S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Feb, 2022

By Ronamil Portes

Editor's note: This Data Dispatch is updated monthly and was last published Jan. 6. The analysis includes current publicly traded U.S. equity real estate investment trusts that trade on the Nasdaq, NYSE or NYSE American with market capitalizations of at least $200 million. Click here to download these charts in Excel format.

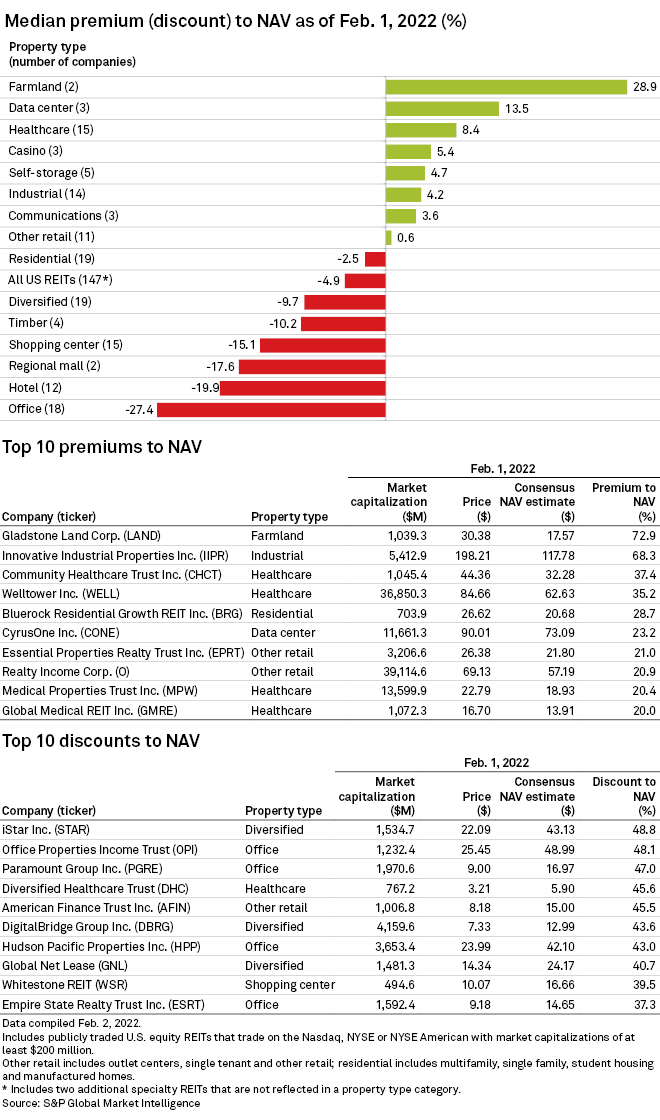

Publicly traded U.S. equity REITs traded at a median 4.9% discount to their consensus S&P Global Market Intelligence net asset value per-share estimates as of Feb. 1, a decline from the 3.1% premium at which they traded as of Jan. 3.

The farmland sector traded at the largest median premium to NAV, at 28.9%. The sector's high median premium was mostly attributed to Gladstone Land Corp., which had the highest premium among all U.S. equity REITs above $200 million market capitalization, at 72.9%. Another farmland REIT, Farmland Partners Inc., was on the other side of the spectrum, as it closed Feb. 1 at $11.51, 15.1% below its consensus NAV estimate of $13.57.

The data center and healthcare segments followed, trading at median premiums of 13.5% and 8.4%, respectively.

On the other hand, office REITs traded at the largest discount to NAV at a median of 27.4%. Following closely behind are hotel and regional mall sectors with median discounts of 19.9% and 17.6%, respectively.

Within the office sector, Office Properties Income Trust traded at the second-largest discount to NAV among all U.S. equity REITs above $200 million market capitalization, at 48.1%. Three other office REITs, namely Paramount Group Inc., Hudson Pacific Properties Inc. and Empire State Realty Trust Inc., were also included in the list of REITs with the largest discounts across all sectors as of Feb. 1.