Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Nov, 2022

|

The start date for the Hinkley Point C power plant in England has been pushed back two years, and costs have risen 50% since construction began in 2017. |

When former U.K. Prime Minister Gordon Brown and former French President Nicolas Sarkozy agreed on a deal for new nuclear power stations in 2008, they laid the foundations for one of the U.K.'s largest infrastructure projects, Hinkley Point C Nuclear Power Plant. Set on the Severn Estuary in western England, the 3.28-GW site was meant to start producing power in 2025.

|

Since construction began in 2017, this start date has slipped back two years, and costs have risen 50% to at least £22 billion. The plant, a new-generation European Pressurized Reactor, or EPR, is being built by Electricité de France SA, or EDF, and co-financed by China General Nuclear Power Corp.

EPRs were intended to improve safety and reduce nuclear waste compared with Cold War-era designs, but the troubles they face in construction are emblematic for new nuclear across Europe and the U.S.

EDF's 1.65-GW Flamanville plant, under construction in northwestern France, is 10 years behind schedule and is set to cost €12.7 billion, four times more than first estimated in 2004, Reuters reported. Finland connected its 1.6-GW Olkiluoto 3 reactor of the same design this year, 12 years later than planned.

The lone new utility-scale nuclear project under construction in the U.S. is Southern Co. subsidiary Georgia Power Co.'s Alvin W. Vogtle Nuclear Plant expansion, expected to begin operations in 2023 after being plagued by setbacks and upward of $16 billion in cost overruns.

"That's the story with new nuclear," said M.V. Ramana, professor and Simons Chair in Disarmament, Global and Human Security at the University of British Columbia. "There is some interest, but the only places where it's actually moving forward are where the government allows these utilities to get a guaranteed recovery of their cost, plus a profit. … They have to find some way of making customers or taxpayers pay for it."

Still, despite past delays and budget overruns, a new push for nuclear is underway in parts of Europe as well as in the U.S. Energy Secretary Jennifer Granholm said the U.S. government is "using every tool available" to achieve President Joe Biden's goal of cleaning up the country's grid by 2035, including prioritizing the existing nuclear power fleet.

"As companies have put forward these commitments to be carbon-free by midcentury ... you're going to need that firm generation that can replace the firm generation that's currently coming from fossil fuels," said Matthew Crozat, executive director of strategy and policy development at the Nuclear Energy Institute, a trade association.

The first green shoots for nuclear came from a 2019 report by the Intergovernmental Panel on Climate Change that warned the world was substantially exceeding global warming limits, said Kirsty Gogan, co-founder of think tank TerraPraxis, which is pro-nuclear. The war in Ukraine and its impact on energy systems have solidified support and changed minds, Gogan said in an Oct. 19 interview.

"All of these factors have led to political leaders and public opinion around nuclear [shifting] in a really substantial way," Gogan said. "There's now proactive support in countries that had been lukewarm at best."

Countries including France, the U.K., the Netherlands, Finland and Sweden have pledged to build more nuclear plants in the coming decades.

China is also accelerating an expansion of its nuclear fleet to decarbonize and secure its energy supply, regaining momentum after a yearslong slowdown for safety reviews and upgrades after the 2011 Fukushima Dai-ichi disaster in Japan.

Small reactors, big questions

Many nuclear backers have high hopes for industry's latest pitch: small modular reactors, or SMRs.

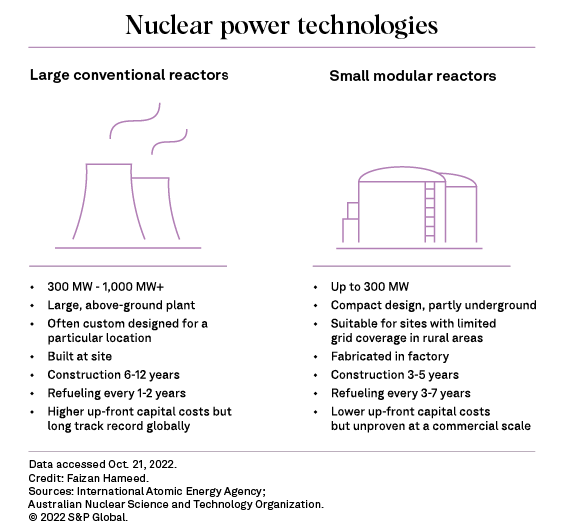

Small modular reactors generate less power than traditional reactors but promise a cheaper and less risky build — "a kind of Henry Ford model rather than a custom design," according to Warren East, CEO of Rolls-Royce Holdings PLC, one of the developers of SMRs. East spoke at the Financial Times of London's Energy Transition Summit on Oct. 18.

SMRs' tantalizing promise remains untested, but industry and government officials see a role for small reactors as a carbon-free option to replace the firm, dispatchable power now often provided by coal and natural gas.

"I would argue that the new nuclear future of America will likely start with SMRs," Southern Co. Chairman, President and CEO Tom Fanning said on an Oct. 27 earnings call. "That could happen, last half of this decade, certainly."

Southern has partnered with Bill Gates' TerraPower LLC on a demonstration project to repurpose the site of the Naughton coal plant near Kemmerer, Wyo., as a 345-MW sodium-cooled fast reactor, a type of SMR. Funding for half of the $4 billion cost would come from TerraPower and its partners, with the remainder committed by the U.S. Energy Department.

The Tennessee Valley Authority, or TVA, could be one of the first to move on utility-scale SMRs in the U.S.

The U.S. government-owned utility holds the only early site permit for SMR deployment issued by the U.S. Nuclear Regulatory Commission, for its Clinch River Nuclear site near Oak Ridge, Tenn. In May, TVA President and CEO Jeff Lyash said the federal power authority could file a license application for an SMR as soon as the fourth quarter of 2023.

TVA has partnered with Ontario Power Generation Inc. to develop advanced nuclear technology. Ontario Power Generation, meanwhile, is partnering with GE-Hitachi Nuclear Energy Inc. to deploy an SMR at its existing Darlington nuclear site in Ontario and plans to submit its license application by the end of 2022. The 300-MW Darlington New Nuclear Power Plant is estimated to be completed by 2028.

Lyash views exploring SMRs as "standing up a platform," the CEO said Oct. 24 at the U.S. Nuclear Industry Council's New Nuclear Capital Symposium. "I don't want to build one reactor, I want to build 20."

TVA may have to build many of those 20 reactors, however, before SMRs really start to pay off.

"The idea for SMR is to benefit from serial effect, modular design. But at the very beginning you cannot benefit from serial construction," said Alain Vallée, president of Paris-based nuclear advisory firm NucAdvisor, in an interview. Vallée spent three decades at French nuclear giant Framatome and helped design the EPR product there.

East, from Rolls-Royce, also concedes there are cost challenges. "There's a financial risk," East said. "We've done everything we can to minimize the technology risk, but it's not actually been done yet."

Episodes of Energy Evolution are available on iTunes , Spotify and other podcast platforms.

Reaching critical mass

Conventional reactor designs must also scale up new supply chains.

While the nuclear sector was able to develop plants in quick succession in much of the world through the 1980s and 1990s, recent struggles can be explained by amnesia, according to Mark Hibbs, nonresident senior fellow in the nuclear policy program at the Carnegie Endowment for International Peace, a think tank.

"The industry has forgotten how to build nuclear power plants in series," Hibbs said in an interview. There are issues with knowledge retention and supply chain management, the expert said.

Lessons learned from the Flamanville and Hinkley Point C projects could cut costs on future EPR projects, Vallée said.

The six new plants envisaged by France are set to be EPR 2s, a design very similar to the three new projects. "They did the design change in order to simplify," and are making it easier to work on-site, Vallée said.

Similarly, in the U.K., EDF is eyeing Sizewell C Nuclear Power Plant in eastern England for a copy-paste replication of Hinkley Point C, a move TerraPraxis' Gogan said should demonstrate learnings and shave off cost. "I would like to see a 30% cost reduction," said Gogan, who has advised the U.K. government on its nuclear policy.

China may offer the best economies of scale.

China's State Council has approved 10 new nuclear reactors so far this year, doubling the 2021 figure and reaching the highest since 2008. It is set to approve between six and eight new reactors per year through 2025. As of September, China operated 54 reactors, with 22 under construction, according to the World Nuclear Association.

China is aiming to expand its nuclear power capacity to 70 GW by 2025, according to its most recent five-year plan, up from 52.15 GW as of September 2022. The China Atomic Energy Authority expects nuclear capacity to reach 150 GW in 2035, which would provide 10% of electricity requirements, versus 5% in 2021.

Expanding nuclear power is part of Beijing's efforts to avoid a repeat of power outages in 2021 and 2022 and pursue energy security amid geopolitical tensions, said Li Miaosu, energy consultant at the Lantau Group consultancy.

Essential or excess?

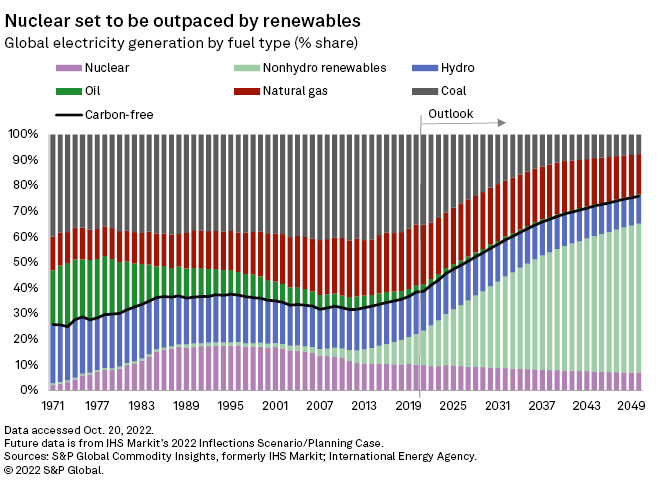

Despite the new interest, with renewables such as wind and solar widely expected to play a pivotal role in utilities and governments meeting net-zero targets, not all are convinced nuclear has a major place in the future grid as it might be too late to contribute significantly.

As part of Europe's response to Russia's invasion of Ukraine, the European Commission proposed increasing the EU's 2030 renewable energy target to 45% from 40%.

"If, over the next eight years, the EU is going to double the share of renewables, I would say there is not the need for additional other capacity to come onto the grid," Antony Froggatt, senior research fellow and deputy director in the environment and society program at policy institute Chatham House, said in an interview.

The U.K. is aiming for 95% low-carbon power by 2030 and a fully decarbonized grid by 2035, by which point Hinkley Point C will be online, along with Sizewell C.

The government is aiming to have 50 GW of offshore wind in operation by 2030 and at the same time is pursuing an ambitious program of new-build nuclear to reach a 24-GW target capacity by 2050. Current levels are around 6.5 GW, according to the World Nuclear Association.

Not only does the renewables build-out raise questions about the need for nuclear, but there are also questions about the compatibility of the two technologies, according to Froggatt.

"As the percentage of renewables on the grid increases, the amount of time that you have a grid that is fully renewable increases," Froggatt said, adding that renewables would be better matched with flexibility services such as batteries rather than baseload power sources like nuclear.

For an industry pinning hopes on projects like TVA's at Clinch River, that is a real risk. Even if all goes right, it would not be online until 2032.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.