Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jan, 2021

By Anna Akins

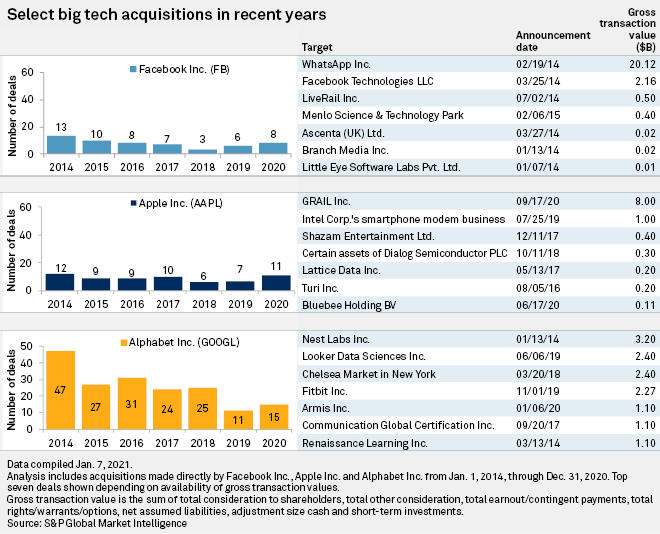

Silicon Valley's breakneck pace of growth, owing largely to acquisitions, stands to face more pushback under the new U.S. administration, analysts said.

The size and market power of some of the largest tech firms, including Facebook Inc., Apple Inc. and Google LLC-parent Alphabet Inc., already is a focal point for lawmakers and regulators globally, who in 2020 held heated congressional hearings and filed antitrust lawsuits that called for remedies from fines to divestitures.

Looking to the rest of 2021, analysts expect President Joe Biden and a Democrat-led Congress to ramp up scrutiny of big tech, which could make large M&A unfeasible.

Wedbush Securities analyst Daniel Ives in a Jan. 6 report said he expects a Democratic sweep of Washington to result in "much more scrutiny" of large tech companies and "sharper teeth" around existing proposals to rein in their market influence. Though he noted the "slim majority" that Democrats currently hold in both the House and Senate will likely make broad legislation difficult to pass, the risk of harsher legal action, including structural separations, "is now clearly in the conversation."

"To be blunt, it's a clear negative for big tech," Ives said. "We still remain firmly bullish on tech stocks for 2021, however the Senate turning blue could tame the tech rally until the Street gets a better sense of the legislative agenda under Biden heading into the rest of 2021/2022."

Facebook has arguably received the most attention from lawmakers and regulators of late. The company in December 2020 was slapped with two separate antitrust lawsuits from the U.S. Federal Trade Commission and a group of 48 attorneys general from across the U.S. The suits allege that Facebook has engaged in anti-competitive behavior, and they call for a slew of potential remedies, including unwinding the company's acquisitions of photo-sharing app Instagram LLC and mobile messaging service WhatsApp Inc., and requiring Facebook to gain approval for future M&A.

Facebook has arguably received the most attention from lawmakers and regulators of late. The company in December 2020 was slapped with two separate antitrust lawsuits from the U.S. Federal Trade Commission and a group of 48 attorneys general from across the U.S. The suits allege that Facebook has engaged in anti-competitive behavior, and they call for a slew of potential remedies, including unwinding the company's acquisitions of photo-sharing app Instagram LLC and mobile messaging service WhatsApp Inc., and requiring Facebook to gain approval for future M&A.

Meanwhile, Google in October 2020 was hit with an antitrust suit from the U.S. Justice Department and 11 states that allege the company unlawfully maintained monopolies in general search and search advertising. Apple also has come under fire from lawmakers and regulators for charging a 30% commission to app developers, which critics claim has resulted in fewer choices and higher prices for consumers.

For his part, Scott Denne, a senior analyst at S&P Global Market Intelligence's 451 Research, expects major tech players to favor "smaller, tuck-in acquisitions" this year as opposed to larger deals that might "raise antitrust flags."

Such a strategy appeared evident in 2020.

Facebook, for instance, in November 2020 agreed to buy customer service startup Kustomer. Though the terms of the deal were not disclosed, multiple outlets pegged the price at about $1 billion.

Apple, meanwhile, in May 2020 purchased virtual-reality startup NextVR, Inc. for approximately $100 million, and in January 2020 snagged XNOR.AI Inc., a Seattle-based startup specializing in innovative artificial intelligence tools, for a reported $200 million.

Google also made smaller acquisitions, agreeing to buy data management firm Actifio Inc. in December 2020 for an undisclosed sum and Pointy, a retail tech company that helps merchants list their products online, reportedly for close to $163 million in January 2020.

Timothy Lesko, a partner and portfolio manager at Granite Investment Advisors, expects the lingering impacts of the pandemic to prompt technology firms to invest in areas like data security and internet speed to accommodate the rise in remote work.

"I think that business was caught somewhat off guard by having the capacity for people to work from home more effectively, and they’re going to continue that spend," he said.

Facebook CEO Mark Zuckerberg on an October 2020 earnings call acknowledged plans to "double down" on investing in connectivity due to the pandemic.

"I think more people are doing kind of synchronous forms of connection ... voice calling and video calling," he said, which will "continue to be elevated in a lot of areas."

For Alphabet, CEO Sundar Pichai on an earnings call for the just-ended period said the company aims to continue investing "deeply" in emerging technologies like artificial intelligence "to ensure the most helpful search experience possible."

Apple executives, meanwhile, noted on a recent earnings call that the company continues to seek out ways to build out its emerging services business, which includes its Apple TV+ streaming service, Apple Music and cloud services.

"This was a record quarter for the App Store, AppleCare, cloud services, Music and payment services," said Apple CEO Tim Cook. "The App Store, in particular, continues to play an essential role in helping small businesses, educational institutions and workplaces adapt to COVID-19."

The potential for increased regulation under the new administration may mean fewer large acquisitions for big tech companies, but M&A in the sector will continue to be transformative, Lesko said.

"M&A really is moving toward 'What can we buy that is going to fundamentally change our business in the future,'" he said, "not add to revenue next quarter."