S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Apr, 2022

By Ranina Sanglap

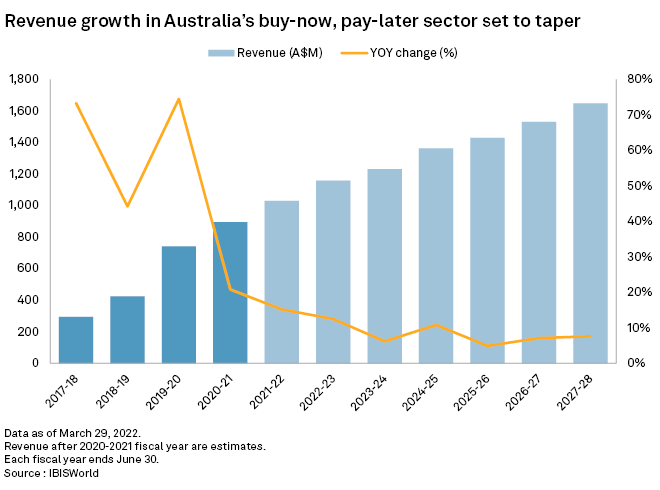

Australia's A$900 million buy-now, pay-later sector will likely see more M&A activity in 2022 as players consolidate to survive rising interest rates and intensifying competition.

The buy-now, pay-later, or BNPL, companies are facing higher costs in borrowing funds as economists widely expect Australia to start hiking interest rates from a record low level later this year. Higher funding costs eat into the margins derived from providing interest-free installment loans for shoppers at point of sale. Also, the explosive revenue growth of the sector in recent years have attracted investments from global companies such as PayPal Holdings Inc. and Apple Inc., which will likely crowd out smaller players, analysts said.

The biggest risk for BNPL companies is higher interest rates, said Grant Halverson of McLean Roche, a specialist retail banking and payments consultancy. "I don't think the BNPL fintechs want to consolidate. However, if they don't, they won't survive."

"Most of the startups will either be purchased or wither without the ability to raise more cash," Halverson said.

The BNPL boom in Australia is likely at a tipping point this year, as higher rates could upend a business model that has attracted more than 30 players to the market. Low interest rates in recent years allowed BNPL operators to borrow cheaply to fund the gap between paying merchants and getting paid by customers. The funding environment in the past few years also gave BNPL companies room to offer more concessions to retailers to increase their market share.

Zip Co Ltd., the nation's second largest BNPL operator by market share, said in its 2021 annual report its after-tax loss would increase by A$9.1 million for the fiscal year ended June 30, 2021, if the bank bill swap rate rose by 1 percentage point during the period. The company posted a loss after tax of A$658.8 million for the year ended June 30, 2021, widening from a loss of A$19.9 million a year earlier. The bank bill swap rate is a short-term interest rate most used for the pricing of floating rate bonds.

Zip's borrowings secured in floating interest rates totaled A$1.63 billion as of June 30, 2021, up from A$1.05 billion a year earlier.

Economists widely expect the Reserve Bank of Australia to raise the interest rate late in 2022 as economic growth and inflation continue to pick up.

The central bank maintained the cash rate at a record low of 0.10% in its latest policy meeting March 1. It said it would not hike the rate until actual inflation is sustainably within the 2% to 3% target range. Headline inflation rose to 3.5% in the quarter ended Dec. 31, 2021, although the Reserve Bank of Australia said in the March meeting it was too early to conclude that it was sustainably within the target range.

Sizing up

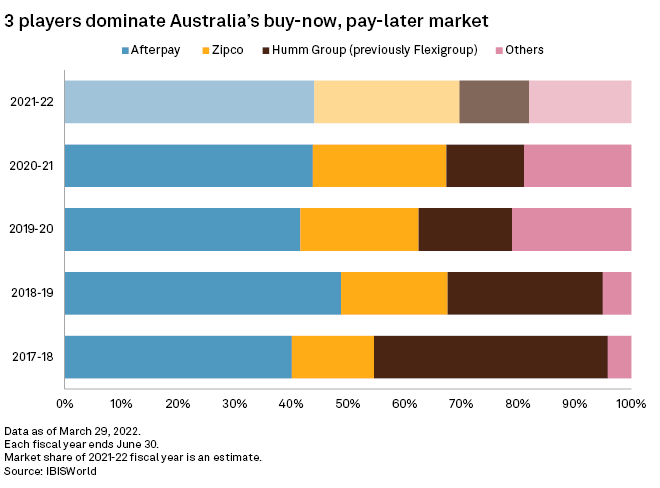

The Australian BNPL sector is dominated by three major players, which has already prompted some companies to seek acquisition targets to scale up in the face of concentrated competition.

The three largest players are estimated to account for over 80% of industry revenue, according to the latest data from IBISWorld. As of June 2021, Afterpay Ltd. had a market share of 43.8%, according to IBISWorld. Zip's share was 23.6%, while Humm Group Ltd., previously FlexiGroup, had a market share of 13.7%. Other players accounted for only 18% of the remaining market share.

"Moving into 2022, we expect to see further M&A in the Australian payments sector — particularly in areas such as BNPL — as financial services organizations look to drive increased value and scale," said Tim Coyne, Oceania financial services strategy and transactions leader at EY.

"We are also seeing an increasing number of nonfinancial services players moving into the financial services by leveraging payments capabilities. This in turn increases M&A, alliances and partnership opportunities between nonfinancial services players and payment providers," Coyne said.

Recent deals driven by the need to scale up include Zip's agreement in February to acquire Sezzle Inc. in a A$491 million deal. The deal, which is expected to be completed in July, will give the combined companies scale. The merged entity will have more than 13 million customers.

Nonbank lender Latitude Group Holdings Ltd. in February executed a binding agreement to acquire Humm's consumer finance business. Humm's consumer business, which includes its BNPL and credit cards operations, has over 2.6 million customers. Latitude CEO Ahmed Fahour said the acquisition will provide additional scale to Latitude. Latitude is aiming for full integration by the end of 2023.

Foreign interest

Survival will likely be the main driver of deal activity in Australia's BNPL sector. It will be a shift from the past few years, when many deals were primarily driven by global as well as local companies seeking a slice of the growing revenue of the market while the country's benchmark cash rate was close to zero.

"There is increasing competitiveness in the Australian payments sector. This interesting landscape in the payments sector sets up the potential for M&A-driven consolidation in 2022," Con Boulougouris, partner at law firm MinterEllison, told S&P Global Market Intelligence.

One of the latest deals involving non-Australian companies was U.S.-listed Block Inc.'s acquisition of Afterpay, the leading Australian BNPL loans provider, in a A$39 billion deal that closed in February.

Global giants including Paypal, The Goldman Sachs Group Inc. and Apple have also invested in Australia's BNPL space. PayPal launched its own BNPL service in 2021, offering no late charge fees and lower minimum purchase thresholds. Apple acquired U.K.-based financial technology startup Credit Kudos Ltd. in 2022 after it was reported in 2021 that the iPhone maker was looking to introduce a BNPL feature to Apple Pay.

Credit card giants Visa Inc. and Mastercard Inc. have also started offering BNPL products in Australia.