S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 May, 2021

By Vanya Damyanova and Adrian Jimenea

After a decade under Chairman Urs Rohner, a new era has begun at Credit Suisse Group AG. But new boss António Horta-Osório faces a tough job ahead as the bank continues to manage the fallout of the Archegos Capital and Greensill Capital (UK) Ltd. crises, which analysts say could hurt the lender's earnings, share price and reputation for the foreseeable future.

The Swiss bank will end up with more than $5 billion losses linked the stock sell-off of U.S. family office Archegos and still must recover roughly half of the $10 billion in assets held in funds related to the now-insolvent supply chain finance firm Greensill, it said in its latest earnings report.

"We would have liked you to have a different kind of farewell," Severin Schwan, Credit Suisse's nonexecutive vice chair, told Rohner at the April 30 annual general meeting, adding that it is "painful" to see the long-term chair retire at a time when the lender struggles with "unjustifiable losses" in its investment bank and asset management units. The two scandals have triggered resizings, bonus cuts and management changes.

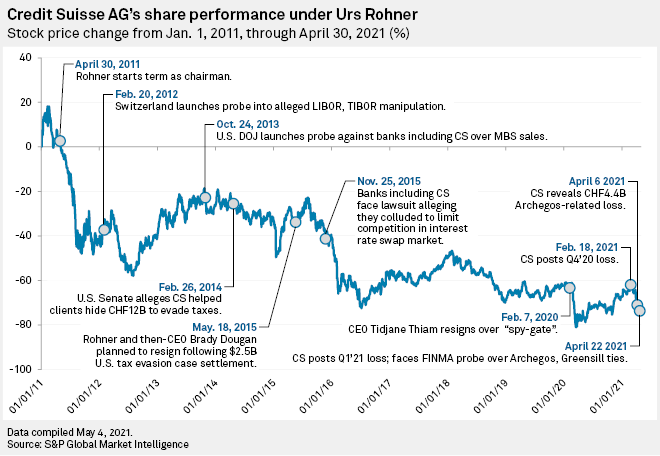

Rohner's 10-year stint as chairman was marred by a slew of controversies including legal battles, hefty fines and a damaging spying affair. Under his chairmanship, Credit Suisse shares lost more than 73% of their value. "Rohner was more than asleep at the wheel," David Herro, vice chair of Harris Associates, a major Credit Suisse investor, told the Financial Times.

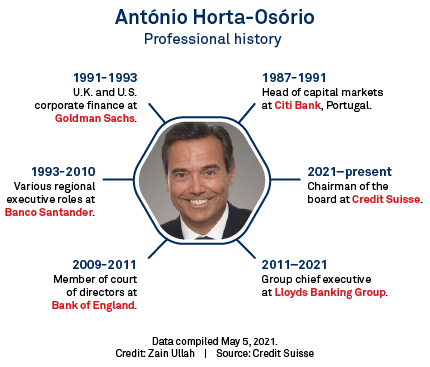

New chairman Horta-Osório spoke of "a tough period and hard decisions" ahead and promised a thorough review of risk management, culture and strategy at Credit Suisse. In an April 23 interview with the FT, a week before he took over his new role, the former CEO of Lloyds Bank said he was not worried and "has a clear idea of what needs to happen" at the Swiss group.

"In our view Horta-Osório brings international experience and a track record of having dealt with significant issues at Lloyds," Maria Rivas, senior vice president in the global financial institutions team of DBRS Morningstar, said in an email, referring to Horta-Osório's successful postcrisis turnaround of the British bank.

"However, he will need to prove that he is able to restore shareholder and investor confidence in the group's risk management by implementing appropriate changes, which is not an easy task at a large and complex institution such as Credit Suisse."

Rough start

The fact that the Greensill and Archegos events came within weeks of each other points to a systemic issue in Credit Suisse's compliance and risk management, Daniel Regli, senior research analyst at Octavian, told S&P Global Market Intelligence. The fallout of the two affairs could cause "lasting damage" to the bank's share price, he said.

Credit Suisse expects another CHF600 million in Archegos-related losses in the second quarter, after booking a CHF4.43 billion charge in the first, and the downsizing of its prime brokerage activities may lead to a loss of business. The bank "is certainly at risk" of losing clients as its ability to maintain a large prime brokerage book comes into question, Octavio Marenzi, CEO of capital markets management consultancy Opimas, said in an email.

However, clients in the investment bank and asset management units, in general, should be largely unaffected, Marenzi noted. Furthermore, first-quarter results showed strong investment bank revenues and solid net new assets growth in asset management, Rivas said.

Credit Suisse's first-quarter investment bank revenues grew 80% year over year, while in asset management revenues rose 60% and net new assets for the last 12 months increased 5%. The group's wealth management business, where first-quarter revenues grew 7% year over year, also contributed to the total group revenue increase of 31%.

Without the Archegos charge, the group would have booked a first-quarter pretax profit of CHF3.6 billion, nearly four times higher than the prior-year result of CHF946 million, which is "a testament to the earnings power of Credit Suisse," CEO Thomas Gottstein said in an earnings statement.

Moody's regards Credit Suisse's "smaller-than-anticipated" first-quarter net loss of CHF252 million as credit neutral as the strong underlying business performance offset larger parts of the Archegos-related loss and mitigated "the corresponding drop in the bank's capital and leverage ratios," analyst Michael Rohr said in a written comment.

'2nd order effects'

Despite the bank's strong underlying results and its diversified franchise, Berenberg, Moody's, CFRA and Morningstar analysts expect Credit Suisse's medium-term performance to come under pressure. The "second order effects" of the Archegos hit, as well as the recent CHF1.76 billion capital raise, which is 8% dilutive to Credit Suisse's EPS, will weigh on capital, hamper future dividend payouts and lead to lower revenues, Berenberg analysts said in an April 26 note. They added that the stock is unlikely to recover anytime soon.

Morningstar equity analyst Johann Scholtz and Moody's credit analysts warned of potential future losses linked to the closed Greensill funds. Three Greensill exposures amounting to CHF2 billion will be particularly hard to recover, and, although the ultimate risk lies with asset management clients, if Credit Suisse does not offer compensation there will be "clear reputational and litigation risk" for the group, Scholz said.

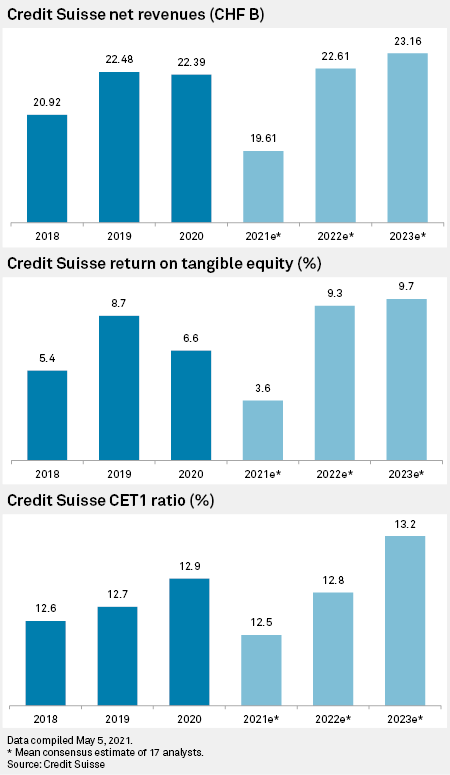

CFRA equity analyst Firdaus Ibrahim and the Moody's analysts questioned Credit Suisse's ability to meet its 10%-12% medium-term return on tangible equity target. Further losses linked to Archegos and Greensill could diminish the bank's ability "to generate earnings in-line with prior years' levels" and put its financial targets at risk at least in 2021, Moody's said.

Consensus forecasts show an expected drop in Credit Suisse's ROTE, revenues and common equity Tier 1 ratio levels in 2021, with ROTE estimates staying below 10% by 2023.