Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jul, 2022

While Netflix Inc.'s push into advertising has captured the imagination of Wall Street and Madison Avenue, analysts expect it will be years before the effort yields material revenue.

The company offered scant new details about the plan on its second-quarter earnings call, leaving analysts and investors with many questions about execution. The slow pace of the product's planned rollout underscores the challenge of the task, even for a streaming leader, analysts said.

Microsoft Corp. will partner with Netflix in handling ad sales beginning early in 2023, initially targeting mature ad markets. To date, Netflix has not provided any information about planned pricing, inventory load or content for the ad-supported product. The company also has yet to name an executive to head its ad sales efforts.

"The ad business is complicated," said Deana Myers, research director at Kagan, a media research group within S&P Global Market Intelligence.

Myers believes that the difficulties of breaking into the ad space may be why Netflix delayed the launch of an ad-supported tier from later in 2022 until early 2023.

Launch headwinds

Netflix will face strong competition from traditional media players with closer ties to the video advertising marketplace, including Paramount Global, Warner Bros. Discovery Inc., NBCUniversal Media LLC and Walt Disney Co., all of which offer competing ad-supported streaming products.

The media conglomerates are newer than Netflix to streaming, but they all have sales forces and legacy ad sales businesses to lean on to support their ad-supported streaming platforms. Disney+, which is launching an ad-supported version of its streaming platform later this year, signed ad deals with all major ad agency holding companies during its just-completed upfront negotiations.

A recessionary environment could also impede Netflix's plan to launch an ad business, Kagan senior research analyst Seth Shafer said.

However, Netflix executives on the earnings call said the company is well-positioned to weather a recession, as consumers generally seek in-home entertainment during downturns.

Netflix COO and Chief Product Officer Gregory Peters said Netflix's advertising efforts will also ramp up over several years.

"At the beginning, it will look like what you're familiar with, but over time, we think there's a tremendous opportunity to leverage that innovation DNA that we have," Peters said, citing addressability and measurability as future opportunities.

In the meantime, the executive reported "a lot of excitement in our early discussions with brands and holding companies and agencies."

Early enthusiasm does not always translate into long-term sales, however. While advertisers and brands are "understandably excited" by the prospects of delivering premium video ads to the streamer's subscribers, Netflix still must build an ad-based customer base, Morgan Stanley analyst Daniella Cohen said.

Revenue impact

A major question for analysts remains what impact the ad-supported tiers will have on average revenue per user or member and overall revenue.

Morgan Stanley's Cohen believes that Netflix can introduce lower-priced tiers to drive incremental net adds without sacrificing ARPU, particularly in high ad ARPU markets like the U.S. Less clear is how well the service will play in low ARPU markets like much of Latin America and Asia-Pacific.

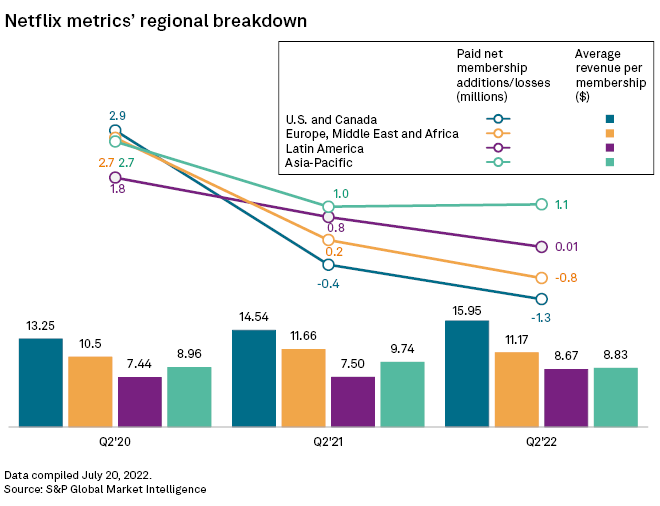

In the U.S. and Canada, Netflix shed 1.3 million members in the second quarter but recorded monthly average revenue per member of $15.95, the highest among reported geographies.

Netflix is optimistic that the monetization of the planned ad-supported product will be "equal or maybe even better than what we would see on the comparable side for the non-ad, subscription-only kind of plans," said Netflix's Peters.

Others, though, see ad-supported tiers negatively impacting ARPU, at least in the short term, as core subscribers in the U.S. and Canada may move to an ad-supported alternative that generates less revenue.

Long-term outlook

MoffettNathanson analyst Michael Nathanson estimated that the benefit of the ad product will not be noticeable for the company until 2024. Nathanson predicts that Netflix could generate an incremental $1.2 billion in high-margin U.S. revenues in 2025.

Wells Fargo analyst Steven Cahall likewise said investors will need to wait until 2024 and beyond to see any material financial impact from the company's ad-supported efforts. Similarly, Cahall expects the company's crackdown on password-sharing among multiple households will take time to bear fruit.