S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

31 Mar, 2021

A pathway to decarbonizing National Fuel Gas Co.'s gas utility is coming into focus for executives, and while it could involve selective building electrification, it remains rooted in the business of moving molecules.

The company recently established four pillars for operating a low-carbon business and aligning with New York climate law: scaling energy efficiency, reducing utility emissions, decarbonizing the energy source and leveraging the existing delivery system. In a March 30 interview, National Fuel Gas Distribution Corp. President Donna DeCarolis discussed the role that energy efficiency, renewable gases and electrification could play in fleshing out that framework.

|

"Energy efficiency really needs to lead the way," National Fuel Gas Distribution President Donna DeCarolis said. "If you have to convert a very large, inefficient building to electricity, it's going to be a real challenge for the grid build out." Source: National Fuel Gas Co. |

Like many of its peers, National Fuel expects ongoing pipeline system modernization will achieve the bulk of its goal. National Fuel is targeting a 75% reduction in greenhouse gas emissions from its operations by 2030 and a 90% reduction by 2050, both from 1990 levels, driven chiefly by pipeline replacement.

But the work also positions National Fuel to blend hydrogen into the gas stream, DeCarolis noted. She stressed that the transition is in its early days, but the recent energy crisis in Texas underscores the need to reassess calls to electrify everything.

"I think we all are even more mindful of the importance of the integrated systems — making sure you have multiple delivery options for consumers and you're doing it in a way that's leveraging what you've already invested in, so it's hopefully also going to be more affordable," she said.

Hydrogen as a future pathway

The company has not yet established a hydrogen test site. It is also still evaluating which parts of its system are best equipped to transport the fuel, which comes with integrity-management and leak-detection considerations. The company's first step was to serve as an anchor sponsor for the Low-Carbon Resources Initiative, or LCRI, a joint program by the Electric Power Research Institute and the Gas Technology Institute to "accelerate development and demonstration of low- and zero-carbon energy technologies."

National Fuel specifically sees hydrogen as a decarbonization pathway for its industrial customers. The company has had "a lot of conversations" with those customers about working together on hydrogen initiatives and has connected some with the LCRI as a potential source of project funding. One area where National Fuel sees potential for hydrogen uptake is Niagara Falls, an industrial corridor where the fuel could be used to decarbonize steel and in heat-treating industries.

"We do envision dedicated hydrogen systems, potentially to help an industrial customer that's going to have trouble decarbonizing because of their process and their heating requirements," DeCarolis said. Asked whether National Fuel's midstream segment would be open to owning pure hydrogen transmission lines, DeCarolis said executives are examining all options and evaluating how hydrogen fits within each business segment.

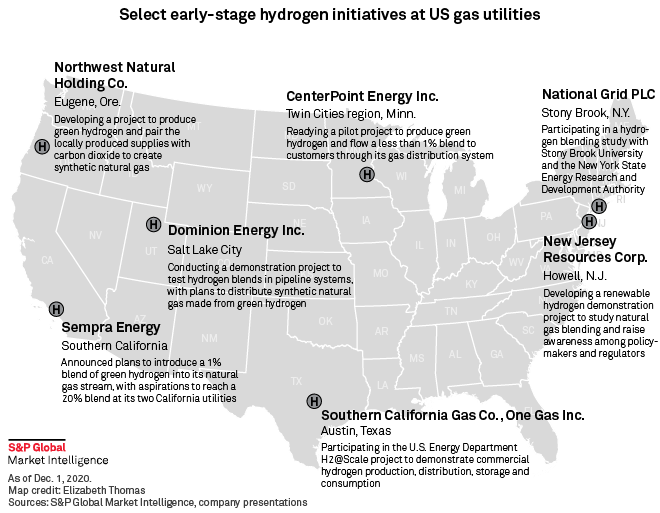

National Fuel aims to draw lessons from projects like the U.S. Department of Energy-backed H2@Scale demonstration in Texas, as well as advanced work on hydrogen transmission in Europe and the United Kingdom, DeCarolis added. The company could soon have more examples closer to home, as the Northeast emerges as an early-stage hydrogen hub.

In February, Capital District hydrogen solutions company Plug Power Inc. revealed plans to build North America's largest green hydrogen production facility, a 120-MW plant, in Western New York. On March 30, the company announced a partnership with Brookfield Renewable Partners LP to develop a facility in south-central Pennsylvania to produce the fuel, made by splitting water into gas using renewable power. Meanwhile, Hydro-Québec is developing an 88-MW facility as Canada plots a national hydrogen strategy.

RNG and electrification

In the nearer term, National Fuel is working toward incorporating renewable natural gas, or RNG, an alternative fuel processed from biomass and methane waste sources. While it has not yet connected to an RNG supply source, it has a tariff in place to allow for interconnection and petitioned New York's utility regulator to purchase 2% of its annual supply requirements as RNG.

National Fuel now counts 17 RNG projects with a combined supply of 3 Bcf per year in active development in western New York, chiefly at dairy farms. Those projects could serve 30,000 residential customers per year based on today's energy consumption patterns, DeCarolis said. RNG resource potential could reach 29 trillion Btu to 49 trillion Btu per year from anaerobic digestion in New York by 2040, according to a 2019 American Gas Foundation study.

Another decarbonization pathway that National Fuel identified for western New York's cold climate is hybrid heating systems like air source heat pumps paired with high-efficiency gas furnaces. That would allow customers to tap electric heating when it makes sense and turn to gas heating during peak winter cold, according to DeCarolis.

That could be a tough sell to environmentalists increasingly focused on electrifying building heating. In February, a state panel charged with decarbonizing the building sector proposed requiring all-electric construction and prohibiting fossil fuel appliance replacements.

DeCarolis noted that western New York homes tend to be larger and older than the typical state residence, so they present challenges for electric heat pumps, which work best in buildings with tight envelopes, particularly in cold climates.

"It's not about eliminating natural gas. It's about reducing emissions," DeCarolis said. "As we progress and we need to be more limiting in technologies, we could do that later. But this early on, let's include all the technologies that we can."