S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Nov, 2022

By Harry Terris and Syed Muhammad Ghaznavi

Another quarter of deposit outflows and an acceleration in deposit cost increases have raised questions about when a cyclical surge in net interest income will run its course.

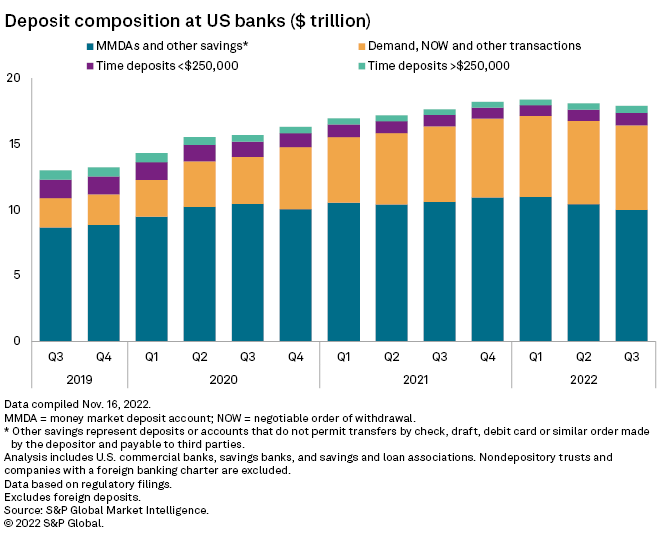

Deposit balances across U.S. banks fell $184.82 billion, or 1.0%, sequentially to $17.891 trillion in the third quarter, according to data from S&P Global Market Intelligence. Funding costs increased 36 basis points to 0.6%. That is much less than the 150-basis-point increase in the Federal Reserve's policy rate during the period. But after four-consecutive jumbo hikes of 75 basis points since June, the strength of the comparison to the last tightening cycle, when deposit costs were well-controlled over gradual, shallow Fed increases, is becoming more uncertain.

In the third quarter, "margins were very good, but I think the stock reactions weren't as strong or as consistent because the deposit costs are starting to ramp," Christopher McGratty, head of U.S. bank research for Keefe Bruyette & Woods, said in an interview. "As you go into the fourth quarter and certainly into early next year, this narrative around peak net interest income and peak margins will get louder."

|

Catch up

Executives at banks, including JPMorgan Chase & Co. and Truist Financial Corp., have said the large lag in deposit price increases relative to underlying interest rates, or "deposit betas" in industry parlance, might be explained by the extraordinary speed of the Fed's hikes this year, while asset yields have been more responsive. As to whether deposit betas over the full cycle will be similar to last time, executives often express uncertainty. "We'll observe that together," Truist CFO Michael Maguire said during the bank's third-quarter earnings report.

It took about three years for the Fed to lift its policy rate from close to zero to its previous peak range of 2.25% to 2.5% in late 2018. The Fed's current target range is already 3.75% to 4%, just eight months after its first increase from close to zero in March, and it is expected to increase further.

The sequential increase to banks' aggregate cost of funds of 36 basis points in the third quarter represented a step up from the sequential increase of just 10 basis points in the second quarter. But at 0.6% in the third quarter, banks' cost of funds remain well behind underlying rates.

"We fundamentally believe that the deposit pricing will catch up as the Fed slows down" its rate hikes, M&T Bank Corp. CFO Darren King said during the bank's earnings report in October.

Consumers have increasingly switched into certificates of deposit and to high-yielding direct banks, and commercial deposit betas have "really picked up," Peter Serene, director of commercial banking at Curinos, a data company for financial institutions, said in an interview. "It gets harder, not easier from here."

"The most rate-sensitive money has already fully woken up," Serene said, adding that, over the next six to 12 months, additional customers are going to look for higher rates, and the jump in cost for that money will be higher than early in the cycle. "When those customers wake up and call their banker, they're generally not going to be satisfied going from 25 [basis points] to 40. They're going to want to go from 25 to 200."

While all banks are under pressure, deposit pricing across institutions varies widely because of factors like how much a bank depends on its online platform and the intensity of funding needs for loan growth.

At Goldman Sachs Group Inc., for instance, a Nov. 7 Jefferies analysis based on advertised rates found that its proxy for the rate the bank pays for savings balances jumped 82 basis points from the third quarter to 2.35% in the early part of the fourth quarter, rivaling the sequential jump of 88 basis points in the full third quarter. Savings deposits account for much of Goldman's deposit base, and Jefferies found that the proxy is tightly correlated with the cost of U.S. interest-bearing deposits the bank reports in its financial statements, which include higher-cost time deposits and jumped 108 basis points from the second quarter to 1.96% in the third quarter.

Meanwhile, Jefferies' proxy for savings balances at PNC Financial Services Group Inc. was flat at 0.03% in the early part of the fourth quarter. PNC reported that its cost of savings deposits increased from 0.04% in the second quarter to 0.09% in the third quarter and that its total cost of interest-bearing deposits increased from 0.12% to 0.45%.

|

|

* Download a template to generate a bank's regulatory profile. * Download a template to compare a bank's financials to industry aggregate totals. |

|

* Download a template to generate a bank's regulatory profile. * Download a template to compare a bank's financials to industry aggregate totals. |

Deposit drain

Another factor heating up deposit price competition is accumulating outflows as customers use up extra cash stockpiled during the pandemic and shift into higher-yielding alternatives. Some banks have already supplemented funding bases by starting to add wholesale borrowing.

The decline in total deposits of $184.82 billion, or 1.0%, sequentially in the third quarter was less than the drop of $303.46 billion, or 1.7%, in the second quarter. But seasonal pressures on deposit levels typically ease after the end of tax season in April. After seasonal adjustment, total deposits were about flat from March 30 to June 29 and dropped by 0.8% from June 29 to Sept. 28, according to weekly data from the Fed. Early in the fourth quarter, the outflows accelerated, with a decline of 1.2% over just six weeks from Sept. 28 to Nov. 9, the most recent data.

Outflows could accelerate in 2023, with the Fed pulling out about $1 trillion of stimulus annually — or about 6% of total deposits — set against potentially soft ordinary growth in the money supply if the economy enters a recession and inflation subsides, according to Serene.

"Current course and speed, which is really strong quantitative tightening and a weak overall economy would point to continued negative deposit growth," Serene said.

On the bright side, banks do retain much of the massive liquidity cushions they built during the pandemic, and slower loan growth that would accompany a downturn would ease funding needs.

Assessing the mood among banks, Serene said, "It's not panic, but there is an increasing sense of apprehension."

|