S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Mar, 2021

By Gautam Naik

Nearly half of the U.K.'s 100 largest companies now use an environmental, social and governance measure when setting targets for executive pay, a sign of the growing acceptance of sustainability metrics in corporate boardrooms, according to a new report.

Growing pressure from investors and other groups has persuaded more companies to shift their ESG emphasis from more traditional areas such as employee engagement and risk to newer concerns such as climate change, the environment and diversity. The study was authored by London Business School and PricewaterhouseCoopers, based on ESG targets disclosed in the pay plans of FTSE 100 companies' 2020 annual reports. The FTSE 100 is an index of the U.K.'s 100 largest companies by market capitalization.

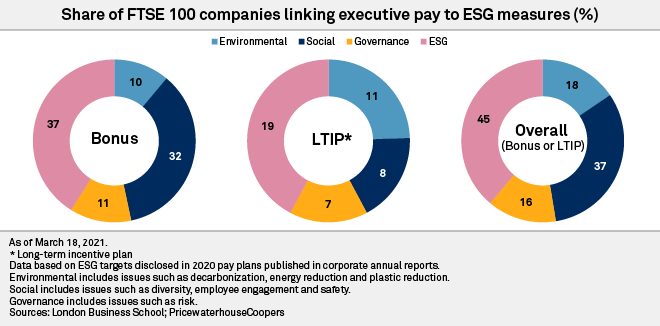

According to the analysis, published March 18, 45% of FTSE 100 companies currently have an ESG measure in either their annual bonus targets or their long-term incentive plans, also known as LTIP. Of the 100 companies, 37% include an ESG measure in their bonus plan with an average weighting of 15%, while 19% include them in their LTIP with an average weighting of 16%. The weighting indicates how much of the pay measure is linked to ESG performance. FTSE 100 companies that link ESG performance to pay include Unilever PLC, Standard Chartered PLC, Royal Dutch Shell PLC and BP PLC.

"One of the biggest motivations is to mobilize an organization ... and achieve the strategy laid out for customers and investors," said study co-author Tom Gosling, executive fellow at London Business School's Center for Corporate Governance, at a webinar to discuss the findings.

According to the report, a third of FTSE 100 companies use traditional metrics relating to employees, which involve risk management, such as health and safety. However, 28% of companies use metrics relating to newer ESG topics such as climate change, employee inclusion and diversity.

In a world where blue-chip companies are tripping over themselves to showcase their ESG credentials, linking such achievement to managerial pay remains a tricky task. ESG measures vary from sector to sector and have spawned a proliferation of competing key performance indicators. That means that a company — and a manager's pay — can be scored very differently depending on which indicator is used.

Compensation committees also face a lag problem. Companies that adopt material ESG measures do tend to perform better, and that ought to translate into a stronger share price, the report found. But this alignment only fully emerges over periods of five years or more. For oil companies and other big emitters of greenhouse gases, that time span could be a decade. "ESG considerations can sometimes take a long time to show in the share price," said Gosling.

In the U.S., about half of S&P 500 companies incorporate ESG metrics in their annual incentive plans, according to a report published by advisory and broking firm Willis Towers Watson in June 2020, although that analysis also concluded that "few give them the importance it deserves." Major players that now link a portion of their executive pay to ESG metrics such as emissions reduction and diversity include Apple Inc., Chipotle Mexican Grill Inc., McDonald's Corp. and Starbucks Corp.

In some vital areas, American companies appear to be running behind. A September 2020 analysis of company public disclosures, also done by Willis Towers Watson, concluded that while 11% of Europe's top 350 companies have CO2 emissions linked to their incentive plans, only 2% of U.S. S&P 500 companies have similar plans in place.

In discussions with investors about ESG and pay, "we've noticed a narrowing in, especially around the [subject of the] environment," said Jenny Craik, global head of performance, reward and conduct at U.K.'s Standard Chartered Bank, who also spoke at the webinar.

Globally, the gap is greater still. An April 2020 paper published by research firm Sustainalytics found that only 9% of companies in the FTSE All World stock index link executive pay to ESG criteria, and when they do, it is usually about occupational health and safety rather than issues such as climate change or gender diversity. The All World index covers more than 3,100 companies.