S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Jun, 2021

By Allison Good and J Robinson

|

This is the fourth in a multipart series exploring the natural gas industry's role and prospects in the energy transition — a globe-spanning movement to cut greenhouse gas emissions across the energy industry.

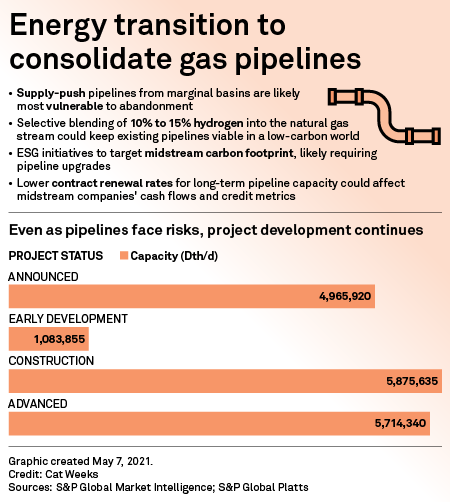

After a yearslong infrastructure spending and building boom, the U.S. midstream sector faces a pivotal moment as the energy transition gathers speed and political and financial barriers to new natural gas pipelines multiply.

Environmental, social and governance-oriented investors are pressuring companies that own and operate interstate gas transmission assets to decarbonize. And many of the pipelines' utility customers are pledging to reach net-zero carbon emissions by or before 2050 to comply with state mandates.

Several gas pipeline industry experts emphasized that even though some pipelines may eventually be involved in transporting cleaner fuels, they will still primarily deliver natural gas for decades to come. At the same time, pipelines that face significant trouble around renewing shipper contracts could become stranded assets, the experts said.

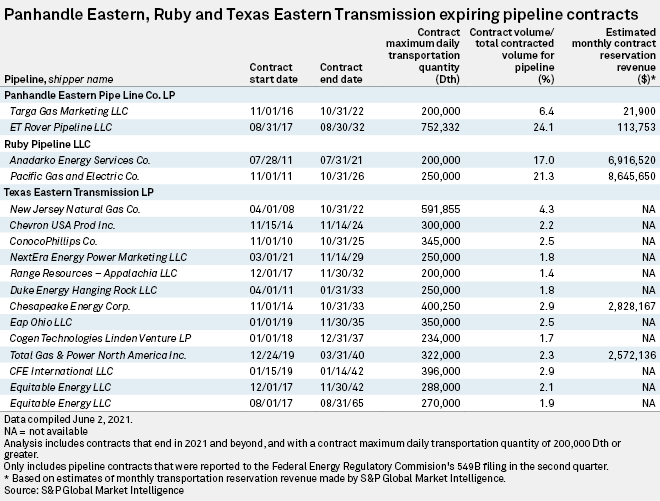

Some supply-push pipelines built during the height of the shale boom are particularly vulnerable to falling out of use, according to S&P Global Ratings analyst Michael Grande. "The contracts all came on in the 2010 time frame," Grande said in an interview. "Down the road in 2019, 2020, contracts tended to roll off and be renewed at lower rates because the basins compressed so much, and there is just lower revenue."

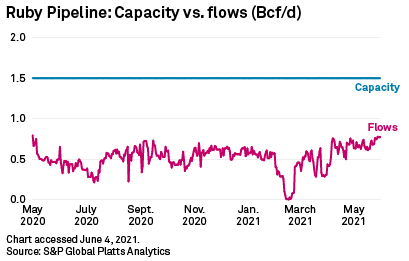

One of these pipelines is Kinder Morgan Inc.'s Ruby Pipeline LLC system, which connects Opal, Wyo., and Malin, Ore. Since the beginning of 2020, the 1.5 million-Dth/d pipeline's flows have not exceeded an average 1 million Dth/d, according to S&P Global Platts Analytics data. Meanwhile, a firm transportation agreement with Anadarko Energy Services Co. comprising nearly 17% of Ruby's reserved capacity is scheduled to expire in July, according to S&P Global Market Intelligence contract data.

S&P Global Ratings in April downgraded the pipeline's issuer credit rating to CCC from B-, while Moody's in March downgraded the company to Caa1 from B1. Fitch Ratings in March downgraded Ruby Pipeline's long-term issuer default rating to CCC+ from BB. All three agencies cited re-contracting concerns. "Lower renewal rates will result in weaker cash flows and credit metrics," Ratings wrote in an earlier downgrade.

Steel in the ground

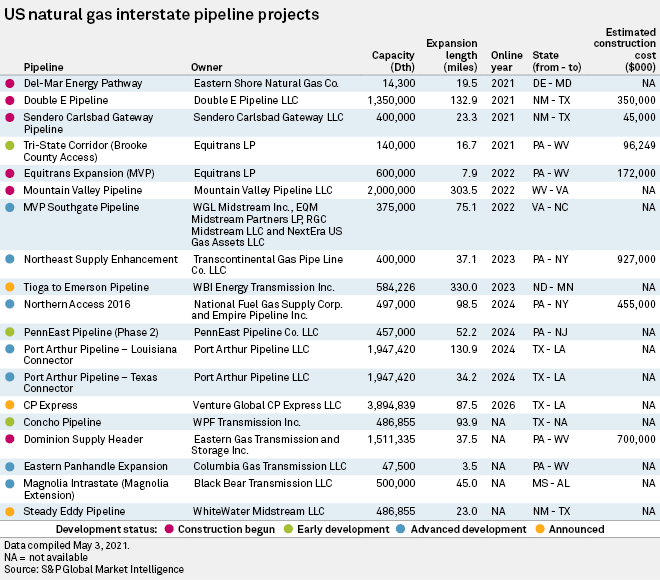

North America's pipeline buildout is not over — companies could add 33 Bcf/d of capacity over 2020-2025, according to a study funded by the INGAA Foundation, the research arm of the trade group representing the industry — but the hurdles to new construction are getting higher. Federal regulators are increasingly considering climate as a factor in pipeline permitting, and state-level barriers and environmental opposition have driven multiple project cancellations.

Given that midstream companies are reluctant to build new long-haul pipelines, operators with ample long-term, take-or-pay capacity see their infrastructure at a competitive advantage.

"The value of the pipe we have in the ground is increasing," Enbridge Inc. President, CEO and director Al Monaco said during a March panel. "You simply can't replicate this pipe in the ground, and it's going to be generating cash flow for a very long time."

A range of technologies could help ensure that gas infrastructure assets do not become stranded but rather aid in the energy transition, according to Erin Blanton, a senior research scholar at Columbia University's Center on Global Energy Policy. Possibilities could include the use of lower-carbon fuels such as hydrogen and biomethane that could still be used to meet demand for highly deliverable fuel supplies that can be stored long term.

"We can make those molecules greener," Blanton said. "If this is an industry that is going to become greener over time, we need to know how much greener it needs to become."

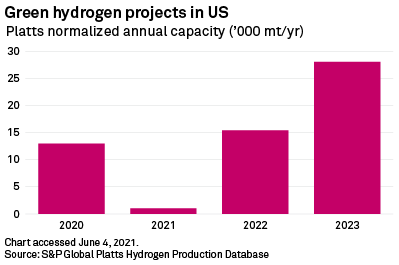

For interstate gas pipelines that have promising longevity, replacing 10% to 15% of flowing volumes with hydrogen and blending the two fuels for transportation is something management teams are considering. Existing gas pipelines are compatible with hydrogen blending at low volumes and low pressures, according to Platts Analytics. Lower-pressure steel pipes are seen as the most likely to be converted in the early days of hydrogen blending.

Heavyweights Kinder Morgan, Enbridge and Williams Cos. Inc. have all expressed optimistic interest in exploring blending opportunities. Enbridge is already working on pilot projects involving gas distribution, where hydrogen blending is less problematic due to lower-pressure gas flows. Hydrogen is most likely to compromise steel pipelines that operate at high pressure, making injection into certain interstate transmission lines more challenging.

Midstream and end-use infrastructure will be another major challenge for blending, according to Platts Analytics. Compressor stations, meters, natural gas turbines, furnaces, water heaters and gas burners would all need to be recalibrated or retrofitted to accommodate the higher burn speed and lower calorific content of hydrogen.

According to analysts at Sanford C. Bernstein & Co. LLC, the best gas transmission pipeline candidates for renewable hydrogen blending include Tallgrass Energy LP's Rockies Express Pipeline LLC and TC Energy Corp.'s ANR Pipeline Co., which are near potential supply sources.

"It appears to be more cost-effective if produced where the renewable generation is available if there is existing pipeline," the firm said earlier this year. "Then ideally you would want the existing gas pipeline to go from a wind/solar nexus to a demand center. These analyses suggest the best locations for pipelines to exist are starting in Middle America and the American Southwest, and going to urban demand centers (California, the Gulf Coast, Midwest)."

Still, BTU Analytics' Matthew Hoza said it is unlikely that entire pipelines will be converted to accommodate hydrogen blending. Instead, he said, "There are opportunities along these pipelines where maybe you do have underutilized segments that you have some room to potentially blend hydrogen."

Enbridge's Texas Eastern Transmission LP has a segment moving Marcellus and Utica shale supplies to Ohio that could fit that bill. Hoza said it is underutilized because it is still configured to carry gas north instead of south, whereas most of Texas Eastern has been reversed to send volumes to Texas and the Gulf Coast. Along that line, a compressor station at the Illinois-Indiana border could provide wind for powering an electrolyzer to make green hydrogen.

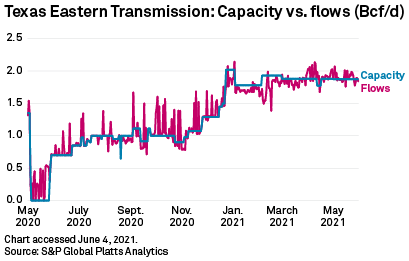

Looking at current flows, though, Texas Eastern is not in near-term danger of becoming a stranded asset. Its net flows southbound have largely kept up with capacity since the beginning of 2020, and many of its contracts for more than 200,000 Dth/d will not roll off until the 2030s and beyond.

Financial and regulatory hurdles

Turning the hydrogen blending potential into reality would require significant financial investment. For steel and iron-based pipelines, which can experience hydrogen embrittlement under high pressure, spray-in liners and certain treated steel can mitigate integrity concerns, according to Platts Analytics.

One option is to send in-line devices through pipes that would apply an interior coating for pushing the hydrogen blending percentage up, but that may not be feasible for much older infrastructure, Hoza said. "The cost to retrofit a pipeline like [Panhandle Eastern Pipe Line Co. LP] is going to be very different than, say, going up to [Algonquin Gas Transmission LLC] that's already had more recent pipe put in the ground and some compressor stations upgraded," Hoza explained.

At present, the Panhandle system appears likely to continue flowing gas in coming decades given that customer Rover Pipeline LLC, with purchased volumes that account for at least 20% of Panhandle Eastern's contracted capacity, only began full commercial service in 2018 and is backed by its own long-term shipper agreements. Re-contracting capacity is not a central concern for Ratings either, which rates Panhandle Eastern's investment-grade issuer-level credit at BBB-.

Hydrogen blending could also pose a problem for the federal regulation of pipeline rates, according to FiscalNote Markets Managing Director Katie Bays.

"It will require additional legislation because [the Federal Energy Regulatory Commission] does not currently have jurisdiction over anything related to hydrogen," Bays said in an interview. "To the extent that the commission wants to try, they probably could expand the scope of their authority in the Natural Gas Act to try to be inclusive of some policy related to hydrogen, but it would be extremely limited."

With hydrogen infrastructure lying outside of FERC's interstate gas transportation mandate, Bays added, "it's a very incomplete regulatory chain."

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.

J Robinson is a reporter for S&P Global Platts. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.