S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Jun, 2023

By Darren Sweeney

NiSource Inc. will receive a "meaningful premium" compared to alternative sources of financing by raising $2.40 billion in equity through the sale of a minority interest in its Northern Indiana Public Service Co. LLC utility subsidiary, company management said.

NiSource said June 20 that it agreed to divest a 19.9% equity interest in Northern Indiana Public Service Co. (NIPSCO) to an affiliate of Blackstone Infrastructure Partners for $2.15 billion. The deal includes an additional $250 million equity commitment by Blackstone Infrastructure to fund ongoing capital requirements.

In November 2022, NiSource said it would pursue the sale of a minority stake in NIPSCO based on the results of a business review launched to support the company's balance sheet and help fund its transition to cleaner energy resources. Upon deal close, NiSource will retain an 80.1% stake in NIPSCO.

The Merrillville, Ind.-headquartered utility, which provides electric and gas service to about 4 million customers in six states, expects the sale of a minority ownership interest in NIPSCO to minimize future external capital market needs and eliminate all equity needs through at least 2025.

"The proceeds reflect a meaningful premium to other potential sources of financing, and the additional funding Blackstone Infrastructure is committing to will support ongoing capital needs, including the renewable transition that is currently underway," NiSource President and CEO Lloyd Yates said on a June 20 conference call with analysts and investors.

The NiSource CEO also pointed out that Blackstone Inc.'s dedicated infrastructure group is "committed to investing in NIPSCO's energy transition and decarbonization programs, as well as helping to increase gas and electric grid resiliency for the customers of Indiana."

NIPSCO intends to invest about $3.5 billion in its electric generation transition through 2030 and retire all coal-fired generation by the end of 2028, among other efforts to reduce greenhouse gas emissions. The utility is Indiana's largest vertically integrated electric and gas distribution company, serving about 1.3 million customers.

"What is unique here is the equity commitment letter, which is a priority for us to identify funding for this large capex profile over the next few years," NiSource Executive Vice President and CFO Shawn Anderson said on the call.

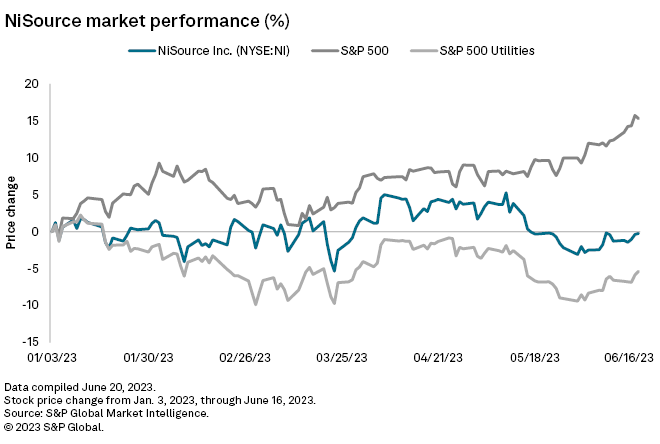

NiSource's stock rose after the deal announcement and was trading up before falling less than 1% to close at $27.22 on June 20 on above-average volume.

The transaction implies an equity value of $10.8 billion and an enterprise value of $14.3 billion for 100% of NIPSCO.

"The results of this transaction speak for itself. It is a premium valuation outcome and is by far one of the most attractive sources of financing for NiSource and NIPSCO's capital plan," Anderson said. "The 32.5x [price-to-earnings] multiple offers a more compelling valuation than traditional capital markets, and it's highly accretive relative to where NiSource trades today. In fact, the implied value for NIPSCO nearly equates to the total NiSource market capitalization, despite only comprising approximately 50% of the economic value of the full NiSource operating platform."

As of June 20, NiSource's market capitalization was about $11.24 billion.

The CFO expects Blackstone to invest its equity commitment over the next three years.

"Blackstone has shown every reason to demonstrate that they are committed to this," Anderson said. "I think the equity commitment letter itself underpins that in the near term, but we expect them to be a long-term partner into perpetuity in continuing to fund that 19.9% pro rata obligation well into the future."

NiSource reaffirmed its non-GAAP net operating earnings guidance of $1.54 to $1.60 per share in 2023, along with long-term annual net operating EPS growth of 6% to 8% through 2027. The company also maintained its funds from operations/debt target of 14% to 16%. Management said they continue to expect annual rate base growth of 8% to 10% driven by $15 billion of planned capital expenditures from 2023 to 2027.

Wall Street analysts appeared to agree that the transaction will be beneficial for NiSource's balance sheet.

"In our view, this transaction appears constructive from a financing and balance sheet perspective, as [management] was clear that it will push [NiSource's] FFO/debt to the top end of its 14%-16% FFO/debt range soon after closing," Guggenheim Securities analyst Shahriar Pourreza wrote in a June 20 research report.

The Guggenheim analyst also said the transaction is "fairly favorable" compared to the implied 28x earnings valuation of Duke Energy Corp.'s decision in January 2021 to sell a 19.9% interest in utility subsidiary Duke Energy Indiana LLC to a Singaporean sovereign wealth fund in a $2.05 billion all-cash deal. This is especially true given current capital market conditions and the high interest rate environment, Pourreza noted.

CreditSights analysts agreed that NiSource's minority interest sale "compares favorably" to similar vertically integrated utility stake sales and is a "credit-positive deal" with proceeds going toward capex funding and the balance sheet.

The NiSource deal announcement also comes just a few months after FirstEnergy Corp. said it would sell an additional 30% ownership interest in its FirstEnergy Transmission LLC subsidiary to a Brookfield Asset Management Ltd. infrastructure fund for $3.5 billion in cash.

FirstEnergy said the deal is "equivalent to issuing common equity at $93 per share."

NiSource's deal is expected to close by the end of 2023, subject to customary closing conditions, including Federal Energy Regulatory Commission approval.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.