S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Jan, 2021

By Gautam Naik

|

Dried mealworms could help meet rising global demand for sustainable forms of protein. |

A new European Union ruling could pave the way for large food manufacturers and retailers to offer more insect-based products.

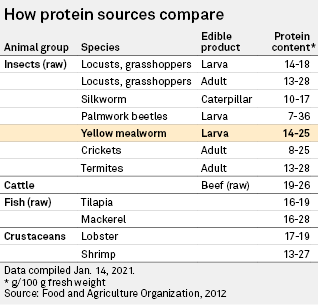

In a report published Jan. 13, the European Food Safety Authority, or EFSA, said dried yellow mealworm, the larval form of a beetle, is safe for human consumption. It is the first completed assessment of a proposed insect-derived food product and part of the EU's effort to regulate "novel foods," which are attracting growing interest thanks to globalization, ethnic diversity and the search for more sustainable protein sources beyond meat.

Several startups make insect-based products and some retailers already stock such items. But a broader rollout — and the more enthusiastic participation of large food companies — has been held back partly by the lack of EU-wide rules. That could now change.

"There is strong interest among some big food actors but one of the bottlenecks we have faced is the absence of an EU stamp that says [insect-derived food] is safe," said Christophe Derrien, secretary general of the International Platform of Insects for Food and Feed, or IPIFF, an umbrella group pushing for the commercialization of insect-based fare. "The latest authorization was needed because it would allow producers to sell the product on the entire EU market" rather than in niche, local areas.

Derrien and other backers argue that insect-based grub will become more popular among consumers, just as plant-based meat substitutes are now a common sight in grocery aisles. The IPIFF expects the new EU ruling to prompt broader commercialization of mealworm-based food by mid-2021.

Several large companies have taken their first nibble. In November 2020, the world's biggest food company, Nestlé SA, launched a new line of pet food partly made from black soldier fly larvae. "We are offering a complete nutritious alternative to conventional dog and cat products, while taking care of the planet's precious resources by diversifying the protein sources," said Bernard Meunier, CEO at Nestlé Purina PetCare for Europe, Middle East and North Africa, in a statement.

In 2018, French supermarket chain Carrefour SA started selling edible insect products made by Jimini's, a French company whose offerings include salted butter caramel mealworms, cayenne pepper crickets and cocoa grasshoppers. Since then, Jimini's has announced that its products will also be sold in 650 stores run by Kaufland, a German supermarket chain and part of Schwarz Gruppe, owner of Lidl Stiftung & Co. KG.

Maple Leaf Foods Inc., Canada's biggest packaged meats company, has invested in Entomo Farms, one of the largest human-grade edible insect farms in North America. "We see a long-term role in this form of sustainable protein delivery, both for animal and human consumption, as it is elsewhere in the world," said Michael McCain, CEO of Maple Leaf, in a 2018 statement.

In the U.K., Tesco PLC has teamed up with a company called Entocycle. In October 2020, the biotechnology firm received £10 million from the U.K. government to build an industrial-scale insect farm. The goal is to feed food waste, such as overripe fruit obtained from Tesco, to black soldier flies, and then use their larvae to feed animals. As a protein source the larvae have a much smaller environmental footprint than traditional sources such as meat, soy or fishmeal. Meanwhile, in 2018, its rival J Sainsbury PLC began selling smoky BBQ crunchy roasted crickets manufactured by a company called Eat Grub.

There are hurdles, though. The EFSA, for example, noted that allergic reactions are likely to occur for some consumers, such as those allergic to crustaceans. And while at least 2 billion people, mainly in Asia and Africa, eat insects as part of their diet, many western consumers are squeamish about crunching into a cricket.

Nonetheless, at least one financial institution is predicting that the "yuck factor" can be overcome. "The insect market is still niche," noted Barclays in a November 2019 report. "However, this space could soon be swarming with small brands disrupting the landscape and acting as catalysts for change within the food industry. We estimate that the insect protein market could be worth up to $8 billion by 2030 [based on a compound annual growth rate of 24%]. If supply and demand factors continue to develop favorably, similar to what has been seen in the plant-based space, this forecast could be conservative."

A major driving force could be the big gulf between a growing global population's demand for meat and the increasing challenge of securing adequate protein supplies for future generations. "There are clear environmental and economic benefits if you substitute traditional sources of animal proteins with those that require less feed, produce less waste and result in fewer greenhouse gas emissions," said Mario Mazzocchi, a professor at the University of Bologna, in a statement published by the EFSA.

Europe's latest opinion on dried yellow mealworm results from an application submitted by the French company EAP Group Agronutris in early 2018. According to the IPIFF, European companies in 2019 sold 500 tons of insect-based food, including whole insects, insect ingredients and products that incorporate edible insects. The group forecasts that production will jump to 260,000 tons by 2030.

"We have noticed an increased willingness of consumers to try insect-based foods," said Derrien. "And that is playing in our favor."