S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 May, 2022

By Abbie Bennett

|

North Carolina is poised for a key step toward offshore wind generation with a May 11 auction. |

North Carolina could take on a renewable energy leadership role among Southeastern states with a key federal offshore wind lease sale set for May 11 and more on the horizon.

The Carolina Long Bay lease auction represents a critical step for a state that has yet to codify a commitment to offshore wind. Duke Energy Corp., the state's largest electric utility, only recently committed to pursuing offshore wind in its home state as it expands its renewable portfolio across a six-state service territory.

The resulting uncertainty could cause developers to balk at offering the eye-popping winning bid prices that the New York Bight auction drew in February, particularly in light of increasing turbine component costs and supply chain issues.

Unlike North Carolina, New York has a law on the books requiring the state to add 9,000 MW of offshore wind energy by 2035. New Jersey legislation requires the state to add 3,500 MW of offshore wind by 2030.

North Carolina Gov. Roy Cooper issued an executive order in 2021 calling for 2.8 GW of offshore wind capacity by 2030 and 8 GW by 2040, but the state legislature has not codified those goals into enforceable policy. Duke has filed integrated resource plans calling for as much as 2,650 MW of offshore wind but needs regulatory approval to proceed. During meetings for its carbon reduction plan, Duke showed plans for 800 MW of offshore wind by 2030 and another 800 MW by 2032, with more after 2040.

Duke's options

"We expect offshore wind will be an option for [regulators] to consider in terms of our generation portfolio to reach [decarbonization] goals," Regis Repko, Duke Energy senior vice president of generation and transmission strategy, said in an interview. "The 2030 timeline is aggressive and optimistic, considering many of the unknowns we have today like the availability of supply chain, workforce, the permitting process."

The Carolinas are Duke Energy's ideal choice for offshore wind among its territories, Repko said.

"The geography of the Carolinas and its proximity to the Gulf Stream sets up for a very steady and stable wind resource," Repko said.

In vertically integrated North Carolina, any offshore wind project would likely be owned by Duke or a third party selling the energy to Duke through a power purchase agreement or other arrangement.

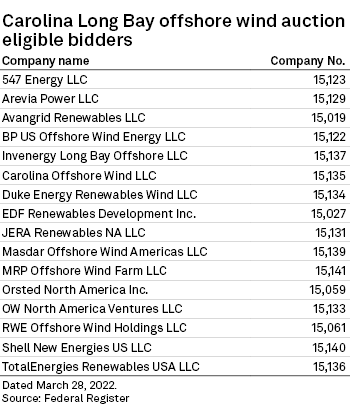

Subsidiary Duke Energy Renewables Wind LLC is among the 16 eligible bidders identified by the U.S. Bureau of Ocean Energy Management, or BOEM.

"If offshore wind is endorsed by the commission, we would pursue ownership," Repko said. "It could be someone else develops it and constructs it and we purchase it."

Duke Executive Vice President and CFO Steve Young said in a May 9 interview that Duke will bid in the May 11 auction but did not elaborate on the size of a potential project, and a Duke spokesperson said they could not share any details. Young's comments are a departure from previous executive remarks on offshore wind, including Young's own from a year ago when the CFO said offshore wind "still needs a fair amount of work to happen here [in the Carolinas]."

North Carolina's major energy legislation in 2021 set decarbonization goals but directed state regulators to plan with utilities to reach those goals using the "least-cost path" and requires Duke to own any generation that regulators select to achieve those goals. Duke is working through the regulatory process for its carbon reduction plans within that framework.

But the legislation contains no specific carveout or requirement for offshore wind, with "wind" mentioned just once in the 11-page law.

Competition

Offshore wind will likely face competition in North Carolina, where solar is king and other options such as onshore wind are geographically viable, said Lillian Federico, energy research director at Regulatory Research Associates, a group within S&P Global Market Intelligence. Duke will have to weigh offshore wind costs against potentially affordable alternatives if it expects to recover its costs through rate cases.

The high New York Bight lease prices raised concerns about whether developers will be able to earn adequate returns on their projects, though a recent RRA analysis found the broader maturation of the U.S. offshore wind industry could support price increases.

Repko said that given uncertainties surrounding offshore wind, Duke estimates generation costs for such projects would be "within the realm" of small modular nuclear reactors, not including transmission costs.

But costs for offshore wind have decreased dramatically in recent years, said Chris Carnevale, climate advocacy director for the Southern Alliance for Clean Energy.

"The cost curve is really coming down, and offshore energy has a pretty long lead time on project development," Carnevale said.

Carolina Long Bay

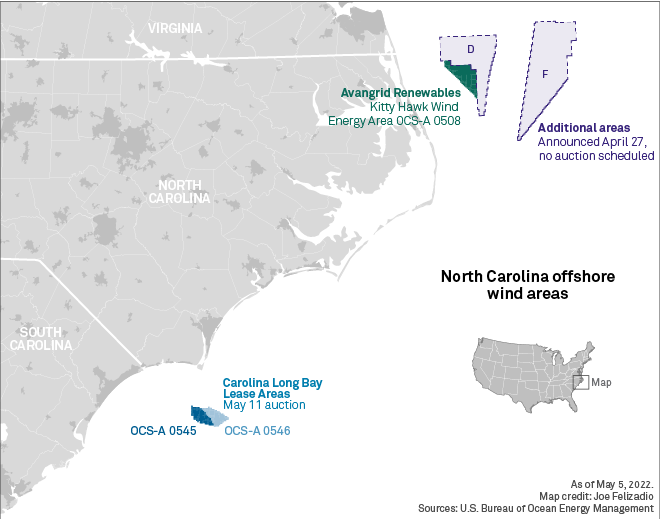

The U.S. Interior Department announced March 25 that BOEM would hold a wind energy auction for two lease areas offshore North Carolina on May 11, covering 110,091 acres in the Carolina Long Bay area, about 20 miles from Bald Head Island. The department estimated that the areas could generate 1.3 GW, at minimum, if developed.

The Carolina Long Bay auction will allow offshore wind developers to bid on one or both of the lease areas within the Wilmington East Wind Energy Area, each of which has similar acreage, distance to shore and wind resource potential.

|

Eligible bidders, according to the BOEM final sale notice published March 28, include 547 Energy LLC; Arevia Power LLC; Avangrid Renewables LLC; BP US Offshore Wind Energy, a partnership between BP PLC and Equinor ASA; Invenergy Long Bay Offshore LLC; Carolina Offshore Wind LLC; Duke Energy Renewables Wind LLC; EDF Renewables Development Inc.; JERA Renewables NA LLC; Masdar Offshore Wind Americas LLC; MRP Offshore Wind Farm LLC; Orsted North America Inc.; OW North America Ventures LLC; RWE Renewables Americas LLC subsidiary RWE Offshore Wind Holdings LLC; Shell New Energies US LLC; and TotalEnergies Renewables USA LLC.

The auction will give a successful bidder the right to potentially develop an offshore wind project. Following a U.S. Justice Department review of the auction and finalization of offshore lease agreements, the successful bidder is expected to file plans for surveying the lease area or areas and building the generation. Those plans must be reviewed to ensure environmental and technical sufficiency and compliance, and if approved, the bidder will be able to survey the lease area and commence construction. Any winning bidder will also likely have to work with Duke Energy and be subject to additional regulatory approvals and interconnection agreements.

Additional sites

On April 27, the Biden administration announced two more sites off the North Carolina coast totaling about 1.2 million acres. The auctions for those sites, which do not yet have dates, are part of the administration's goal of 30,000 MW of offshore wind generation by 2030.

Previously, the BOEM awarded the first lease off the North Carolina coast to Avangrid Renewables to develop the planned 2,500-MW Kitty Hawk Offshore Wind Farm project. The first 800-MW phase of the project is scheduled to come online in 2026 and the second 1,700-MW phase in 2030.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.