S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Aug, 2021

|

Gov. Kathy Hochul took over from former Gov. Andrew Cuomo on Aug. 24. The change in leadership comes on the heels of several years of increasing regulatory and policy scrutiny for the natural gas industry. |

As New York implements a nation-leading climate law, business groups, climate activists and ratepayer advocates are closely watching the state's new governor and seeking opportunities to influence how the administration shapes natural gas policy.

The departure of Andrew Cuomo — a pugilistic executive known for a top-down approach — could empower policymakers to more freely express their views on energy policy, stakeholders said. Yet interest groups also acknowledged that Gov. Kathy Hochul's rise to power injects fresh uncertainty into policymaking, raising questions about how the new governor will weigh on the transition from gas to electric heating, the uptake of renewable gas and fossil fuel infrastructure investment.

Hochul, a Western New York native, promised a more collaborative approach to governing, informed by several years of crisscrossing New York as lieutenant governor to meet with constituents and local politicians. "People will soon learn that my style is to listen first, then take decisive action," Hochul said during an Aug. 11 press conference.

The governor also said the administration's vision includes continuing the "strongly progressive policies that take this state forward" and highlighted her role in promoting those policies, including clean energy.

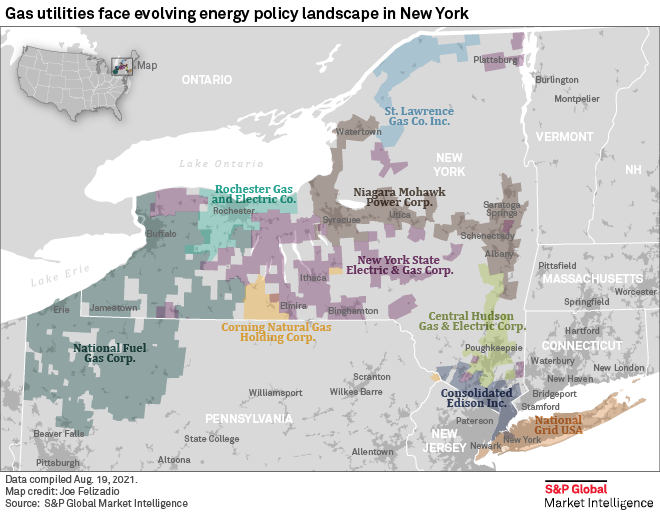

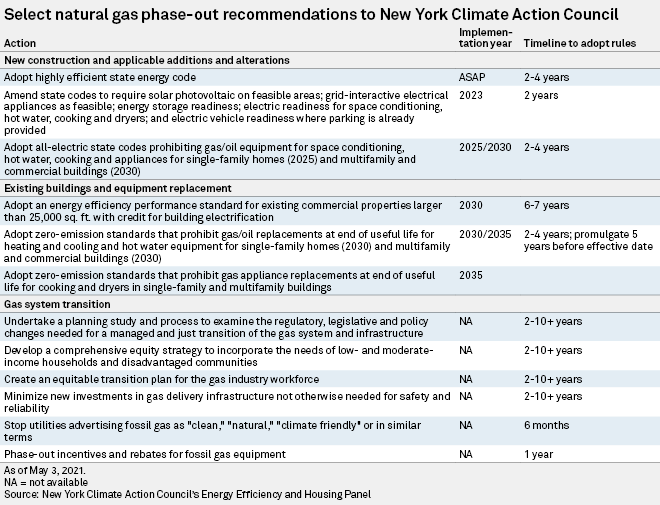

The transition comes as state utility regulators have signaled to gas distributors that future rate cases will seek to minimize gas demand and infrastructure expansion. Meanwhile, New York's Climate Action Council is developing a roadmap to implement the 2019 Climate Leadership and Community Protection Act, or CLCPA, which could include a timeline for implementing new building electrification mandates and phasing out fossil fuel furnaces in existing buildings.

"Gas utilities are going to have to adapt to a world where their role is very much diminished in New York," Morningstar equity strategist Travis Miller said. "It's not clear that the state can entirely eliminate gas from its energy mix, but the role gas plays in the energy mix in New York is going to be substantially less in the coming years."

Early tests for new governor

Hochul will have to start campaigning soon after taking office, first for a Democratic primary and then for a general election in November 2022. Meanwhile, the Climate Action Council will continue preparing its scoping plan for presentation to the newly elected governor at the start of 2023.

Still, Hochul will face an early test in January 2022, when she must present the annual budget to the state legislature, Environmental Advocates NY Executive Director Peter Iwanowicz noted. Stakeholders will be watching how Hochul aligns budget priorities and spending with climate action, including by fully funding greenhouse gas reduction initiatives.

"She can do a lot within the context of a state budget to either help or harm New York's ability to meet its climate goals," Iwanowicz said. "I would just say it's hard for me to see her winning a Democratic primary next June unless she's really strong on dealing with climate."

Another interim test will be how Hochul's administration applies Section 7 of the CLCPA, which requires state agencies to align decision-making and permitting with the law's legally mandated targets to reduce state emissions by 40% from 1990 levels by 2030 and by at least 85% by 2050, Iwanowicz said. The law factored into the New York State Department of Environmental Conservation's latest decision to deny a critical water permit to The Williams Cos. Inc.'s Northeast Supply Enhancement Project, a gas pipeline extension into New York City.

Relationship with utility regulators in focus

The New York State Public Service Commission has moved in that direction, declaring Aug. 12 that the CLCPA will guide its decisions in rate cases. That means gas distributors can expect decisions that restrict natural gas marketing and prioritize energy efficiency, demand response, electrification and other non-pipe alternatives, according to the commission.

The commission moved toward that policy under former chair and Cuomo appointee John Rhodes. Cuomo filled the seven-member commission's vacant seats shortly before resigning, and the next vacancy opens in 2024 unless a commissioner steps down.

During his tenure, Cuomo sparred publicly with utilities, going as far as to threaten to strip National Grid USA of its downstate gas franchise over a six-month moratorium on new hookups, prompted by the New York State Department of Environmental Conservation's refusal to permit the Northeast Supply Enhancement Project.

"I think [Cuomo has] made it very clear at every step where he felt the state should go, and the commission's activities reflected that," said Richard Berkley, executive director at the Public Utility Law Project of New York Inc., a ratepayer advocate. It is unclear how Hochul's relationship will develop with the Public Service Commission, but Berkley noted that a lot of New York policymaking is done in rate cases.

Under Cuomo, many people questioned the commission's independence, and investors would prefer to see a more independent commission, according to Lisa Fontanella, research director for Regulatory Research Associates, a group within S&P Global Market Intelligence. Still, New York remains a state where gas utilities can reach multiyear rate settlements, which provide predictability and include constructive cost-recovery mechanisms, Fontanella said.

Implementing CLCPA

Another major question is how Hochul would guide CLCPA implementation if elected in 2022. Some are looking to her roots for clues.

Nearly 90% of homes and businesses across National Fuel Gas Distribution Corp.'s Western New York footprint use natural gas, according to the company. The fuel's low cost is one reason for its widespread use in the area, which has large low- and moderate-income populations, according to Berkley.

Berkley thinks that Hochul would think twice about quickly replacing a cheap fuel with a more expensive alternative — electric heat pumps — absent significant subsidies. "If there were a rapid switch to replacing gas furnaces with electric in residential, that would be very difficult for low-income New Yorkers — in fact, impossible for a lot of them."

Still, Environmental Advocates' Iwanowicz cautioned against putting too much stock into Hochul's relatively poor ranking by the League of Conservation Voters during her short time as the Buffalo area's U.S. congresswoman. Iwanowicz said the score reflected the record of a representative seeking reelection in a narrow, fairly conservative district. Hochul's promise of a more open workplace could allow for agency expertise to shape policy and engender more creative climate action, Iwanowicz added.

"So much of Cuomo's approach was dictatorial that the agency heads that sit at the table with me at the Climate Action Council really were very quiet, not participatory."

Industry hopes for 'pragmatic approach'

Industry stakeholders are hoping for something similar. There was not a strong reliance on industry experts in developing the CLCPA, according to Joseph Foskett, a director of government affairs for The Business Council of New York State Inc. who manages the organization's energy and environment portfolio. This led to "a tremendous amount of trepidation and uncertainty in the business community," Foskett said.

As an example, Foskett said conversations around renewable natural gas and hydrogen have been "unduly cumbersome." Gas utilities are increasingly turning to renewable natural gas, processed from methane waste sources like farms, and low- or zero-carbon hydrogen to give their distribution networks a second life. In July, New York launched a program to study green hydrogen's role in decarbonizing the state, but renewable natural gas has faced opposition from environmentalists in rate cases, putting New York behind states like California, Berkley said.

The difficulty of having a conversation on the merits of renewable natural gas and hydrogen threatens to limit options that could help the state meet its climate goals and create an opportunity for all stakeholders to benefit from the energy transition, including the agricultural industry, Foskett said.

"Right now, for natural gas utilities, I think allowing them to pivot in a meaningful way is something that the Climate Action Council, I feel, needs to take seriously," Foskett said. "So I'm hoping for a bit more of just a pragmatic approach, and I think the business community would really appreciate just some clearer market signals."