S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Aug, 2021

By Ranina Sanglap and Rehan Ahmad

National Australia Bank Ltd., or NAB, will become the second-biggest issuer of credit cards in Australia after its proposed acquisition of Citigroup Inc.'s consumer business in the country.

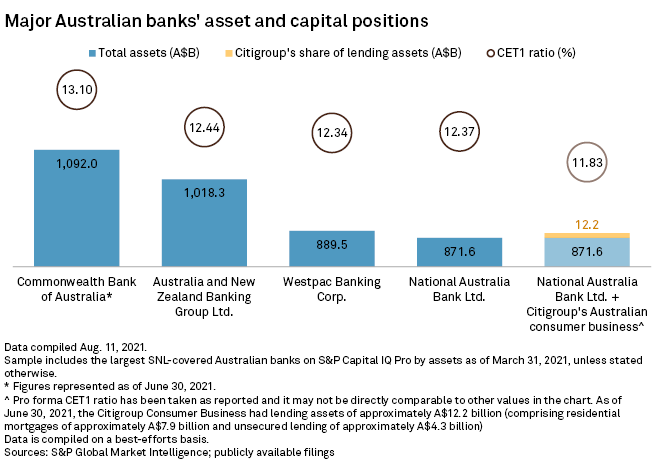

The A$1.2 billion deal to acquire Citi's Australian consumer business underscores NAB's bet that credit card usage will return to growth after the pandemic recedes. If the acquisition succeeds, the size of NAB's credit card portfolio, based on current outstanding balances, will rise closer to market leader Commonwealth Bank of Australia. It currently ranks fourth, behind Australia and New Zealand Banking Group Ltd. and Westpac Banking Corp., according to Australian Prudential Regulation Authority data.

"NAB was always in the box seat as their credit card portfolio was the smallest ... the Citi portfolio beefs up its scale," Grant Halverson, chief executive of McLean Roche, a banking and payments consulting firm, told S&P Global Market Intelligence.

The deal will also add about A$12.2 billion of loan assets to NAB, including A$4.3 billion of unsecured lending, allowing the smallest of the so-called big four Australian banks to grow its business and counter the rapid growth of the buy-now, pay-later industry.

Australia's unsecured lending industry has seen the emergence of buy-now, pay-later companies such as Afterpay Ltd., Zip Co Ltd. and Brighte Capital Pty. Ltd., which convert shoppers' purchases into instant credit at check out. Data from the Reserve Bank of Australia show that the number of credit cards on issue in Australia has been on a decline after hitting a peak in 2016 and the popularity of buy-now, pay-later players was one of the reasons.

Inorganic growth

"NAB's acquisition of Citigroup's consumer business will provide the bank with inorganic growth and significantly boost its market share in the credit card issuance industry, where Citigroup accounts for 12.0% of the industry," said Matthew Barry, an analyst at market research firm IBISWorld.

The total number of personal cards on issue fell to 16.2 million in June, from a peak of 22.3 million in July 2016, according to central bank's data. The number and value of transactions on the cards, however, have recovered after a dip in 2020 during the peak of the COVID-19 pandemic. The value of transactions recovered close to pre-pandemic levels at A$22 billion in June, after falling to A$15 billion in April 2020.

"We don't believe that the credit card business is in massive decline. You saw a drop because of COVID ... [but] it's starting to come back up again, we believe that it will stay as a very strong part of the payment structure," Ross McEwan, NAB's chief executive, said on Aug. 9 when the deal was announced. Citi's business will bring with it "deep expertise" in unsecured lending, particularly credit cards, McEwan said. The Australian lender expects the transaction to close by March 2022.

The deal will likely be closely scrutinized by the Australian Competition and Consumer Commission, or ACCC, as it would further consolidate the credit card market among the big four banks. Rod Sims, the chairman of the competition watchdog said the commission "will be carefully considering credit cards" as it reviews the deal.

That may even put the approval for the deal at risk, according to J.P. Morgan. "We believe there is a material risk that ACCC knocks it back, given it will increase the combined major bank share of [the Australian Prudential Regulatory Authority] system in credit cards to 93%," analysts Andrew Triggs and Nicholas Dalton said in an Aug. 9 note. NAB has argued that there will be no significant reduction in competition.