S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Oct, 2021

By Allison Good and Gaurang Dholakia

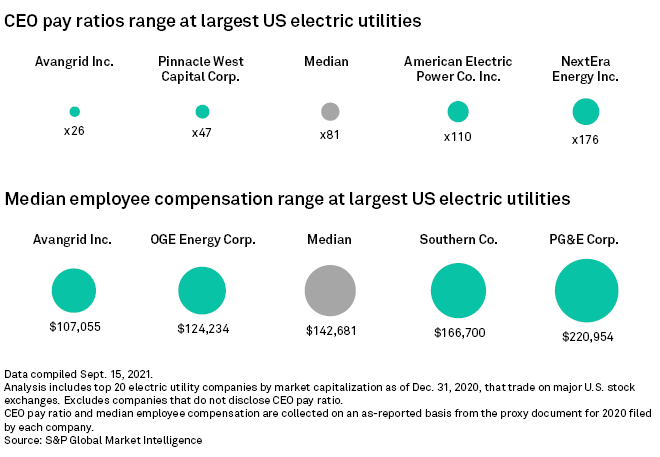

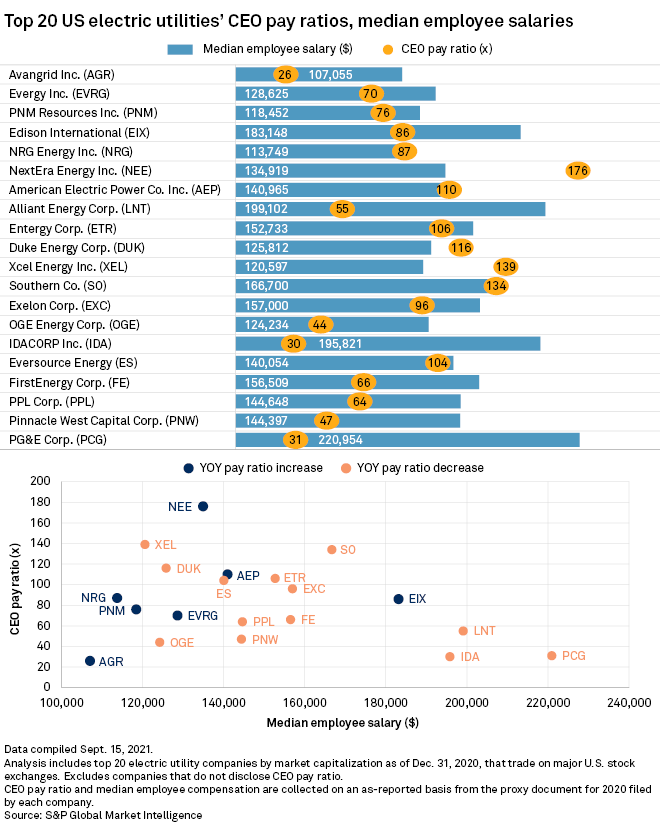

NextEra Energy Inc. again reported the highest CEO to median employee pay ratio in 2020 among U.S. utilities as Chairman, President and CEO James Robo remained the highest-paid utility executive, according to an S&P Global Market Intelligence analysis.

NextEra reported a CEO to median employee pay ratio of 176-to-1 for the year, and the median employee's annual total compensation was $134,919. Robo, meanwhile, saw total adjusted compensation increase 8.6% to $22.8 million as the company's stock price rose just over 30%.

Florida-headquartered NextEra reportedly approached both Duke Energy Corp. and Evergy Inc. separately about potential mergers in 2020, though the company never confirmed its interest in either electricity provider.

S&P Global Market Intelligence analyzed public disclosures for the top 20 U.S. utilities by market capitalization as of Dec. 31, 2020. The SEC requires publicly traded companies to disclose the annual compensation of their median employee and the ratio between that individual's pay and that of the CEO.

Xcel Energy Inc. and Southern Co. reported the second- and third-highest pay ratios for 2020, recording 139-to-1 and 134-to-1, respectively. Xcel Energy's median employee salary was $120,597 and Southern, whose Chairman, President and CEO Thomas Fanning was the second-highest paid utility executive in 2020, recorded a $166,700 median employee salary.

Shares of Atlanta-headquartered Southern gained less than 1% in 2020 amid continuing construction delays and cost overruns at subsidiary Georgia Power Co.'s Alvin W. Vogtle Nuclear Plant expansion project. In July, Georgia Power said it expects unit 3 to be operational in the second quarter of 2022 and unit 4 in the first quarter of 2023, estimating an additional $460 million increase to its share of costs.

Connecticut-based Avangrid Inc., meanwhile, reported the lowest CEO pay ratio of 26-to-1 and a $107,055 median employee salary. The utility announced a $4.3 billion merger with PNM Resources Inc. in October 2020, but must still obtain approval from the New Mexico Public Regulation Commission before closing.

Idacorp Inc. recorded the second-lowest pay ratio of 30-to-1, with PG&E Corp. third from the bottom at 31-to-1, and paying the highest median employee salary of $220,954. The embattled PG&E Corp. and subsidiary utility Pacific Gas and Electric Co. emerged from Chapter 11 bankruptcy in 2020 with a joint $58 billion reorganization plan after a series of catastrophic Northern California wildfires linked to the utility's electric infrastructure.

In September, Shasta County, Calif., District Attorney Stephanie Bridget filed criminal charges against PG&E over the utility's role in igniting the fatal 2020 Zogg Fire, a few months after PG&E Corp. unveiled plans to bury roughly 10,000 miles of distribution lines underground. The utility expects to invest between $15 billion and $20 billion in what new CEO Patti Poppe called a "safer, permanent fix."

FirstEnergy Corp., which has also had its fair share of troubles recently, reported a pay ratio of 66-to-1 in 2020, recording a $156,509 median salary. The Ohio-headquartered investor-owned utility fired former CEO Charles Jones Jr. and other senior company executives after a July 2020 FBI affidavit linked it to bribes allegedly paid to the former speaker of the Ohio House of Representatives and his associates to steer a nuclear subsidy bill through the state legislature. In July, FirstEnergy agreed to pay a smaller-than-expected $230 million fine as part of a settlement.