Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Dec, 2021

By Lauren Seay and Umer Khan

U.S. banks are looking to do more with less by rapidly consolidating their branch footprints and reinvesting resources into digital channels.

|

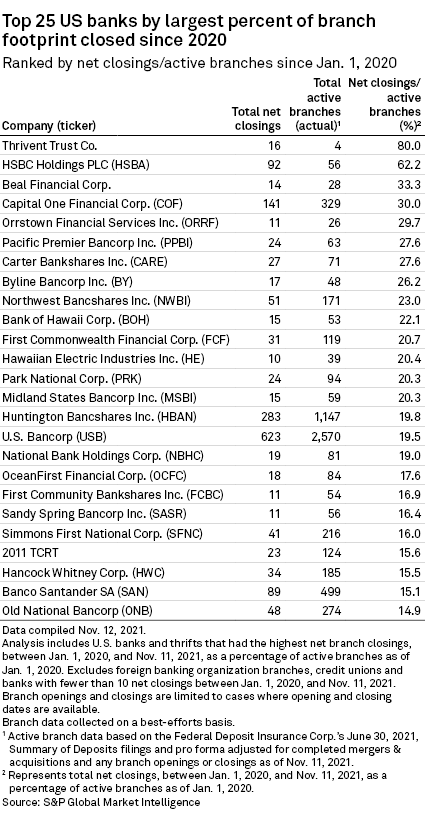

Since the onset of the COVID-19 pandemic, a number of U.S. banks have drastically reduced their branch footprints. Among U.S. banks that had at least 10 net branch closures since Jan. 1, 2020, 14 have closed at least 20% of their footprints and an additional 10 have closed at least 15%.

The pandemic has bolstered digital banking usage, allowing banks to accelerate branch closures and shift resources toward technology and digital. The industry has closed more than 2,700 branches so far in 2021, surpassing the record number of net closures in 2020, and industry experts do not expect banks to slow down anytime soon.

"There are a lot of branches that have been underutilized for years. ... 2022, in my opinion, is the year, that's going to actually push the tide further to say, 'Let's go ahead and close some of those branches,'" said Christopher Marinac, director of research at Janney Montgomery Scott, in an interview. "There was some piecemeal activity in 2019 and 2020. And obviously, everything changed with the pandemic, but as we now know so much more, I think the attitude is 'We can definitely do with less branches. We can do with less space.'"

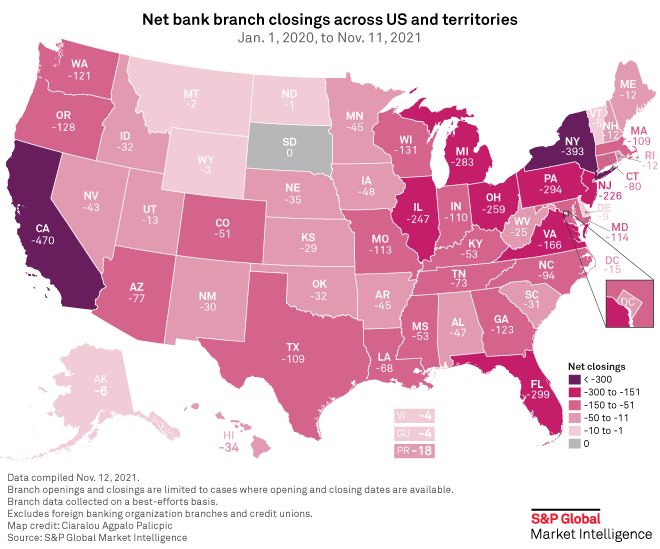

U.S. banks posted 4,836 net branch closures across the country since the first quarter of 2020. U.S. Bancorp was the most active among all U.S. banks since Jan. 1, 2020, with 623 net closings, but banks of all sizes are consolidating their footprints.

Among the top 25 banks that have trimmed their footprints the most on a relative basis — and have closed at least 10 net branches since Jan. 1, 2020 — 10 had less than $10 billion in assets as of the third quarter.

"Any bank that has more than 10 branches in their network is taking a hard look," said Paul Davis, director of market intelligence for advisory firm Strategic Resource Management, in an interview. "You'll see banks who kind of held off on large closures revisit it as part of the budgeting process, and I think you'll see a large wave of closures early next year."

|

Banks will also continue to consolidate branches over time as their long-term leases end, Davis said.

In addition to consolidating their footprints, more banks will also begin experimenting with new branch models, such as technology-focused branches with interactive teller machines, or ITMs, or subleasing space to other businesses, Marinac said.

Red Bank, N.J.-based OceanFirst Financial Corp. has closed 17.6% of its footprint since Jan. 1, 2020, and has plans to close at least 20 more branches by February 2022 after a 15% to 20% decline in total transactions at most branches and a "radical increase" in digital transactions, Chairman and CEO Christopher Maher said in an interview.

"What we're doing is we're simply shifting the resource allocation we currently have in branches over into the digital channels to follow them where they go," he said.

OceanFirst is also experimenting with new branch models in which a group of bankers at one back-office facility supports 41 different branch locations with ITMs.

"Imagine the staff it would take to run drive-ups that are branches, 12 hours a day, five days a week, right? We can do it very efficiently," Maher said.

OceanFirst is also looking into leasing its buildings out to other businesses, a strategy other banks have executed on since the onset of the COVID-19 pandemic.

Capital One Financial Corp. has closed 30% of its footprint since Jan. 1, 2020. The pandemic bolstered the company's branch-lite model, said Chairman, CEO and President Richard Fairbank at a conference in February.

"While others are going out to buy more banks, what we want to do is try to build the bank of the future in a sense, which leads with a digital-first, mobile-first banking experience, but has some physical distribution in the form of our existing footprint, physical branches, but on a thinner basis," he said.