S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Oct, 2022

By Rebecca Isjwara

|

| Singapore is positioning itself as a green finance hub for Southeast Asia. Source: tobiasjo / E+ via Getty Images |

Singapore's biggest banks by assets are doubling down on sustainable finance transactions, as they seek to support the government's bid to become a green finance hub for the Southeast Asian region.

DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd., or OCBC, and United Overseas Bank Ltd., or UOB, are targeting between S$30 billion to S$50 billion each in sustainable finance loans as early as 2024, facilitating more transactions than they had earlier envisioned. This came as the government and companies accelerate their moves to renewable energy to prepare for a future with net-zero carbon emissions. Singapore plans to get to net-zero by 2050, in line with the aims of several major global economies.

|

| Mike Ng, head, sustainability office, global wholesale banking of Oversea-Chinese Banking Corp. Source: Oversea-Chinese Banking Corp. |

"When Singapore makes a statement like that, it has every intention and every ambition to meet it even though, as a country, geographically, we are quite disadvantaged because we don't have a lot of wind and we don't have a lot of land for solar," said Mike Ng, head, sustainability office, global wholesale banking at OCBC.

National net-zero targets are naturally passed down to businesses, government agencies, regulators and consumers, Ng said, as governments will pull certain levers to reach their goal, such as using carbon tax as penalties.

The Singapore Exchange Ltd. and Monetary Authority of Singapore on Sept. 12 launched ESGenome, a digital disclosure portal, to attract more environmental, social and governance investments. The island nation on Aug. 4 priced the world's longest-tenor sovereign green bond to finance sustainability projects, such as electric rail networks.

"Energy transition is going to be a major [industry] that is a major contributor in terms of emissions reduction," Ng said, adding that power generation is a key industry that will require new investments. "The renewable energy ecosystem will continue to be a key focus for us."

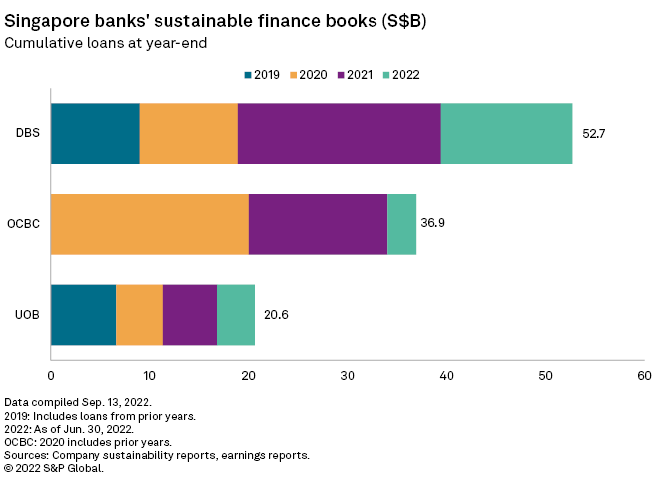

DBS, OCBC and UOB have all surpassed their initial goals of sustainable loans, according to their sustainability reports. DBS Bank is currently the leading lender for sustainable loans, having issued S$52.7 billion since 2018. The bank has not announced a new target.

Banks report cumulative loans issued at the end of each fiscal year and the outstanding loans can be resized and repriced over time.

|

| Yulanda Chung, head of sustainability, DBS Institutional Banking Group Source: DBS Bank |

Sustainable loans in Singapore largely comprise green loans and sustainability-linked loans, with a growing proportion toward the latter. DBS Bank, for example, issued S$12.4 billion in sustainability-linked loans and S$6.9 billion in green loans in 2021.

Green loans require all proceeds to go toward environmental or climate-related projects, while sustainability-linked loans allow for a portion of the funds to be used for general corporate purposes, provided the use of the funds overall are linked to a company or a project's sustainability targets.

"We're looking at beyond the entity that we're financing; we're looking at the supply chain," said Yulanda Chung, head of sustainability, DBS Institutional Banking Group. Chung added that supply chain financing takes factors such as environmental and social conditions into the framework.

"The trend is going beyond just club loans or lending in a sustainable way," Chung said.

Sustainable loans can also be classified by the group that the banks are lending towards. UOB highlighted that S$2 billion out of the S$21 billion loans issued is given to small and medium-sized enterprises.

The majority of UOB's clients are in the SME sector. "They are small businesses,” said Melissa Moi, head of sustainable business at UOB.

"If we're really trying to drive this massive flow of capital that's needed for this transition, we also need to find ways to facilitate our SME clients to be able to access this type of financing in order to transition their businesses," Moi said.

|

| Melissa Moi, head of sustainable business, United Overseas Bank Source: United Overseas Bank |

Challenges

The path to a green and clean environment is not straightforward, the bankers said, noting factors such as sanctions against Russia that continue to stifle gas supply and have forced countries to double down on natural gas production to prepare for the coming winter.

The sustainability leaders at the three banks see this as a strong counterargument for financing green projects this year, but believe that the businesses they lend to will still move toward clean energy in the long run as it will benefit them from both a climate change and economic perspective, particularly when rules such as carbon taxes penalize emitters.

The three lenders have worked to create their own standards when it comes to assessing ESG risks of projects and clients they lend to. UOB in 2021 conducted more than 8,000 ESG assessments alone, referring to ESG definitions from the Association of Banks in Singapore and their responsible financing guidelines. The bank also takes on factors such as reputational risk when conducting ESG assessments.

"The risk for ESG issues is huge and reputational risk is quite large as well, not to mention the physical transition risk stress testing we're going through all the climate related risks conversations we have," Moi said.

As of Oct. 21, US$1 was equivalent to S$1.42.