S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Nov, 2021

By Karin Rives

| An LNG tanker is passing through the Singapore Strait. Source: IgorSPb/Getty Images News via Getty Images |

The eye-popping financial promises made Nov. 3 at the COP26 climate summit in Glasgow, Scotland, could shift global energy markets — and, it appears, with some unintended consequences.

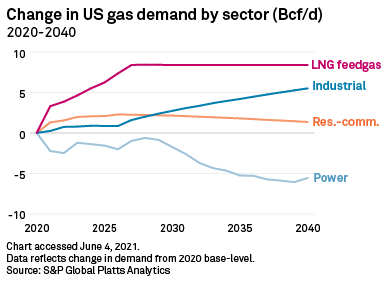

With energy needs still growing in nations like India and China, already-booming U.S. exports of liquefied natural gas could skyrocket to replace some of the coal-fired generating capacity that will be phased out, analysts predicted. Neither the Biden administration nor other leaders at COP26, nor investors, have thus far signaled that they want natural gas production curtailed.

The global climate efforts could result in more drilling and fracking for natural gas in the U.S., boosting the industry and bringing new jobs and revenue. But it would also result in more carbon emissions from states like Texas and Pennsylvania — all to help other nations wean themselves off coal.

"Asia continues to demand more LNG, the U.S. is happy to supply it, and to the maximum extent possible seems likely to continue doing so," said Kevin Book, managing director of ClearView Energy Partners. "And if you look at investors and their portfolios, it's hard for them to put tens of trillions of dollars to work without buying a little bit of gas."

The Glasgow Financial Alliance for Net Zero announced Nov. 3 at the COP26 climate conference that it now has 450 private capital firms representing $130 trillion committed to financing the global energy transition. Philanthropies and development banks said the same day that they have lined up $10.5 billion to help emerging economies phase out coal.

Samantha Gross, director for the Brookings Institution's Energy Security and Climate Initiative, agreed that many nations that today depend heavily on coal-fired power plants for their energy needs will need to rely on natural gas for some time as they seek to decarbonize their economies. That will benefit U.S. exports of LNG, Gross said.

"Eventually," Gross added, "uncontrolled gas-fired power becomes problematic for power generation too, as it is also a fossil fuel, just a less carbon-intensive one."

Economic opportunities, more pollution

Burning natural gas to produce electricity generates about half the emissions of a coal plant. The extraction and processing of natural gas have additional environmental impacts.

Natural gas production systems in the U.S. released nearly 195 million metric tons of greenhouse gas emissions in 2019, rising 4.5% from the previous year, according to the U.S. Environmental Protection Agency's latest greenhouse gas inventory. That is equivalent to driving 42 million passenger cars for a year.

Methane emissions, which the Biden administration seeks to tackle with new rules proposed Nov. 2, made up the bulk of greenhouse gas emissions from the sector. Methane traps 84 times more heat in the atmosphere than carbon dioxide during a 20-year period, which is why it is considered key to slowing climate change.

Other pollutants from the industry include ground-level ozone, or smog, and other air pollutants that affect public health. A recent Stanford University study of oil and gas wells in California going back 14 years found that people living within 1.5 miles of oil and gas wells are more likely to suffer from preterm birth, asthma and heart disease.

California Gov. Gavin Newsom ordered a rulemaking in 2021 to ban new hydraulic fracturing permits in the state by 2024 as part of California's ambitious goal to decarbonize by 2045. So far, however, such bans have done little to sour the outlook for U.S. LNG exports, and a national ban is not yet in the picture.

"Let me be clear," U.S. President Joe Biden said shortly after getting sworn into office in January, "we're not going to ban fracking."

Natural gas production and processing for LNG exports could add up to $73 billion to the U.S. economy and create more than 450,000 jobs by 2040, according to the trade group Center for Liquefied Natural Gas, citing a 2019 study conducted on behalf of the U.S. Energy Department.

"We believe that LNG exports will benefit global climate goals, not the other way around," Charlie Riedl, the group's executive director, said in an email. "LNG and natural gas will be vital in creating a clean energy future."

Producers are actively trying to reduce emissions associated with natural gas drilling and processing, Riedl noted.

But the Natural Resources Defense Council estimated that LNG exports could generate 130 million to 213 million metric tons of new carbon emissions in the U.S. by 2030. That would be enough to reverse the country's decline in greenhouse gas emissions over the past decade, the group said.