Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Jun, 2021

|

This is the first in a multipart series exploring the natural gas industry's role and prospects in the energy transition — a globe-spanning movement to cut greenhouse gas emissions across the energy industry.

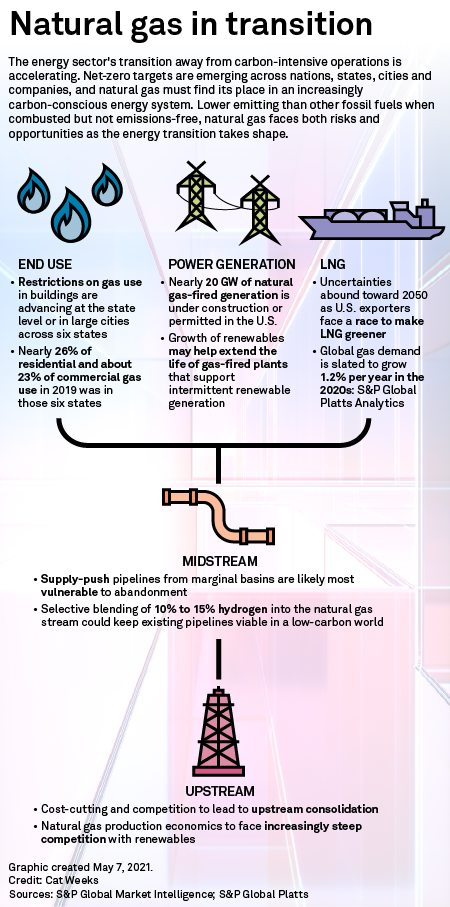

The U.S. natural gas sector faces risks and opportunities across the value chain as the energy sector accelerates toward less carbon-intensive operations. Some segments and businesses are better positioned than others to survive the shift.

Downstream companies have found themselves in the middle of a tug of war over the future of direct-use: A number of communities have made moves to block gas use in buildings, driving pro-gas backlash in some states.

In the electricity space, gas-fueled power generation has beaten coal on costs and cleanliness. But with costs falling for renewable power and associated technologies, the longevity of gas depends on its cost competitiveness and its flexibility to back up intermittent power sources.

Changes in gas use will in turn dictate the demand for pipeline capacity, with some assets at risk of becoming stranded. Other pipelines stand to benefit from growing LNG demand and forays into hydrogen blending in the gas stream.

Farther upstream, natural gas producers will find their product facing intensifying competition from renewable energy resources. Emissions along the value chain are growing more relevant in many markets, and the gas industry may have to clean up to find an outlet in international markets that are pushing to green their energy sectors.

Some of the largest gas-consuming states in the U.S. are pursuing aggressive climate policies that could cut into the fuel's growth prospects — or even whittle away at existing consumption. Yet growing anti-gas sentiment has marshaled the fuel's defenders, and some believe that the "electrify everything" movement underestimates how difficult it will be to sideline gas.

"There are pockets ... where they clearly want to go to 100% electrification yesterday," said Lillian Federico, an analyst with Regulatory Research Associates, a group within S&P Global Market Intelligence. "There seems to be a disconnect between what policymakers and legislators are out there saying and wanting to do to grab headlines and what is feasibly possible for regulators in terms of implementing these things."

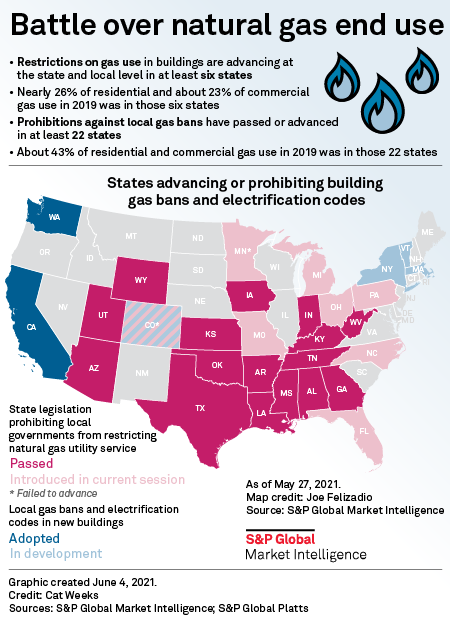

Policies in a handful of states to restrict gas use in new buildings have prompted lawmakers in more than 20 states to introduce laws prohibiting gas bans. Meanwhile, the industry has accelerated efforts to decarbonize the gas grid, including through the uptake of hydrogen and renewable natural gas, or RNG.

Lately, equity analysts have advised investors in the energy space to distinguish parts of the country where policy risk truly exists from areas that just have generalized anxiety about the future of gas and the pace of the energy transition.

Gas bans pose rising threat

Perhaps no development has rattled the gas industry like the building gas ban movement, catalyzed by a surge in electrification ordinances in the San Francisco Bay Area since July 2019.

Most gas bans and electrification codes apply to new buildings, so they chiefly threaten customer growth. Yet in many cases, electrification advocates see retrofits as the next step, and state policymakers in Washington and New York have put forward plans to phase out gas use in existing buildings.

Five of the six states where restrictions on building gas use are advancing at the state or local level are among the nation's largest consumers of gas for building heating. These states accounted for nearly 26% of residential gas use and about 23% of commercial consumption in 2019, the latest year for which U.S. Energy Information Administration data is available. Two of the five states, California and New York, were the top consumers. The others — Colorado, Massachusetts and Washington — each ranked in the top 20. Illinois, where some utility stakeholders are advocating for building electrification, ranked third.

Out of eight regions in the Lower 48, S&P Global Platts Analytics forecast the U.S. Northeast will post the second-highest residential and commercial gas demand growth through 2040. The EIA forecasts the highest growth in New England.

However, a new climate law in Massachusetts could allow towns and cities to restrict gas use in new buildings. Burlington, Vt., is developing an all-electric construction policy. And electric and geothermal heat pumps are central to building decarbonization plans in Maine and Rhode Island.

In May, the International Energy Agency essentially endorsed those policies, advising policymakers to ban new fossil fuel boiler sales by 2025 and implement net-zero building codes by 2030. Around the same time, the Biden administration proposed federal initiatives to decarbonize and retrofit buildings, boost energy efficiency and electrify heating load.

In addition, state and local opposition to new fossil fuel infrastructure has led some Northeast gas utilities to impose moratoriums on new gas hookups.

"All of that is suggesting even more limited growth that's possible in the residential-commercial sector, particularly on the coasts: the East Coast and the West Coast," said Rich Redash, head of Global Gas Planning at S&P Global Platts.

Among at least 22 states where laws prohibiting gas bans are in play, Ohio, Pennsylvania, Texas and Indiana rank among the largest residential and commercial gas users. Together, the bloc is building a substantial firewall.

Lawmakers have adopted the laws in 16 states that together accounted for nearly 22% of residential gas use and 23.5% of commercial consumption in 2019. If the bills introduced in other legislatures pass, that firewall would expand to states that consumed more than a third of total U.S. residential and commercial gas in 2019.

The effort has overlapped with areas where forecasters expect substantial residential-commercial demand growth. Platts Analytics ranked the Southeast first for residential-commercial demand growth through 2040, while the EIA projected that three regions across the southern U.S. will trail only New England in commercial gas consumption growth.

Industrial gas use more stable

The building gas ban movement presents less risk to gas use by the industrial sector. Some California ordinances have excluded industrial facilities, and the laws typically include exemptions for applications where electrification is not viable. This reflects the view that industrial sectors reliant on high-heat applications will be the hardest to decarbonize. Emissions reduction pathways such as carbon capture and storage, renewable hydrogen and RNG are still emerging for these applications.

|

Yet in a sign of how U.S. gas has become critical to manufacturers, Platts Analytics sees U.S. industrial gas consumption growing 12% from 2020-2040. This would follow 14% growth over the previous 10 years driven by an economic recovery, greenfield development of gas-intensive manufacturing such as petrochemicals facilities, and expansion of ammonia and methanol plants, Redash said.

The anticipated slowdown is partly due to decarbonization; an emphasis on environmental, social and governance issues; net-zero targets; and increased electrification, Redash said. "We still see growth continuing in the industrial sector," Redash added. "It's just going to happen at a slower rate than what we saw over the last 10 years."

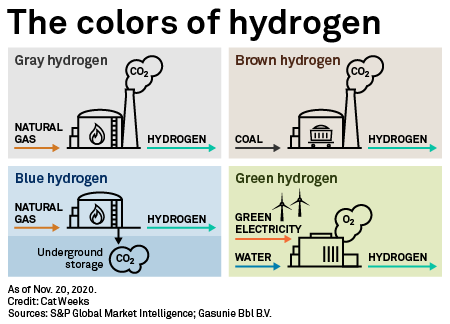

The nation's third-largest gas consumer for industry, California, is positioning itself to displace fossil fuel use in factories with green hydrogen. Green hydrogen is produced through electrolysis powered by renewable energy. The Green Hydrogen Coalition and the Los Angeles Department of Water and Power in May launched a partnership to develop the nation's first green hydrogen hub in the LA area, one of the nation's top manufacturing bases.

Notably, industry observers frequently identify the nation's highest consuming region, the Gulf Coast, as a potential hydrogen production hub. It has plentiful storage potential and is home to much of today's U.S. hydrogen supply and infrastructure. Hydrogen in the region is chiefly consumed in the refining and chemicals sectors.

Texas and Louisiana, which underpin the U.S. petrochemicals industry, together represented more than a third of U.S. industrial gas consumption in 2019. Since the Gulf Coast is a major contributor to U.S. industrial sector emissions, it is also an ideal place to scale up decarbonization and carbon capture and storage infrastructure, or CCS, according to Julio Friedmann, a former U.S. Energy Department principal deputy assistant secretary who led the agency's research and development program for CCS.

These CCS efforts could include building a pipeline network to transport carbon captured from so-called blue hydrogen production, which is produced from natural gas, Friedmann told S&P Global Market Intelligence in an interview. Friedmann, a senior research scholar at Columbia University's Center on Global Energy Policy, believes that blue hydrogen production will be critical to building the long-envisioned hydrogen economy.

Prices play a role

Texas is also the nation's top renewable power generator, presenting a case for the state as a green hydrogen hub. However, green hydrogen presents steep challenges, Friedmann said during a February webinar.

While electrolyzer costs are falling, power prices account for most of green hydrogen's cost, Friedmann explained. A cheap contract for industrial off-take from renewable resources typically falls around 4 or 5 cents per kWh, which would make it difficult to produce green hydrogen affordably, Friedmann said. Projects also need to boast a sufficient capacity factor to generate the excess electricity necessary to make hydrogen, Friedmann noted.

"I don't want people to necessarily believe that this is going to end up being cheap and easy," Friedmann said. "It will not."

The Gulf Coast states also boast some of the nation's lowest industrial gas prices, a potential barrier to renewable gas adoption. Today, RNG typically costs $5/MMBtu to $15/MMBtu without federal support or tax credits, Northwest Natural Holding Co. President and CEO David Anderson told analysts and investors at the American Gas Association's Financial Forum in May.

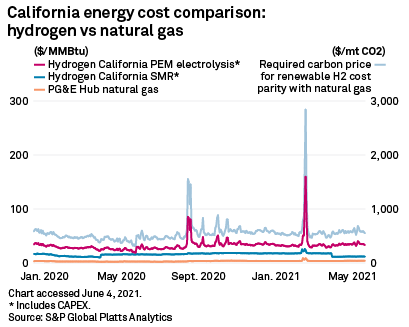

Hydrogen production from electrolysis and using carbon capture trades at a substantial premium to natural gas, according to S&P Global Platts price assessments. A $600/tonne carbon price would be necessary for Platts Hydrogen California PEM Electrolysis, including capital expenditure, to be at parity with natural gas at PG&E Citygate. That said, as capex and electrolyzer costs fall for PEM Electrolysis, the required carbon price to reach parity would also decrease.

Cost headwinds can also apply to building electrification. In announcing a plan for all-electric construction, Denver officials noted that the state's low natural gas prices could mean all-electric buildings would carry higher operating costs than the current ones. Prices for delivering gas to residential and commercial customers in Colorado are among the lowest in the nation. Delivery costs are generally lowest in the surrounding Mountain region and the North Central U.S., an area stretching from the Rockies and the Southwest through Illinois and Ohio.

The regions with the highest gas delivery costs to residential and commercial customers are the Northeast and the South Atlantic, home to legislatures that have sought to preserve access to gas utility service.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.