S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Jul, 2021

By Chris Rogers

Two of Nike Inc.'s suppliers in Vietnam — Chang Shin Vietnam Co. Ltd. and Pou Chen Corp. — have halted manufacturing due to a rapidly expanding COVID-19 outbreak, Reuters reported. That comes as the pandemic has had a new wave of infections across South and Southeast Asia, as discussed in Panjiva's research of June 29, which the apparel and footwear industries appear to be particularly susceptible to.

That may exacerbate the supply chain disruptions that the company has had to deal with. Nike CFO Matthew Friend noted in late June that he "expect[s] supply chain delays and higher logistics costs to persist throughout much of fiscal '22 [to May 31, 2022]."

Panjiva's data shows that Vietnam accounted for 49.0% of U.S. seaborne imports linked to Nike and its products in the second quarter of 2021 after growth of 6.6% year over year. There has been a refocusing on China though, with imports up 54.6% year over year in the second quarter of 2021 being the major driver of a 12.5% rise in total imports linked to the company.

Nike's imports from Vietnam are led by footwear, which was included in 82.0% of shipments in the 12 months to June 30 after climbing 28.8% in the second quarter of 2021 versus a year earlier. That raises the question as to whether other major sneaker brands may face similar challenges.

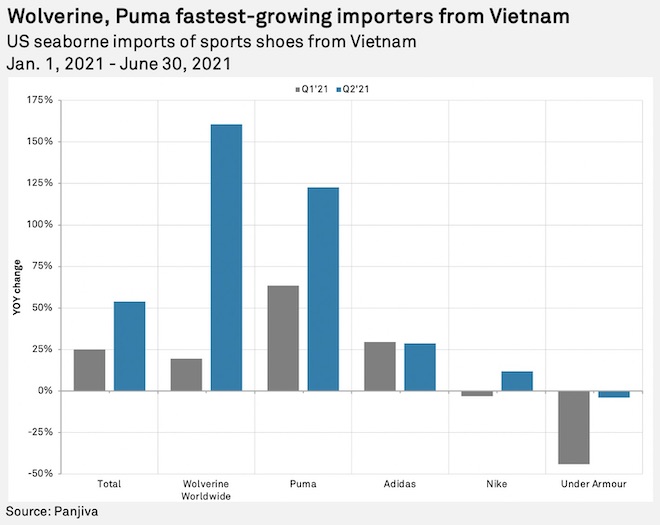

Total U.S. seaborne imports had surged 53.9% year over year in the second quarter of 2021 after an increase of 25.2% in the first quarter of 2021. The accelerating growth has been driven by Wolverine World Wide Inc. — owner of the Saucony brand, among others — and Puma SE with growth of 160.7% and 122.7%, respectively, in the second quarter of 2021 versus a year earlier. By contrast, imports linked to Under Armour Inc. fell 4.0%, though that was a slower rate than the 44.1% decline experienced in the first quarter of 2021.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.