Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Mar, 2023

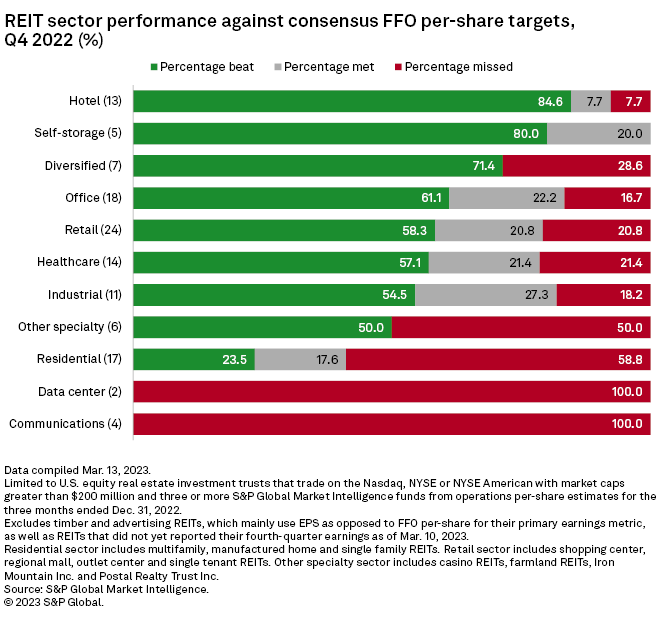

Just over half of U.S. equity real estate investment trusts recorded fourth-quarter 2022 funds from operations that exceeded sell-side analyst expectations.

S&P Global Market Intelligence analyzed financial results for 121 U.S. REITs, 66 of which reported FFO per share higher than consensus estimates for the last three months of 2022. Twenty REITs in this analysis reported FFO per share equal to consensus estimates, while 35 fell short of expectations.

The analysis covered U.S. equity REITs that trade on the Nasdaq, NYSE or NYSE American with market capitalizations of more than $200 million and had three or more FFO-per-share estimates.

Most hotel REITs surpass analyst expectations

Hotel REITs closed 2022 with a strong fourth quarter, with 11 of the 13 analyzed hotel REITs topping analyst FFO-per-share estimates. Despite some macroeconomic concerns, hotel REIT executives remain optimistic for 2023.

Braemar Hotels & Resorts Inc. reported the largest beat of all REITs in this analysis, reporting adjusted FFO of 16 cents per share, nearly 45.5% higher than its consensus estimate of 11 cents per share. Sunstone Hotel Investors Inc. followed next, surpassing its FFO per share estimate by 36.8%.

The self-storage sector also posted solid fourth-quarter 2022 results, with four of the five analyzed self-storage REITs beating their respective FFO-per-share estimates.

Public Storage, the largest self-storage REIT by market capitalization, reported FFO at $4.16 per share, compared to a consensus estimate of $3.97 per share.

* Click here to create email alerts for future Data Dispatch articles.

* For further earnings analysis, try the Real Estate Beats & Misses Excel template.

All six communications and datacenter REITs reported FFO per share below analyst estimates.

S&P Global Market Intelligence calculated communications REIT American Tower Corp.'s FFO at $1.31 per share for the quarter, 48% below its consensus estimate of $2.52 per share. The large discrepancy stemmed from foreign currency exchange rate fluctuations, which drove a loss of $661.9 million in the period. American Tower did report AFFO of $2.46 per share for the quarter, a metric more representative of the REIT's incoming cash flow.

Biggest beats, misses

In addition to Braemar Hotels & Resorts and Sunstone Hotel Investors, office REIT Vornado Realty Trust was also among the largest beats for the quarter, exceeding its consensus FFO estimate by 35.8%.

Other prominent beats included diversified W. P. Carey Inc. and single-tenant retail REIT Getty Realty Corp., which topped their FFO-per-share estimates for the quarter by 34.9% and 26.0%, respectively.

Multifamily-focused Veris Residential Inc. posted the biggest miss, reporting core FFO of 5 cents per share, 61.5% below its consensus estimate. Speaking on an earnings call, CFO Amanda Lombard said Veris Residential's transition to a pure-play multifamily REIT is driving variance in earnings in the short term, with the sale of highly levered assets with high capital requirements resulting in depressed earnings.