S with 156.2%, down year over year from 161.4%.

Swedish lender Skandinaviska Enskilda Banken AB (publ) had a loan-to-income ratio of 104.1% at the end of September, down from 129.9% a year ago.

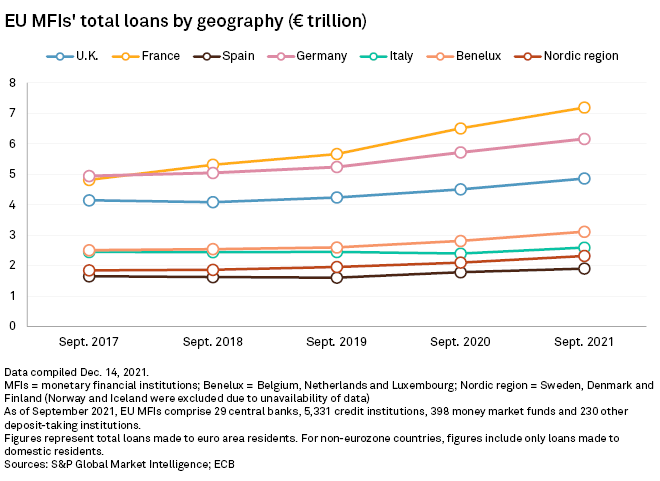

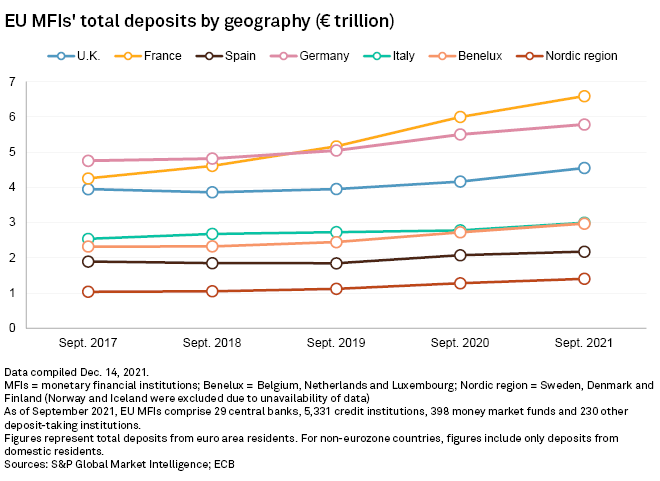

Monetary financial institutions, or MFIs, in the Nordic region saw their total loans rise to €2.32 trillion in September from €2.10 trillion a year ago, according to ECB data. Total deposits also rose on a yearly basis, to €1.40 trillion from €1.28 trillion, although the remained the lowest in Europe.

French MFIs continued to hold the highest levels of total loans, at €7.19 trillion, and deposits, €6.59 trillion, in the period, followed by Germany and the U.K., respectively. France's Crédit Agricole SA sat at the bottom of the ranking of European lenders by loan-to-deposit ratio, with 56.5% at the end of September.

Spanish MFIs had the lowest level of total loans, €1.90 trillion, in the quarter, compared to €1.78 trillion a year ago. Their deposits increased year over year to €2.17 trillion from €2.07 trillion.