S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Jul, 2021

After seeing a surge in streaming during the pandemic, Netflix Inc. could now be facing a growth problem.

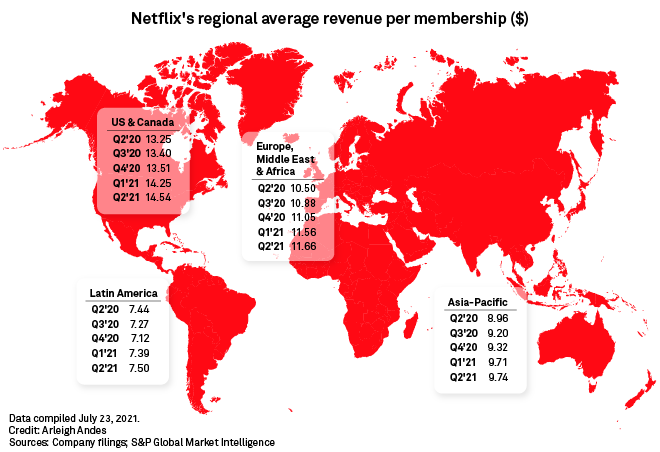

Some of the company's most valuable markets by average revenue per user are showing signs of maturity. In the second quarter, the U.S. and Canada saw a net loss of subscribers, and growth in Europe, the Middle East and Africa slowed. Meanwhile, Netflix's Asia-Pacific regional segment accounted for the bulk of the company's second-quarter membership growth, but those customers generate less revenue and lower margins for Netflix.

With the company's revenue-growth mix increasingly favoring lower ARPU markets, some analysts are questioning whether Netflix is sacrificing its margins in favor of subscriber growth. Others believe there may be merits to this strategy, given rising competition in the global streaming market.

"Saturation in UCAN/EMEA is clearly approaching," said Wedbush Securities analyst Michael Pachter, who has an "underperform" rating on the company's stock. "We think it is clear that Netflix can grow overseas for the foreseeable future, but we remain concerned about the quality of its growth."

Notably, while the Asia-Pacific region accounted for about two-thirds of Netflix's membership growth in the second quarter, ARPU in that market was $9.74 — or about two-thirds of Netflix's ARPU in the U.S. and Canada.

Going mobile

In some respects, Netflix has made a conscious decision to trade higher membership growth for lower ARPU by expanding its low-price mobile-only plans. First launched in India in 2019, the mobile-only plan subsequently became available in Malaysia, Indonesia, the Philippines and Thailand. Prices were generally 50%-60% cheaper than Netflix's Basic plan in each country, according to data from Kagan, a media research group within S&P Global Market Intelligence.

"They don't break that out and report that, but from what we can tell and see, a good bit of their growth in APAC is coming from mobile-only plans with lower ARPU," Kagan analyst Seth Shafer said in an interview.

Netflix recently expanded its low-cost mobile-only plan to an additional 78 countries across Southeast Asia and sub-Saharan Africa, according to its letter to shareholders this month.

While this expansion could drive subscriber additions, Truist Securities analyst Matthew Thornton said in a research note, he believes the strategy "warrants monitoring" in the third quarter.

According to Netflix, in the five markets where it first had a mobile-only plan, it has proven "an effective way to introduce more consumers to Netflix while being roughly revenue neutral as the lower average revenue per membership is offset by incremental acquisition and generally better retention."

Maximizing ARPU in the company's underserved markets is a balancing act, Netflix Chief Product Officer Greg Peters acknowledged during the company's July 20 earnings call. Netflix is attempting to add its lower-priced plans in foreign markets without cannibalizing its higher-priced offerings.

Shafer said the company has done a good job of striking that balance, and its mobile-only plans, particularly in markets where broadband access is still in its early days, will likely provide a stepping stone to get customers into the ecosystem to purchase higher-tier plans down the road.

Competition

Netflix's lower-ARPU plans are not only about ensuring continued subscriber growth for investors; the company also wants to entrench itself in foreign markets as more streaming services launch across the globe.

AT&T Inc.'s HBO Max began its global rollout in late June, launching in 39 Latin American and Caribbean territories. Globally, HBO/HBO Max subscribers totaled about 67.5 million as of the end of the second quarter, and the company now expects HBO/HBO Max to have 70 million to 73 million global subscribers by year-end.

The Walt Disney Co.'s Disney+ is in dozens of markets, mostly across North and South America and Europe, and it counted over 100 million global subscribers as of March. "Disney+ plans to launch in all major markets and more will be announced soon," the company said on its website as of July 26.

Netflix, by contrast, ended the second quarter with more than 209 million global streaming subscribers, far outstripping its streaming competitors.

Pachter views the competition headwind as a real threat to Netflix, arguing that the rise in streaming services and the consolidation of content companies by well-funded conglomerates will drive up the cost of content creation and make it increasingly difficult for Netflix to keep revenue ahead of expenses.

But Netflix's competitors who want to grow their platforms globally will face the same ARPU limitations, and they will not have first-mover advantage, Shafer said.

"They're going to have to go through this same learning curve Netflix has been wrestling with for years," Shafer said.

'Pure gravy'

Moody's Investors Service debt analyst Neil Begley agrees the competition will have to balance the same equation, and the quality of content will determine the winners. Begley believes the company's expansion into lower-tier plans is a viable path to growth.

"This is scaling business for them, and any revenues you can pick up, particularly for the content that they own exclusively, is pure gravy. I don't really think there's much downside to it," Begley said in an interview.

While the company shed members in the U.S. and Canada in the third quarter, it still grew revenue by 19.4%. Netflix co-CEO Reed Hastings said maintaining that revenue growth in the 20% range is "the big prize." However, its second-quarter revenue growth is down from 24.9% in the 2020 second quarter, and the company said it expects revenue to decelerate further in the third quarter, down to 16.2% growth.

But the company has other levers it can pull, Begley said. In its mature markets, he believes Netflix can add substantial growth by restricting password sharing, a strategy the company has already begun experimenting with on a limited basis. Further, despite consistent executive pushback on the idea, Begley believes there is an advertising opportunity in markets where customers are leaning heavily on low-cost tiers.

"In some markets where ARPU isn't going to rise ... you have to imagine they are thinking about adding advertising," the Moody's analyst said. "It's probably a stronger pitch if people have trouble affording an [subscription video-on-demand] service."