Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Mar, 2021

The ESG Insider newsletter compiles news and insights on environmental, social and governance developments driving change in business and investment decisions. Subscribe to our ESG Insider newsletter and listen to the ESG Insider podcast on SoundCloud, Spotify and Apple Podcasts.

"We still have a long way to go."

That is how Ceres CEO Mindy Lubber summed up the findings of a new report benchmarking the decarbonization plans of the companies with the highest carbon emissions globally. The report comes from the Climate Action 100+, an initiative of more than 575 investors with assets under management totaling $54 trillion.

While more than half of the biggest carbon emitters have set net-zero targets, many are still far behind on setting climate-aligned short- and medium-term goals or committing to make the capital expenditures necessary to achieve those targets, the report finds.

"Companies now need a robust set of actions to implement this effectively," Lubber told reporters.

This week we also heard officials from multiple U.S. federal agencies describe a coordinated governmentwide approach to addressing the systemic risks that climate change poses to financial markets.

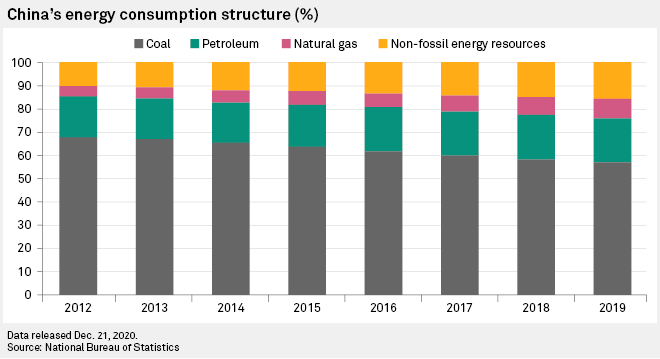

And in China, the central bank's governor outlined plans to further incorporate climate change factors into its monetary policy, including potentially introducing these in stress tests for financial institutions. Our Chart of the Week looks at how China, the world's largest energy consumer, has recommitted to developing nuclear power to support its transition to a lower-emission economy.

Podcast

|

|

EU revolutionizes sustainability regulation with SFDR

New sustainable finance disclosure regulations came into force in Europe on March 10 as part of the EU's push toward making the economy greener. The new Sustainable Finance Disclosure Regulation, or SFDR, is expected to drastically change the scope of sustainable investing by requiring asset managers to disclose environmental, social and governance risks in their portfolios.

We unpack the implications in the latest episode of the "ESG Insider" podcast. "The underlying shift is that we are now moving into a world that ... is embracing sustainability goals," Nathan Fabian, chief responsible investment officer at the Principles for Responsible Investment, tells us in an interview.

—Listen on

Top Stories

Benchmark report finds more companies targeting net-zero, but gaps remain

The investors behind a new net-zero report are pushing companies in the energy, metals and mining, chemicals, transportation and consumer sectors to assess and disclose their climate risks. They plan to use the report to help engage with companies and inform their votes on climate-related shareholder proposals at annual meetings. The 167 companies included in the report are collectively the third-largest source of emissions in the world annually.

Officials describe governmentwide approach to systemic climate financial risks

This week the U.S. Federal Reserve announced that it established a Financial Stability Climate Committee to identify, assess and address climate-related risks to financial stability. The Fed joins several U.S. federal agencies that have launched climate-related initiatives in recent months. The work is part of a "collective effort," Commodity Futures Trading Commission Acting Chairman Rostin Behnam said at a conference.

Uranium gains momentum as China recommits to nuclear power development

Energy experts expect China to expand the use of nuclear power in its energy mix to help the country achieve its climate goals of reducing carbon emissions through 2025 and achieving net-zero emissions by 2060.

Chart of the Week

Environmental

China to further merge climate change factors into financial policy

Nonprofits press Biden to cut off gas projects from global public financing

Era of 'ever-declining' solar panel prices is over, Canadian Solar says

Social

Union seeking national approach to address jobs lost to the energy transition

Virus spread in Papua New Guinea challenges miners' community engagement efforts

First-year Goldman Sachs analysts blast unsustainable, 'inhumane' workload

Governance

Occidental CEO calls on big banks to invest in carbon capture, utilization space

Tough goals, COVID-19 cause some UK financial firms to miss gender targets

Rio Tinto supports activist shareholders' climate proposals

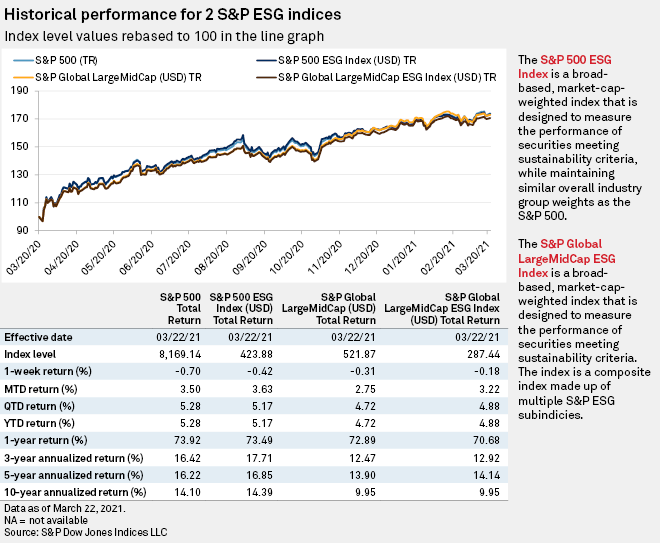

ESG Indices

Upcoming events

Sustainability Week

The Economist

March 22-25

Online

Impact Investing World Forum 2021

Impact Investing World Forum

March 22-23

Online

GreenFin 21

GreenBiz

April 13-14

Online

RI Europe 2021

Responsible Investor

June 14-18

Online

PRI in Person 2021

PRI

Sept. 14-16

Tokyo

The European SDG Summit 2021

CSR Europe

Oct. 11-14

Online

COP26

United Nations Climate Change Conference

Nov. 1-12

Glasgow

Questions or suggestions? Contact S&P Global Market Intelligence's ESG News team at ESGNews@spglobal.com.