S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Jul, 2023

By Zoe Sagalow and David Hayes

More US banks are taking a second look at their uninsured deposit levels following recent regional bank failures that brought the topic front and center for investors and regulators alike.

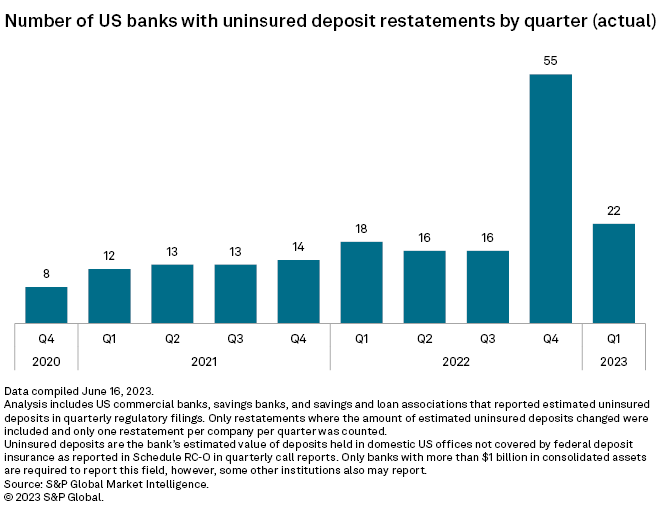

Fifty-five banks restated their total of uninsured deposits on their fourth-quarter 2022 call reports, well above the number of restatements in prior quarters, according to an analysis by S&P Global Market Intelligence. That trend continued into the first quarter with 22 restatements. The uptick comes after recent failures of banks with high levels of uninsured deposits and a proposal from the Federal Deposit Insurance Corp. calling for banks with the most uninsured deposits at Dec. 31, 2022, to replenish the Deposit Insurance Fund (DIF) with a special assessment payment.

"Whether you're worried about regulatory scrutiny, whether you're worried about customer scrutiny or whether you're worried about the special assessment, it's really the same thing," James Stevens, partner and co-leader of Troutman Pepper's Financial Services Industry Group, said in an interview. "If people are paying more attention to it, they may be dotting their i's and crossing their t's, and that's potentially causing some restatements."

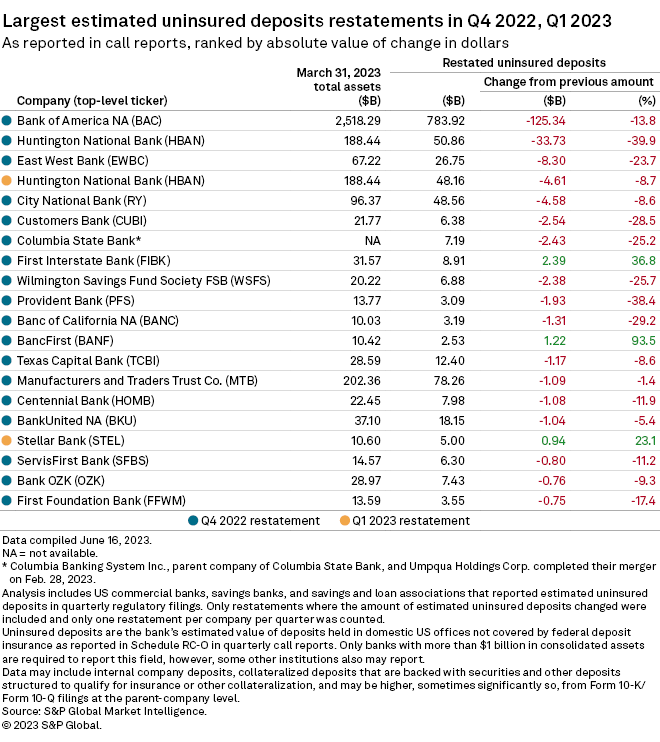

Fifteen companies restated uninsured deposits by at least $1 billion in either the fourth quarter of 2022 or the first quarter. The majority were downward revisions.

Among those downward revisions, Huntington National Bank's restatement on its fourth-quarter 2022 call report was the largest percentage decline, at 39.9%. Huntington also restated its first-quarter uninsured deposit call report data.

Bank of America NA's downward revision was the largest by dollar amount, reducing the uninsured deposit total on its fourth-quarter 2022 call report by $125.34 billion.

Among the upward revisions, BancFirst's restatement was the largest on a percentage basis, adjusting its fourth-quarter 2022 uninsured deposit figure 93.5% higher. First Interstate Bank's upward revision was the largest by dollar amount, raising its fourth-quarter 2022 uninsured deposits by $2.39 billion.

Reasons for the restatements

Changes in how banks are treating intercompany deposits or intrabank accounts is one of the main reasons for the restatements. Intercompany deposits are held by one member of a company for another within a consolidated structure, such as cash accounts of a holding company with its bank subsidiary, according to Rick Childs, a partner at Crowe LLP.

Bank of America Corp. restated its uninsured deposit levels after the company "identified certain internal or intra-bank accounts that shouldn't have been reported," spokesperson William Halldin wrote in an email.

Other banks that restated also previously reported high levels of intercompany deposits. Previously, Huntington reported $84.59 billion in uninsured deposits in its call report filing for Dec. 31, 2022, but then revised it down to $50.86 billion, which more closely aligns with what its parent company, Huntington Bancshares Inc., reported in its most recent Form 10-Q for uninsured deposits minus intercompany deposits as of Dec. 31, 2022.

The Federal Deposit Insurance Corp. did not respond to a question about whether intercompany deposits and intrabank accounts between subsidiaries should be excluded from call reports.

Banks with payroll processers could have also been mistakenly counting funds that the processors were holding for companies making payroll even if they might qualify for pass-through deposit insurance, according to Matthew Bisanz, a partner in Mayer Brown's Financial Services Regulatory and Enforcement practice.

Increased regulatory scrutiny of uninsured deposits is also motivating banks to take a closer look.

"Because of lingering supervisory concerns from the recent bank failures, we've already seen examiners ask our clients more pointed liquidity-related questions about uninsured deposits, concentrations, and contingency plans," John Geiringer, a partner in the Financial Institutions Group at Barack Ferrazzano Kirschbaum & Nagelberg LLP, wrote in an email.

Impact on special assessment

The restatements from year-end 2022 would lower how much some banks owe in a special assessment if an FDIC proposal aimed at replenishing the Deposit Insurance Fund (DIF) becomes finalized. Under the proposal, those with larger amounts of uninsured deposits will have to make higher payments, and the special assessment payments would be based on banks' reported uninsured deposits as of Dec. 31, 2022.

For example, Bank of America would pay $1.95 billion over two years for the special assessment as proposed using its restated fourth-quarter 2022 data, down from $2.26 billion under its original call report data.

Huntington would pay $114.6 million over two years using restated data, compared to $199.0 million using its previously reported fourth-quarter 2022 numbers.

The FDIC previously disclosed that the estimated loss to the DIF in relation to the systemic risk determination after the failures of Silicon Valley Bank and Signature Bank was $15.8 billion.

The restatements could mean the FDIC will fall short of replenishing the DIF. If the collection period ends and the actual loss exceeds what was collected, the agency will extend the period one or more quarters to make up the difference after providing notice at least 30 days in advance.