S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Jul, 2021

By Akankshita Mukhopadhyay and Cheska Lozano

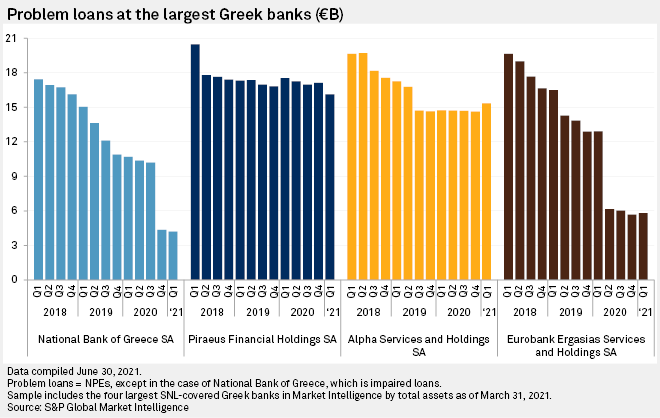

As Greece's big banks embrace securitizations as a way to improve asset quality, National Bank of Greece SA and Eurobank Ergasias Services and Holdings SA are leading the way, sharply reducing problem loans in the first quarter.

National Bank of Greece's impaired loans fell to €4.2 billion in the first quarter, from €10.7 billion in the same quarter of 2020, while Eurobank's problem loans dropped to €5.8 billion from €12.9 billion, according to S&P Global Market Intelligence data.

Greece's "big four" banks — National Bank of Greece, Piraeus Financial Holdings SA, Alpha Services and Holdings SA and Eurobank — have wrestled with bad loans that have accumulated over the last decade amid the country's debt crisis. Piraeus' first-quarter problem loans totaled €16.1 billion, down from €17.5 billion a year earlier, while Alpha's increased slightly to €15.3 billion.

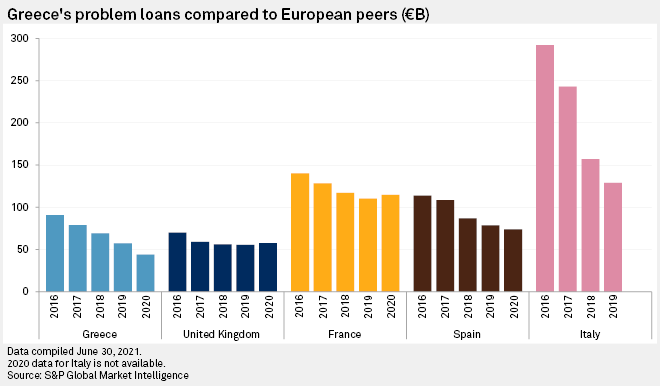

Greek banks' aggregate problem loan ratio declined significantly to 25% at the end of 2020, from close to 40% in 2016, but it remains far above that of other European countries, including Italy.

Securitizations

The lenders have been using securitizations as a way to remove bad loans from their books with the help of the Hercules Asset Protection Scheme. This program encourages banks to securitize bad debt by offering a state guarantee on the least risky tranche of notes for sale.

In March, Eurobank unveiled project Mexico as part of ongoing efforts to clean up its balance sheet, aiming to reduce its 14% nonperforming exposure, or NPE, ratio down to single digits by the end of 2021. The deal follows on from its earlier €7.5 billion bad-loan securitization, Cairo, which it completed in mid-2020. National Bank of Greece's Project Frontier aims to reduce its €10 billion NPE exposure by approximately €6 billion.

Piraeus said in March that its Sunrise 1 and Sunrise 2 securitizations, amounting to €7 billion and €4 billion, respectively, would be carried out using Greece's Hellenic Asset Protection Scheme 2. Earlier deals included Vega and Phoenix.

Alpha Bank's Galaxy securitization had a value of €10.8 billion, and it has been preparing another named Cosmos.

Loans under moratorium

The Bank of Greece, the country's central bank, anticipates that Greek banks could book around €8 billion to €10 billion of new problem loans in 2021 amid COVID-19.

It expects the impact of the pandemic on Greek banks to intensify in 2021 as they face challenges from low core profitability and competition from nonbanks, among other things.

Greece's big four banks granted moratoriums on a combined total of €19.2 billion of loans during the pandemic to cushion struggling borrowers from default. Most moratoriums finished at the end of March, and lenders have not been bit by a wave of defaults, according to Yiannis Mouzakis, managing director at MacroPolis, a think tank focused on Greek economic and political affairs.

Greek banks' loans under moratorium fell to €4.1 billion in the fourth quarter of 2020 from €22.2 billion in the second and third quarters, according to the European Banking Authority.

In aggregate, Greece's problem loans fell to €44 billion in 2020 from €57 billion in 2019.

According to the Economist Intelligence Unit, the country's GDP growth is expected to be 5.40% in 2021, following a contraction of 7.81% in 2020.