S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Mar, 2021

By Mary Christine Joy and Francis Garrido

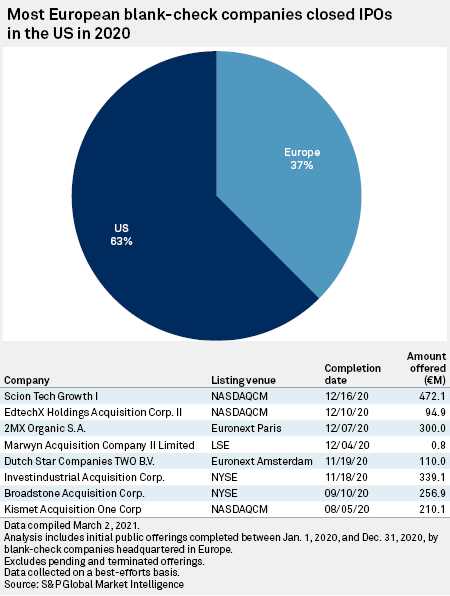

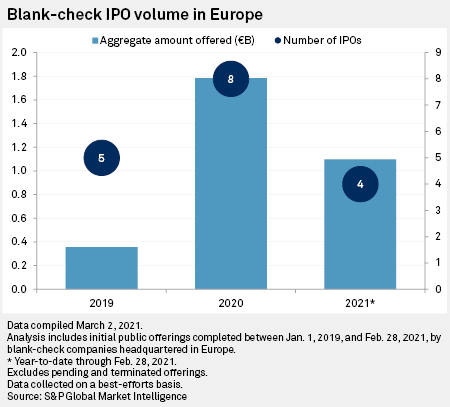

More Europe-based special purpose acquisition companies were listed on U.S. exchanges than on European ones during the so-called blank-check boom of 2020, but this could change in 2021.

SPACs are skeleton organizations that launch with the intention of buying and reverse merging with a private company, and they have come to offer private companies a more certain pathway to the public markets, particularly during a highly uncertain year 2020.

A total of eight Europe-based SPACs completed an IPO in 2020, only three of which chose to list on European stock exchanges, S&P Global Market Intelligence data shows. U.K.-based Marwyn Acquisition Company II Ltd. listed on the London Stock Exchange, France-based 2MX Organic SA on Euronext Paris and Dutch Star Companies TWO BV on Euronext Amsterdam, raising roughly €410.8 million in aggregate, compared to the roughly €1.37 billion in aggregate raised by European SPACs that were listed on the U.S. stock exchanges in 2020.

In 2021, four European blank-check companies — Lakestar SPAC I SE, ESG Core Investments BV, ScION Tech Growth II and Centricus Acquisition Corp. — had made their stock market debut as of Feb. 28.

Lakestar completed a €275.0 million transaction on the Frankfurt Stock Exchange, while ESG Core Investments raised €250.0 million on Euronext Amsterdam. The other two, ScION Tech Growth II and Centricus, chose to list in the U.S., with a total transaction value of approximately €572.2 million.

The Dutch capital of Amsterdam, where a significant amount of London's share and derivatives trading business moved after Brexit, is emerging as Europe's center for blank-check companies, the Financial Times reported Feb. 17, citing bankers and lawyers who also said that executives behind SPACs are enticed by the city's flexible rules and international reputation.

Former Commerzbank AG CEO Martin Blessing was said to be in discussions with potential partners over a plan to list such a company in Amsterdam, while former UniCredit SpA CEO Jean Pierre Mustier will reportedly list a SPAC in Amsterdam with LVMH Moët Hennessy - Louis Vuitton Société Européenne founder Bernard Arnault. Mustier's planned company will be named Pegasus Europe, the FT said.

Meanwhile, an independent government review of listing rules in the U.K. has recommended liberalizing the rules surrounding SPACs. The reforms will make it easier for global companies to list and grow in the U.K., the Treasury said.