S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Dec, 2022

By RJ Dumaual

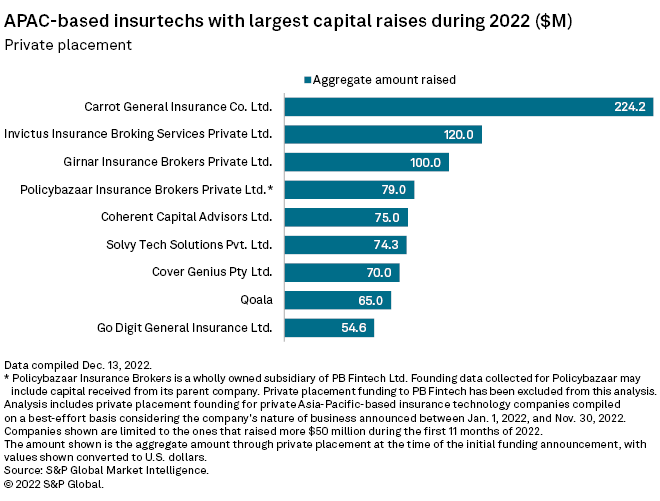

Insurtechs that have managed to carve out a niche within the insurance industry were some of the biggest fundraisers in Asia in 2022 even as the overall dollars raised declined sharply from the previous year.

South Korea-based Carrot General Insurance Co. Ltd., which offers distance-based auto insurance, was one of the most active companies in 2022, announcing that it would raise a gross amount of $224.2 million at a valuation of over $850 million as of September 2022.

Carrot has already received the first tranche of 175 billion South Korean won. The additional 125 billion won is expected to be raised during the first half of 2023, according to a company spokesperson.

Commenting on the company's growth trajectory, CEO Richard Moon said in an email that Carrot is nearing the 1 million sales mark while keeping a retention rate of about 90%.

Carrot is aiming to go public by 2025 but is aware of the struggles of listed insurtechs. However, Moon said Carrot's "usage-based" business model is "countercyclical" to the "economic winds" as consumers become more price-sensitive.

"We are excited to progress forward with plans to go public with our current priority focused around really showing the investor community our sustainable growth and profitability," Moon said.

In South Asia, India's Solvy Tech Solutions Pvt. Ltd., which operates the Zopper insurance infrastructure API platform that connects businesses to insurers, closed a $74.3 million funding round in September.

Other notable raises involved Indian insurance aggregator Policybazaar Insurance Brokers Private Ltd., which has been actively raising funds in recent years.

A word of caution

However, investors are becoming more cautious when investing in insurtechs, especially after a number of high-profile IPOs in the U.S. resulted in sharp share price declines.

Insurtechs need to present a path to a profitability, according to Kaenan Hertz, managing partner with Insurtech Advisors, or demonstrate that they are finding their way to that path, whether they are product-focused such as Carrot or an "enabler" such as Zopper.

"Almost all of the investors that are active in later-stage companies are looking for profitability, or at least unit economics that could make sense," Hertz said. "Earlier-stage investors are also being more cautious, but less about the ideas, but more about expected growth rates and expected profitability."

As of Jan. 9, US$1 was equivalent to 1,234.87 South Korean won.