S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jun, 2021

By J Robinson, Tom DiChristopher, and Kassia Micek

|

This story is part of a series exploring the natural gas industry's role and prospects in the energy transition — a globe-spanning movement to cut greenhouse gas emissions across the energy industry.

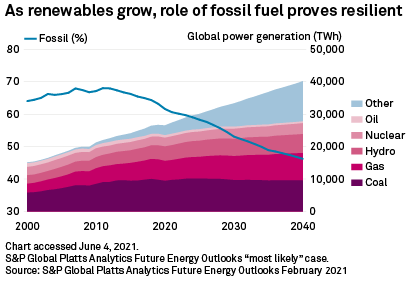

Advancements in battery storage pose a significant risk to natural gas as the rapid growth of renewable power erodes market share for the fossil fuel in the decades ahead.

In independent system operator territories across the U.S., wind power has become the single largest threat to market share for gas as a cleaner power source as coal and nuclear generation retires. At less than $30/MWh, the levelized costs of wind and solar power have fallen dramatically in recent years, with both technologies continuing to undercut even the cheapest gas-fired generation.

Growth in renewable power has created a supporting role for gas as a backup fuel, balancing the intermittency of wind and solar generation. But rapid advances in lithium-ion battery storage technology have dramatically altered the green-energy landscape.

For years, fast-ramping batteries capable of replacing gas as a grid-balancing resource were out of the money. According to a recent analysis of global battery-storage projects by BloombergNEF, however, lithium-ion batteries are now cheaper than gas peaking plants in much of the world.

At an all-in cost of $132/MWh, a four-hour utility-scale battery is now priced below the global gas-peaker plant average at $173/MWh. Even within the U.S., where gas prices are significantly lower than elsewhere, batteries are now cost-competitive with gas-fired power due in part to state-level clean energy goals and federal tax credits.

Such policies have boosted the competitiveness of renewables in recent years and threaten to undermine the economic viability of new gas-fired power investments, according to Morris Greenberg, S&P Global Platts Analytics senior manager for North American power.

State policies

Natural gas generation development in the U.S. is now focused mostly on combined-cycle unit construction aimed at replacing baseload generation from retiring coal-fired plants and, in some cases, older nuclear plants, according to Greenberg. Of the 20 GW of gas capacity under construction or permitted, less than 3 GW consists of gas peakers, Platts Analytics data showed.

In California, pressure from state policy has not only stymied the development of new-build gas peakers, it has also cut into existing gas use, according to S&P Global Market Intelligence analyst Alex Cook. The state's 2050 carbon-neutral grid mandate has already skewed investment heavily toward assets such as solar, storage hybrids or stand-alone battery storage. Even in the state's regulatory response to widespread blackouts, greenfield gas-fired plants have been effectively excluded from providing service, Cook said.

Future grid-balancing projects are likely to favor battery storage over gas peaker plants in many states where renewable portfolio standards are in place. In states with less aggressive standards, the falling cost of lithium-ion technology has still bolstered the outlook for battery-stored power.

"We're already seeing that in our forecast as we update our assumptions on the cost of battery storage," Cook said. In some states, "it's not so much a policy risk as it is just a competition between different asset classes to fulfill the same service."

Gas's role

There is some potential to build gas generation in other U.S. states, though, especially if the current gas price outlook remains constant. Florida is one possibility, Cook indicated. That state's integrated resource plans, and a utility's ability to secure approval to pass through costs to ratepayers, could spur future investment in gas-fired power as a grid-balancing tool, the analyst said.

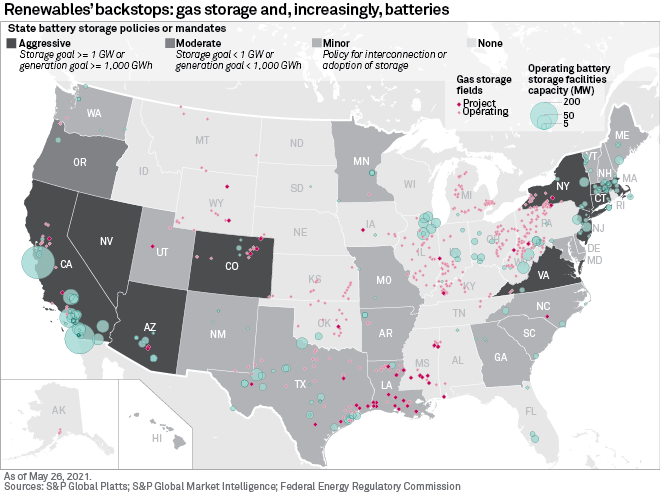

A broad region of the U.S. where analysts forecast possible future growth for gas peakers is in the West. With that potential in mind, some gas utilities have recently invested in gas storage capacity designed to complement growing intermittent power generation from renewable assets such as wind and solar.

In 2019, Northwest Natural Holding Co. completed its expansion of the Mist underground gas storage facility in Columbia County, Ore. The project helped Portland General Electric Co. manage volatility on the grid and integrate renewable power generation. The 4-Bcf storage addition brought the facility's total inventory capacity to 20 Bcf and was the only new gas storage reservoir to come online that year, according to data from the U.S. Energy Information Administration.

The following year, Spire Inc. proposed a substantial investment in its Wyoming storage facilities. The expansions and upgrades were designed to meet the needs of the Western energy markets, which rely on intermittent renewable power. After regulatory approval, Spire would complete construction of the project by fall 2023 with service startup targeted for summer 2024 if everything goes to plan.

In the wake of this winter's severe storms, reliable gas access has been at the crux of energy system discussions, and utilities — particularly those with storage assets to offer — have emphasized the importance stored gas to keep the grid running.

Market growth amid combined-cycle gas dominance

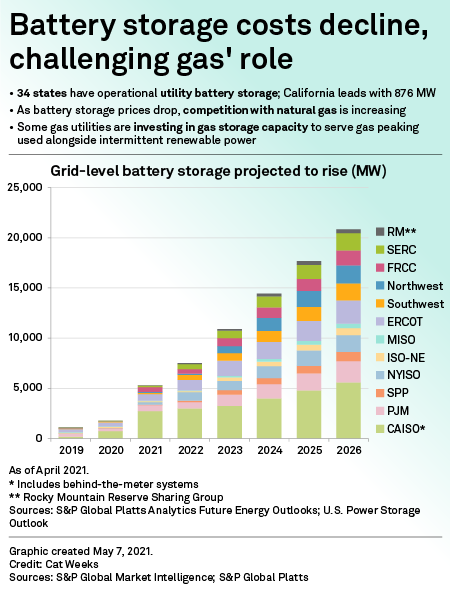

In 2020 alone, the U.S. nearly doubled its annual battery storage deployments, adding 1,765 MW as developers moved quickly to meet demand for large-scale projects. The expansion, led in large part by installations in California, included roughly 700 MW of grid-level battery storage, making it a record year for U.S. grid-level deployments, recent data published by S&P Global Platts Analytics showed.

According to American Clean Power, 34 U.S. states now have operational utility battery storage, with California leading at 876 MW followed by Texas at 134 MW and Illinois with 133 MW. Platts Analytics sees U.S. battery storage capacity approaching 18 GW by 2025, with federal and state-level policies playing a significant role in the market's growth.

To truly compete with gas in the power generation markets, battery storage must be capable of discharging for longer than four hours, a technology that has yet to be developed at a competitive cost.

"Lithium-ion battery storage can already beat gas peaking plants on costs for up to two or three hours of daily power balancing," BloombergNEF associate Tifenn Brandily said in an interview. But battery technology is not there beyond that time frame, Brandily said.

Flow batteries, a new entrant into the storage market, are one possible option. The technology harnesses electrochemical energy generated by flowing chemicals dissolved in liquid across separate sides of a central membrane. Flow batteries offer the advantage of a long-cycle life and long operational lifetime, but they have yet to compete effectively with lithium-ion technology's low and rapidly falling cost.

In the utility-scale energy storage market, seasonal and even just diurnal power-balancing solutions need to be developed to meet low-carbon energy targets in a cost-effective way, according to Brandily. "Until then, flexible gas-fired power will have a key role to play," Brandily said.

J Robinson and Kassia Micek are reporters for S&P Global Platts. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.