S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Jun, 2021

By Corey Paul and Maya Weber

|

This is the third in a multipart series exploring the natural gas industry's role and prospects in the energy transition — a globe-spanning movement to cut greenhouse gas emissions across the energy industry.

The U.S. natural gas industry faces a new urgency to keep its exported LNG cargoes attractive to consumer nations that aspire to meet net-zero targets in 2050.

U.S. LNG will influence and be influenced by the global landscape for gas. The election of U.S. President Joe Biden has placed attention on climate, clean energy and managing the emissions of fossil fuels, and European buyers have expressed a preference for LNG cargoes with low volumes of greenhouse gas emissions associated with their production. Many countries around the world are working to meet decarbonization goals outlined in the Paris Agreement on climate change.

Some analysts see the potential for climate policies to expand growth opportunities for gas in the global market, especially in parts of Asia that favor gas as a bridge fuel. But there is also uncertainty when looking out to 2050 as analysts and industry players try to answer questions about the shape of energy policies in gas markets, the selection of energy resources and the competitive pressures on gas.

"There is a clear clock ticking until 2050," said Nikos Tsafos, a senior fellow with the energy security and climate change program at the Center for Strategic and International Studies. "The idea of gas as a useful short-to-medium decarbonization strategy has lost a lot of its appeal. Not everywhere, obviously. But the conversation is just so different."

As countries adopt aggressive decarbonization goals, it has become harder to make decadeslong investment decisions on gas projects without asking tough questions about the fuel's role, Tsafos said.

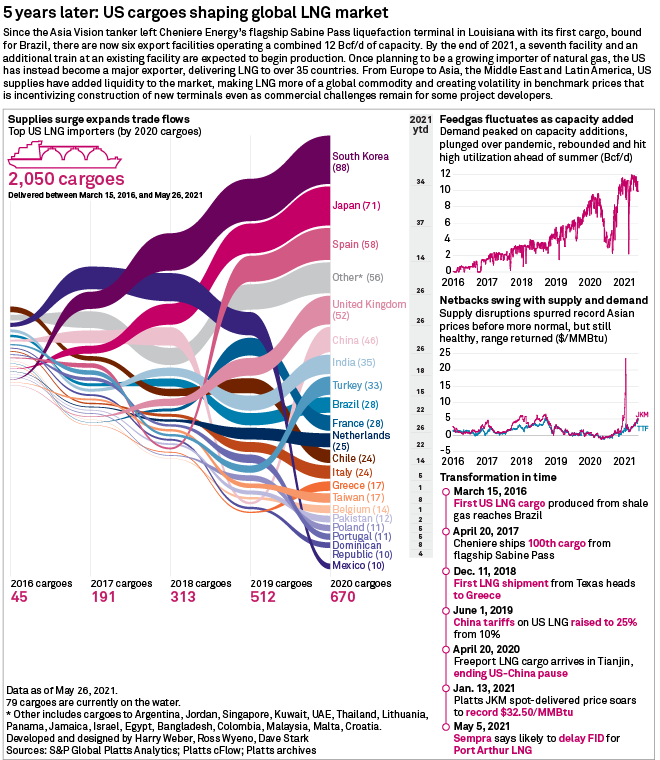

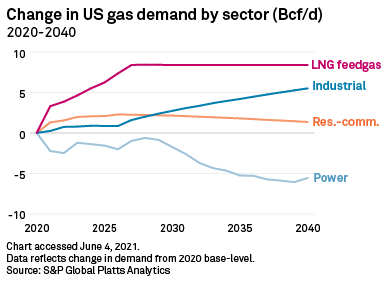

Other countries' attitudes toward gas are important to the U.S. because LNG feedgas demand is poised to be the single-largest driver of growth in domestic gas consumption in the next 20 years.

S&P Global Platts Analytics has estimated that global gas demand will rise 1.2% per year in the 2020s, fueled by Asia-Pacific region growth and the use of gas as a bridge fuel in Western power markets. The demand increase is forecast to slow in the 2030s as net-zero carbon goals pressure governments to rely less on gas and LNG.

Still, a steady increase in Asian natural gas demand will be an integral sink for new supply out to 2040, according to Ross Wyeno, LNG analyst with Platts Analytics. But European LNG demand is likely to peak in the mid- to late 2020s, Wyeno said

Diverse entities, including the International Energy Agency and BP PLC, have released outlooks over the past year that show a narrowing space for gas over the next three decades. The IEA's road map for reaching net-zero emissions by 2050 said many LNG facilities under construction or at the planning stage will not be needed, with the LNG trade falling 60% from 2020 under the agency's scenario.

"In most advanced economies, the window for increased natural gas consumption is probably already closed, while developing and emerging economies, especially in Asia, have some further room to grow in the decades ahead," IEA analyst Akos Losz said. "Gas can play a more positive role in the transition, but for that, the whole value chain would have to adapt."

Even assuming demand growth, industry observers anticipate an increasingly competitive global gas market, with national oil companies growing in importance. Upping the pressure on U.S. export developers, Qatar recently announced a 33 million-tonne-per-year LNG expansion that features technologies to improve the facility's carbon footprint, such as carbon capture and storage.

Scrubbing the US industry

The Biden administration is expected to set stricter environmental controls for U.S. shale gas production, something that could help buttress exports in the near term. But cleaning up the supply chain will be especially challenging in the U.S., where thousands of independent producers supply the natural gas for export.

Fred Hutchison of U.S. trade group LNG Allies said he sees the U.S. gas industry embracing the need to address issues such as leaks, emissions and flaring in order to remain relevant in a net-zero carbon future. The question is how quickly the industry can do so.

In a recent report on climate change policy scenarios, Cheniere Energy Inc. said it expects LNG demand growth to continue for the next two decades but "continued action to reduce global [greenhouse gas] emissions may cause LNG demand to decline beyond 2040."

The company also underlined its belief in the long-term resilience of its business. At a conference in March, Cheniere CEO Jack Fusco was bullish about a "long, very robust runway" for gas throughout the world.

But Cheniere is also putting new emphasis on its efforts to drive transparency and curb emissions along its supply chain. The company has unveiled plans to report carbon-equivalent emissions for each LNG cargo it produces, starting in 2022.

Cheniere's announcement joined those by other sellers marketing carbon-neutral cargoes. At least 14 such cargoes have been announced, with all but two going to Asian buyers, and Cheniere said it delivered one in early April to Royal Dutch Shell PLC.

"There is a race to make LNG as green as possible," Tsafos said.

Questions remain, though, about how the efforts to assign greenhouse gas emissions to LNG cargoes will develop, including whether buyers will choose cargoes based on lower emissions numbers and whether buyers will pay more for greener cargoes. It is also unclear whether there will be widespread adoption and standardization of the practice.

Some analysts suggested that the next, more difficult step will be finding ways to reduce emissions.

In one move to curb emissions, LNG developer NextDecade Corp. launched a carbon-capture project in March tied to its proposed Rio Grande liquefaction terminal in Texas. This followed reports in 2020 that France's Engie SA had halted talks about a long-term contract linked to the export project amid pressure over the emissions profile of U.S. shale gas. Fellow LNG developers Cheniere, Sempra Energy and Venture Global have since said they were looking at adding carbon-capture projects at their facilities.

Green groups recommend going without gas

Environmentalists cautioned against governments, banks and businesses pinning their long-term plans on natural gas. They pointed out that gas already faces competition from low-cost renewables and that climate policies could further eat into the market share for gas.

"We're still a long way from seeing the kind of pledges and actions from governments that will get us to 1.5 degrees Celsius," said Lorne Stockman of Oil Change International. Stockman's group is lobbying against U.S. financing of overseas gas projects, including in growing Asian energy markets.

The Natural Resources Defense Council, which is also involved in that effort, argued in a December 2020 report that the carbon footprint of U.S. LNG is only "marginally better" than that of coal when considering emissions throughout the supply chain. The group has warned about a lock-in effect if the U.S. continues to build out its LNG export infrastructure.

"There needs to be a recognition from investors that in a climate-conscious world, you're talking about infrastructure that's designed to last to the point where we are net-zero," Natural Resources Defense Council analyst Amanda Levin said. "How do you make that money back?"

Mark Brownstein, senior vice president of energy at the Environmental Defense Fund, expressed a similar concern, saying: "If oil and gas want to continue to be relevant in many parts of the world, they're going to have to be clean and low-carbon to compete with those technologies that can provide those services in cleaner, low-carbon ways."

Maya Weber is a reporter for S&P Global Platts. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.