S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Apr, 2022

By Reicelene Joy Ignacio

Top nickel-producing nations can rapidly ramp up production and meet global demand if sanctions or an export ban curtail supply from Russia, the world's fourth-largest nickel producer.

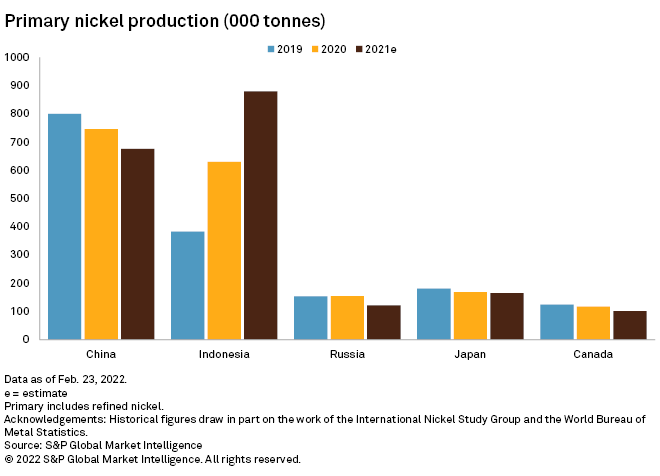

Russia, home to nickel giant PJSC MMC Norilsk Nickel, produced 195,000 tonnes of mined nickel in 2021, or 7.2% of global supply, according to data from S&P Global Commodity Insights' Metals and Mining Research team. It produced 121,000 tonnes of primary nickel, or 4.6% of global production. And while nickel has not been the subject of sanctions or a target of Russian President Vladimir Putin's March 10 ban on certain exports, markets fear the loss of so much supply.

With nickel demand high for use in batteries used in electric vehicles and on the grid, nickel prices have skyrocketed since Russia's Feb. 24 invasion of Ukraine. A member of The Wall Street Journal's editorial board articulated market fears in a March 14 commentary headlined "Russia Can Hold Nickel Hostage."

But analysts and nickel producers say the Russian supply can be replaced. Scrap recycling becomes viable at high prices, helping backfill any deficits in the very near term, and nickel-producing heavyweights in the South Pacific have new mines and processing plants set to come online soon.

"Western Australia is the world's fifth-biggest producer of nickel and is well placed to meet the strong global demand for nickel," Western Australian Minister for Mines and Petroleum Minister Bill Johnston said in an email.

Here come the nickel mines

High nickel prices were stimulating exploration and mine expansion even before the Russian war in Ukraine. The London Metal Exchange three-month nickel price is up 54% to $31,803 per tonne since the start of the year, according to S&P Global Market Intelligence data, though it is down from the more than $100,000/t the metal hit amid a short squeeze March 8, which caused LME trading to shut down.

BHP Group Ltd. announced in October 2021 that it produced the first nickel sulfate crystals from its Nickel West sulfate plant in Western Australia. The miner is looking for opportunities to grow production at the plant, Johnston said.

"BHP is ramping up to 20,000 nickel-equivalent tonnes per year to be fed directly into the electric vehicle battery market," Johnston said.

According to BHP, the plant will produce 100,000 tonnes of nickel sulfate per year, enough to make 700,000 electric vehicle batteries each year. The company did not clarify when the plant will be fully operational and has not responded to a request for comment.

Meanwhile, the Philippines, the world's second-largest nickel ore producer next to Indonesia, is expected to open 10 nickel mines this year, according to Mines and Geosciences Bureau Director Wilfredo Moncano. The Philippines now has 32 nickel mines in operation.

Philippine Nickel Industry Association and Global Ferronickel Holdings Inc. President Dante Bravo said the invasion has created more opportunities for junior nickel miners to bring new mines into commercial operation to take advantage of the increasing nickel ore prices, which would lead to more investments in the sector.

Indonesia and the Philippines have resources that can support the global nickel supply chain.

"I do not think that there is any mine that could match the pure nickel production of Russia, but laterite ores are abundant both in the Philippines and Indonesia that can support the ferronickel production, which is a pure nickel substitute, used for stainless steel, nickel concentrates and other nickel products that can be used for battery production," Bravo said.

A Market Intelligence report in February forecast that continued growth of Indonesian primary output and moderating global demand would move the global primary nickel market to a 34,000-tonne surplus in 2022 from an estimated 181,000-tonne deficit in 2021.

Vale SA, which is Indonesia's largest nickel producer and also has nickel operations in Brazil and Canada, is maintaining its production guidance of 175,000 to 190,000 tonnes for 2022 amid the conflict.

High prices make scrap valuable

If Russian nickel exports were disrupted, consumers could ease any near-term shortages by recycling nickel scrap, according to Angela Durrant, Wood Mackenzie principal analyst for nickel.

"The customers in Europe and elsewhere that consume nickel for ferronickel production will likely turn to scrap to replace nickel units from Russia," Durrant said. "At such high nickel prices, scrap or stainless steel scrap becomes readily available and effectively lessens the need for Class 1 nickel in ferronickel production, so, in the short-term, we do not expect that the Russian-Ukrainian conflict will have a material impact on the global supply of nickel."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.