S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jun, 2021

By J Robinson, Markham Watson, and Tom DiChristopher

|

This is the second in a multipart series exploring the natural gas industry's role and prospects in the energy transition — a globe-spanning movement to cut greenhouse gas emissions across the energy industry.

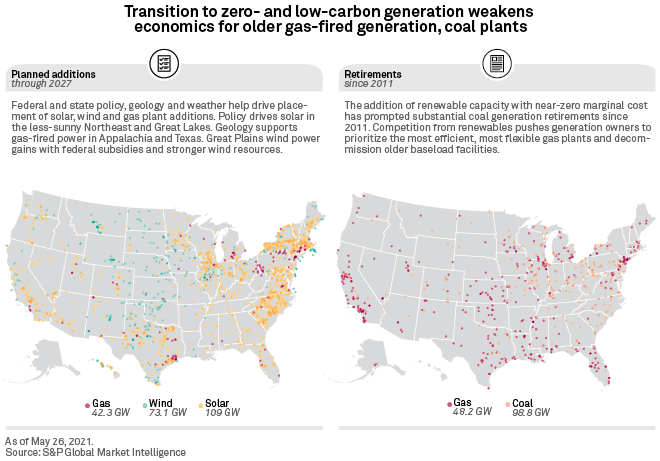

An accelerating transition toward a low-carbon energy future appears poised to drive a decline in natural gas-fired generation. Underpinning that transformation in the years ahead will be sustained wind and solar adoption, propelled by their falling costs and mounting policy pressure for renewable energy.

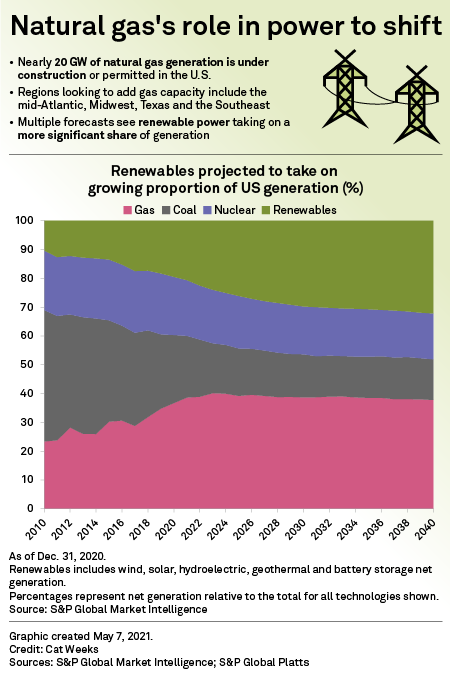

In 2020, natural gas accounted for a record 38% of total power generation in the U.S. By the early 2030s, gas's market share could fall below 30%, S&P Global Platts Analytics forecasts.

Over the same decade, total generation from wind and solar power is expected to climb from just 11% in 2020 to over 28% by 2030, according to the reference-case forecast from Platts Analytics.

The rise and fall of individual gas-fired power plants in the 2030s and beyond will depend on their locations and their prevailing policy and market environments.

Adaptive strategies will become key to the survival of many.

Adopting or blending gas with lower upstream emissions, renewable gas or hydrogen could allow generators in some markets to compete effectively with renewables. For generators continuing to burn traditional natural gas, the integration of carbon capture and storage may be the way forward. For other generators, retrofits and modifications could allow combined-cycle units to fill a peaking function, potentially delaying early retirement.

Such adaptive strategies have yet to be adopted by the operators of most gas-fired power plants.

Renewable growth

In some corners of the U.S., gas generators are feeling the heat from renewable growth. In the Southwest Power Pool, where much of the U.S. wind capacity is installed, wind has generated an average almost 260,000 MWh per day through early June, with its output growing more than 54% since the first half of 2018. Over that same period, total generation from gas in SPP has declined more than 32% to average just 134,000 MWh per day this year, SPP data shows.

The size of wind generation's market and its dominance in SPP are unique, but its growth trajectory is not. In both the Midcontinent Independent System Operator and PJM territories, wind power has grown 45% and 29%, respectively, since 2018, generating an average 218,560 MWh per day in MISO and 86,263 MWh per day in PJM this year, based on MISO and PJM data.

Across the U.S., power generation from wind has grown at an exponential pace since the early 2000s. According to the U.S. Energy Information Administration, wind generated 6 billion kWh in 2000, accounting for 0.1% of total U.S. generation. By 2020, wind power had grown to 338 billion kWh, accounting for 8.4% of total U.S. power generation.

According to the EIA's "Annual Energy Outlook 2021," generation from all renewable sources should surpass the individual outputs of coal and nuclear later this year. The agency's model predicted renewables will collectively eclipse total gas generation around the end of the current decade.

Renewables versus gas

From a cost perspective, the recent growth in renewable power generation makes sense.

According to financial advisory and asset management firm Lazard, the costs of wind and solar power have already undercut the comparable cost of even the cheapest combined-cycle gas plants. In a levelized cost of energy analysis, which accounts for capital costs and excludes subsidies, solar power now prices at $29/MWh, with wind as low as $23/MWh. By comparison, gas-peaker and combined-cycle plants bottom out at $124/MWh and $41/MWh, respectively.

From a policy perspective, renewables also appear well positioned to compete with gas generation.

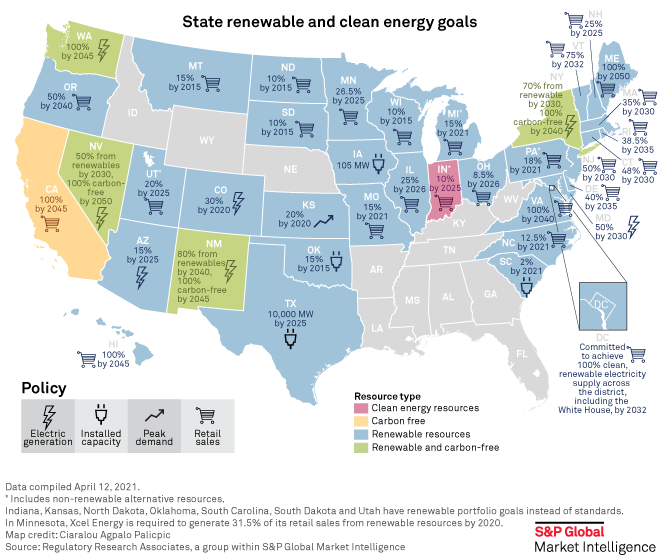

Across the U.S., state clean energy mandates and incentives are already in place in many markets, Regulatory Research Associates has reported. Most set targets for power generation from renewable sources but vary widely in their ambition. In the Midcontinent, many states target minimum retail power sales from renewables. In other states, stricter mandates look to phase out gas entirely. Washington, New York, Nevada and New Mexico have all set renewable and carbon-free electric generation standards for the coming decades. California has targeted 100% carbon-free retail sales by 2045.

Even at the federal level, many analysts now see a brighter outlook for a national clean energy standard that would accelerate natural gas's decline in the power sector. With the recent change in U.S. presidential administration and various congressional bills proposed, most notably the CLEAN Future Act, Platts Analytics updated its long-term power forecast to reflect the much greater likelihood of a national renewable energy standard rather than the previously anticipated carbon cap-and-trade program.

Gas generation in 2030s, 2040s

With the adoption of a national clean energy standard during the current administration's term, gas-fired power generators could face stepped-up competition from renewable power by the mid-2020s.

Still, the market environment in some states could give some gas-fired power generators a chance to prosper through the 2030s and 2040s, even without material changes to their current business models.

One potential opportunity for gas generators could come in market locations where renewables operate at relatively low capacity factors. "The best wind and solar locations are being exhausted, [and] multi-jurisdictional transmission is difficult to get permitted," said Gürcan Gülen, principal at G2 Energy Insights, a Boston-area energy consultancy.

"These conditions imply that we would have to build even more capacity in locations where capacity factors are lower," resulting in significantly higher expenditure for renewable development, Gülen said.

The relative competitiveness of gas will also depend on the restrictiveness of federal- and state-level clean energy mandates, according to Morris Greenberg, senior manager for North American power at Platts Analytics. For example, it will matter whether such policies allow some CO2 emissions or zero. The location-specific costs of renewable power, carbon capture and long-duration carbon storage will also be a factor.

In market locations where carbon-free electric generation mandates at the state level are absent, gas may serve as a tool to provide seasonal or even diurnal balance to variable, carbon-free electric generation from renewables.

"Even with a zero-emissions target, retaining some gas-fired capacity as a backup energy for grid support is likely to be much less expensive than forgoing that option," Greenberg said.

The state that consumes the most gas for power generation, Texas, also boasts one of the more bullish outlooks for new gas-fired generation, according to S&P Global Market Intelligence analyst Alex Cook. However, Cook noted that even in Texas, the pace of solar-plus-battery adoption has outstripped Market Intelligence's initial projections.

Gas peaking plants could outlast combined-cycle plants, particularly if they can clear a capacity market, such as in the Northeast, Cook said. "Then they're being paid revenue just to remain available. And that's what they were really designed for, in contrast to a combined-cycle unit."

Adaptive strategies

In markets where natural gas-fired plants face fierce competition from renewables and greater potential for early retirement, generators may opt to pursue adaptive strategies to make them more viable. For instance, using lower-emissions feedstock fuel could enable compliance with federal and state regulations.

This spring, the largest U.S. gas producer, EQT Corp., took its first step toward become a supplier of certified low-methane fuel, saying that its Marcellus Shale output would undergo an independent assessment of its environmental impact. In the future, power generators could pay premium prices for such fuel.

With major natural gas pipeline operators such as Kinder Morgan Inc., Enbridge Inc. and Williams Cos. Inc. already expressing interest in hydrogen blending, some generators could opt for, or be required to use, hydrogen-blended methane as a feedstock fuel. According to Greenberg, combined-cycle gas plants could be retrofitted someday to burn pure, carbon-captured blue hydrogen produced from natural gas.

In cases where the adoption of alternative feedstocks is potentially cost prohibitive, retooling or retrofitting certain combined-cycle gas units could allow them to operate at lower capacity factors, cycling on and off to meet demand in peaking markets.

J Robinson, Kassia Micek and Mark Watson are reporters with S&P Global Platts. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.