S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Jan, 2022

| National Grid's problems securing permits to enhance infrastructure at its Greenpoint Energy Center in Brooklyn exemplify the challenges it has faced in meeting future energy demand. Source: Alex Potemkin / E+ via Getty Images |

Another moratorium on downstate New York natural gas hookups may be in store as National Grid USA scrambles to implement its long-term supply plan, the company warned.

The National Grid PLC subsidiary said there is a high likelihood that federal and state permits will not be issued in time to start construction on critical gas capacity programs and avoid a supply-demand imbalance by winter 2023-2024. Additionally, inflation, supply chain problems, and inadequate market resources are placing massively ambitious demand-side management efforts in jeopardy, the company said in a Dec. 29, 2021, filing.

The issues in part stem from a previous New York State Department of Environmental Conservation decision refusing to issue a critical permit for National Grid's preferred option for increasing supply: an expansion of the Transcontinental Gas Pipe Line Co. LLC system. The project, known as the Northeast Supply Enhancement project, would be capable of delivering 400,000 Dth/day of gas into New York City and Long Island.

A disagreement over the project led to a 2019 moratorium on gas hookups and subsequent settlement between New York and National Grid, which distributes gas in Brooklyn, Queens, Staten Island and Long Island through Brooklyn Union Gas Co. and KeySpan Gas East Corp.

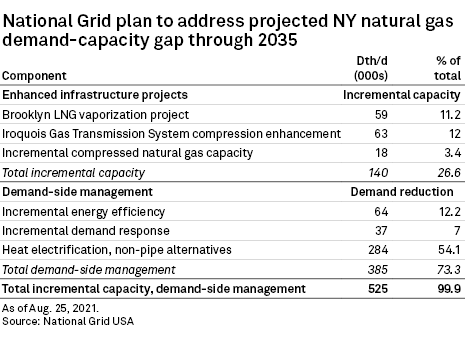

Ultimately, National Grid settled on a two-track approach to deal with its supply constraints: enhancing existing gas infrastructure and managing demand.

Infrastructure continues to face hurdles

Permitting uncertainty and regulatory risks present the greatest challenges to completing the infrastructure enhancements, National Grid said. Despite filing for permits in 2020, National Grid is still waiting on permits to add two liquefied natural gas vaporizers at its Greenpoint Energy Center in Brooklyn.

The company said it could still complete the project for the 2023-2024 heating season if it receives all outstanding permits by February. However, the operator's outlook has changed since its last update in August 2021: It now sees a high likelihood that the state's Department of Environmental Conservation will not issue the permit by February.

National Grid also expects that pipeline company Iroquois Gas Transmission System LP may fail to swiftly obtain Federal Energy Regulatory Commission approval and subsequent state and local permits to add 125,000 Dth/d of compression to its existing network. With a FERC decision unlikely before the second quarter, the project may not be operational until winter 2024-2025, the company said.

National Grid sees less permitting risk in its effort to increase truck and trailer delivery of compressed natural gas. However, the company has yet to locate and procure several acres of land near low-pressure points on its distribution system zoned for industrial use, a class of real estate the operator called "extremely difficult to find in the Downstate N.Y. area."

'Unprecedented' demand-side management hits snags

Regarding demand-side management, or DSM, National Grid flagged several rising risks as it seeks to enhance its energy efficiency programs.

An inadequate pool of contractors and vendors, as well as building cost increases that are outpacing inflation, are complicating the company's effort to expand home weatherization work, the operator said. Underpinning those risks is the sheer magnitude of the project.

"The levels of DSM required to close the Demand-Supply Gap in the long term are unprecedented; in our peer benchmarking we have found no other utility who has attempted to roll out DSM programs at this scale so rapidly," National Grid said in the report.

National Grid also saw a high likelihood that it will not be able to sign up or retain enough customers in demand response programs, which allow utilities to throttle down users' consumption during peak demand times.

Problems with accelerating building electrification

In the final leg of its plan — increased electrification of heating — National Grid also flagged contractor shortages and obstacles to accelerating technology adoption, as well as regulatory hurdles to incentivizing electric heat pump adoption. Additionally, global supply chain problems have recently hit the building electrification equipment market, National Grid said.

National Grid expressed concern that investing heavily in electrification simply to allow for new gas hookups may not be consistent with state climate law. The council charged with creating a framework for implementing the law recently released a blueprint largely premised on electrifying buildings and phasing out parts of the gas distribution system.

Nevertheless, National Grid is in talks with fellow downstate utility Consolidated Edison Co. of New York Inc. to accelerate the heat electrification proposal. Presenting potential barriers, National Grid said accelerating electrification could cost $1.2 billion through 2025 and spur a roughly 10% increase in gas bills.