Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Mar, 2022

| The Norilsk nickel refinery in Norilsk, Russia, is pictured above. A Norilsk Nickel spokesperson said operations were "proceeding as usual" as of March 1, following Russia's incursion into Ukraine. Source: Oleg Nikishin/Getty Images News via Getty Images |

Nickel prices jumped after Russia, a top global nickel producer, invaded Ukraine on Feb. 24, threatening to drive up electric vehicle battery costs that were already under pressure from rising raw material prices.

The London Metal Exchange three-month nickel price increased on the news of Russia's incursion, reaching an 11-year high of $25,575 per tonne in trading on Feb. 24, while LME stocks tumbled in the run-up period, dipping throughout February to 82,314 tonnes as of Feb. 22, according to S&P Global Commodity Insights data.

While governments have pummeled Russian financial institutions and individuals with a litany of sanctions following the country's incursion into neighboring Ukraine, commodity exports from Russia have been left largely untouched. But the possibility of sanctions is heating up metal markets, especially in nickel, where Russia is a leading producer. Should sanctions be imposed, China, which has declined to criticize the invasion, could become one of the only buyers of Russian metals, giving its EV makers a competitive edge.

"[The invasion] will have an inflationary effect on battery metals and battery costs, which have already been rising strongly this year," said Stuart Burns, founder and editor-at-large of Metal Miner, a metal pricing and analysis platform. "It's going to add further fuel to that particular fire."

Russia is one of the world's leading producer of primary nickel products, such as the refined nickel used in EV batteries. LME stocks of the metal have already decreased on fears of further trade restrictions by Western governments.

"Such activity is most likely being driven by memories from the last time sanctions on Russia hit the base metals market," Commodity Insights' senior analyst Jason Sappor said in a Feb. 28 report. In 2018, sanctions imposed on Russian aluminum company UC RUSAL prompted the LME to stop its delivery and use of Rusal-branded metal, causing the price of aluminum to spike.

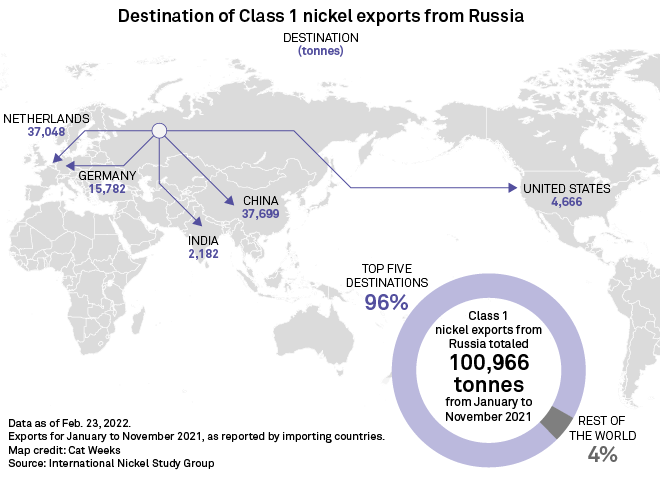

From January to November 2021, the majority of Russia's class 1 nickel products went to China and the Netherlands, which each received 37% of the exports, according to the International Nickel Study Group. Germany received about 16% of Russia's class 1 nickel exports during the same period.

Business as usual

While Western companies are watching closely for sanctions, there are none on Russian metals so far and companies say they are making deliveries.

Operations are "proceeding as usual" for PJSC MMC Norilsk Nickel, the world's largest primary nickel producer, a spokesperson told Commodity Insights in a March 1 email. "We continue to meet all our contractual obligations and remain committed to our clients and partners."

Norilsk Nickel produced 62,736 tonnes of the world's primary nickel in the fourth quarter of 2021, more than any other company, according to Panjiva data.

German battery-maker BASF SE produces battery materials and established a long-term supply agreement with Norilsk Nickel in 2018 for nickel and cobalt. That same year, BASF announced plans to construct a

"There is currently no impact on supplies of metals from Russia," Daniela Rechenberger, a spokesperson for BASF, said in a March 1 email. "Should sanctions be imposed that specifically limit or ban the trade of metals of Russian origin, we would rely on alternative sources including our [platinum group metals] recycling to cover our own needs. We could bridge short-term supply interruptions with our own stocks."

Risk for EV makers

Western automakers, already confronting surging lithium prices, an ongoing shortage of semiconductors, and high energy input costs, now also face the possibility of future sanctions and higher costs for nickel. Rising battery metal prices pushed up the cost of nickel-manganese-cobalt batteries by 124% over the past 12 months, according to Commodity Insights' senior analyst Alice Yu. Surging costs could slam into automakers' bottom line, or force them to raise prices just as sales begin to take off. Global sales of EVs rose 106.8% in 2021.

"As Europe is looking to build out a local supply chain, with locally sourced raw materials, this is a big headache for European automakers and [battery] cell producers who will be forced to look further afield," Greg Miller, an analyst at Benchmark Mineral Intelligence, said of the conflict in Ukraine in a Feb. 25 report.

Sanctions are potential boon for China

If commodity export sanctions are imposed, Russia could turn to China, the world's leading battery and EV manufacturer, for relief, multiple industry experts said. China is already a leading EV maker, and becoming the only buyer of Russian nickel could give it a price advantage in battery production.

"China is going to be Russia's release valve for raw materials," Burns said. "It would just strengthen China's hand in the battery market because they will have almost exclusive rights to the Russian material. China will take whatever the Russians cannot ship into Europe or into North America or to the rest of the world. They will gladly take it, but they'll take it at a discount. We're not at that point yet, though; the Russians are still able to export at the moment."

Panjiva is the supply chain research unit of S&P Global Market Intelligence, a division of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.