Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Jun, 2023

By Karin Rives and Raymond Barrett

|

Utah Attorney General Sean Reyes, seen here at a 2020 Republican event in Washington, recently said the Net-Zero Insurance Alliance might be violating US antitrust laws. |

More than a dozen insurance companies have left a UN-led climate alliance in the three weeks since a group of Republican attorneys general warned that their participation appeared to violate US antitrust laws.

The Biden administration's federal antitrust enforcers have not weighed in on whether net-zero alliances raise anti-competitive concerns, but experts say the potential legal jeopardy around any industry collaboration on climate initiatives should not be taken lightly.

Insurance companies that join the Net-Zero Insurance Alliance pledge to engage with their greenhouse gas-intensive clients on decarbonization and net-zero transition strategies. Utah Attorney General Sean Reyes, one of the 23 top legal officers taking the industry to task, has accused the alliance of pursuing a "radical environmental agenda" with requirements for members that could contravene federal and state competition laws.

"You're always going to have antitrust risk with industry alliances," said Steve Nickelsburg, a partner with law firm Clifford Chance who advises corporate clients on risk management. "The question is whether you're taking appropriate steps to manage those risks and staying on the right side of the line."

Clients that belong to other UN-convened or global climate alliances have been calling his firm asking how to navigate potential legal threats if the GOP attorneys general expand their investigations to more sectors, Nickelsburg said in an interview.

Group boycotts a red flag

The antitrust risk is acknowledged in the statement of commitment that new alliance members sign. "Members will refrain from disclosing competitively sensitive information and be particularly careful in not reporting information that may negatively affect competition in the concerned markets," it says.

GFANZ "takes competition concerns seriously and has implemented a robust antitrust compliance program to mitigate potential issues," the alliance said in an emailed statement.

In their letter to the Net-Zero Insurance Alliance, the GOP attorneys general requested a trove of documents and other communication between insurers with US operations and their customers and suppliers showing how they plan to implement and meet their net-zero commitments. They also raised the possibility that the alliance could be an "illegal boycott" of certain carbon-intensive industries. Anti-competitive boycotts are illegal in the US as well as in many other countries.

"A collective boycott is problematic in any jurisdiction," Ronan Scanlan, a Dublin-based antitrust lawyer with Arthur Cox LLP and former deputy director of the UK Competition and Markets Authority, said in an interview. "You are excluding a customer from a market that, absent the agreement, they would have access to."

For example, insurers that coordinate to deny coverage to companies in a specific carbon-intensive sector could be violating antitrust laws if a resulting lack of competition pushes up the price of coverage, according to a recent Moody's research note.

US courts typically apply a so-called rule of reason standard when assessing antitrust liability that does not involve per se illegal activity such as price fixing or bid rigging.

"Generally, if the market impact of the restraint will be limited, the restraint may be deemed reasonable. For example, an optional, non-binding code of conduct among companies to encourage environmentally friendly practices is likely to raise fewer antitrust concerns than a compulsory standard might," Mayer Brown attorneys wrote in a note to clients in November 2022.

Neither the Justice Department nor the FTC — the two primary antitrust enforcers in the US — responded to questions from S&P Global Market Intelligence about the validity of the legal concerns raised by the state attorneys general.

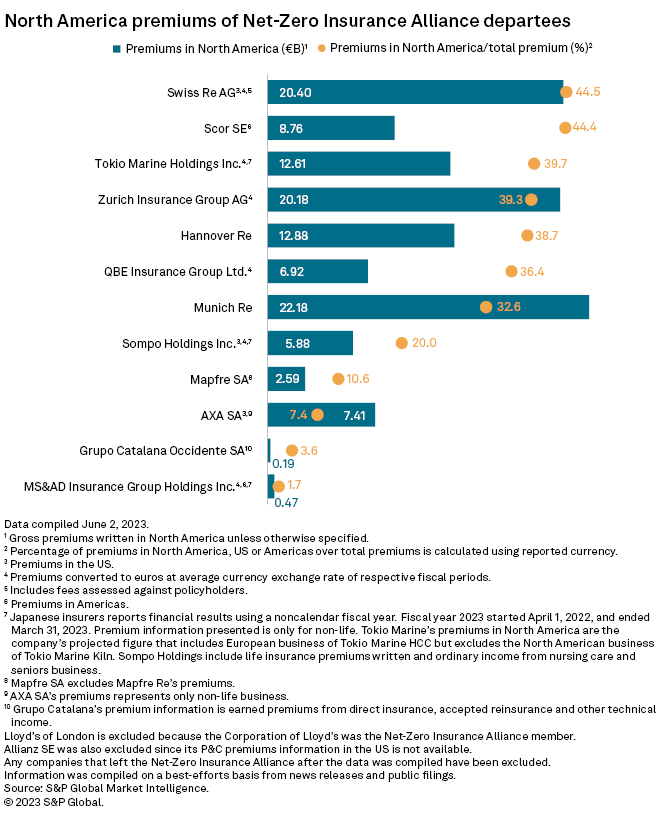

The departing members of the alliance did not address the merit of the antitrust allegations, but insurers in the US are particularly aware of the power local regulators yield, as each state has its own insurance regulator. Many of the European-based companies that left the alliance receive a significant proportion of their premiums in the US.

While the Net-Zero Insurance Alliance quickly attracted members from Europe — Aviva PLC, AXA SA, Allianz SE, Assicurazioni Generali SpA, Munich Re, SCOR SE, Swiss Re AG and Zurich Insurance Group AG were the eight founding members — no US insurers joined the alliance. From a high of 30 companies in March, the alliance's website listed 14 members as of June 7, with only Aviva and Generali remaining of the original eight signatories.

Other potential pitfalls

The wording of industry agreements is critical to avoid scrutiny and liability, legal experts say. For example, mandatory commitments or penalties for not meeting goals are not advisable.

In June 2022, the UN Race to Zero campaign, which approves membership criteria for GFANZ, announced new and stricter rules to speed up the transition away from fossil fuels. Within a year, financial firms would have to restrict support for unabated fossil fuel projects, make their transition plan public and align all lobbying with net-zero goals. The same month, GFANZ released new draft guidance for the financial sector for a "managed phaseout of high-emitting assets" such as coal plants and mines.

The reaction was swift: By September 2022, several US banks warned that the new directive might force them to leave the alliance over antitrust concerns. Race to Zero quickly dialed back its ambition, acknowledging "there may be cause for legal concern" with the text, but the event gave new fodder to GFANZ critics.

The 2022 incident, as well as the recent exodus of insurers, illustrate how GFANZ has struggled to find a balance between its stated climate commitments and the principle that such commitments must be voluntary and lack legal teeth.

It also helps to explain why some companies have decided to stake out their own net-zero journeys independent of global alliances. Financial firms that decarbonize portfolios on their own are less likely to face legal challenges than those that do it as part of a joint action, legal experts say.

Vanguard Group Inc., the world's second-largest asset manager, said as much when it left the Net-Zero Asset Managers Initiative in December 2022. The company wanted to "make clear that Vanguard speaks independently on matters of importance to our investors," Vanguard said in a statement at the time.

No such thing as zero risk

EU antitrust regulators recently published guidance clarifying that antitrust rules do not stand in the way of agreements between competitors that pursue a sustainability objective. The EU guidance follows various cases at the national level where regulators have sought to strike a balance between climate change and competition.

But a climate objective is not a get-out-of-jail-free card in Brussels, either. Even with the new guidance, companies still need to be careful as they pursue their sustainability goals, lawyers said.

"You're never going to drive that risk to zero," Nickelsburg said of the antitrust concerns dogging industry climate collaborations. "And you're certainly not going to drive the scrutiny to zero, especially in an area that's as contested as this."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.