S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jan, 2022

By Zach Fox and Ronamil Portes

Several banks said they would cut overdraft fees this week amid growing regulatory scrutiny and competitive pressures from fintech start-ups.

Wells Fargo & Co. and Bank of America Corp. each announced changes on Jan. 11. Wells Fargo's move will eliminate transfer fees for customers enrolled in overdraft protection while also nixing non-sufficient funds fees. Bank of America said it would cut its overdraft fees to $10 from $35, as well as eliminating the transfer fee associated with its overdraft protection service known as "Balance Connect."

The moves follow JPMorgan Chase & Co.'s announcement in December 2021 that it would provide a $50 "overdraft cushion," meaning customers would not be charged if their account is overdrawn by $50 or less. JPMorgan will also allow customers until the end of the next business day to bring their balance within the cushion, as well as allowing customers to access direct deposits two business days early.

It is not just the megabanks moving away from overdraft. Several large regional banks, including Ally Financial Inc., Capital One Financial Corp., PNC Financial Services Group Inc., Cullen/Frost Bankers Inc. and more, cut or eliminated overdraft fees last year. And Flushing Financial Corp., a New York-based community bank with $8 billion in assets, announced this week it would eliminate overdraft, insufficient funds and transfer fees on checking accounts.

"The tide has turned," said Todd Baker, senior fellow at Columbia University and managing principal of Broadmoor Consulting, in an interview. "It's only a matter of time before it becomes standard practice to either not offer overdraft at all or offer modified plans that are fairer to customers."

The flurry of moves come as regulatory and competitive pressures are building on banks to move away from a costly service that is disproportionately used by financially vulnerable customers. Politicians have taken big bank executives to task over their overdraft policies at congressional hearings, and the Consumer Financial Protection Bureau issued a report in December 2021 that showed banks were still heavily dependent on overdraft revenue, pledging stepped-up supervisory and enforcement scrutiny of banks dependent on the fees.

In addition to pressure from policymakers, neobanks — fintechs that offer banking services primarily through mobile and digital channels — have amassed significant deposit bases. The neobanks have attracted customers, in part, by offering consumer-friendly policies such as early access to funds from direct deposits or allowing cushions as high as $200 before charging an overdraft fee.

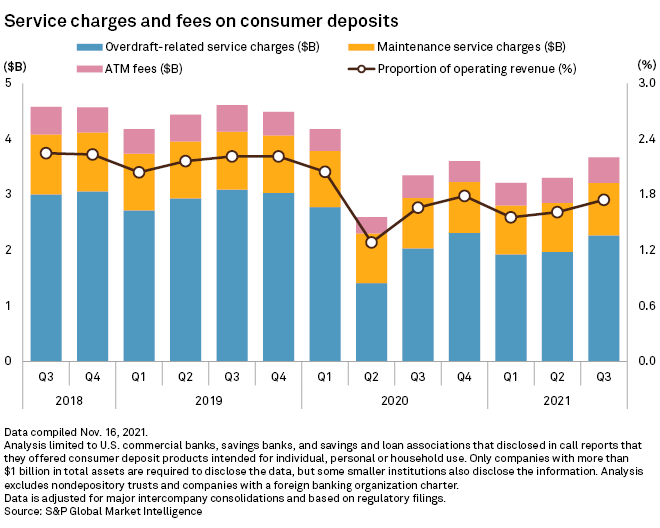

Overdraft revenues plunged near the onset of the COVID-19 pandemic as a wave of stimulus checks and reduced spending buoyed consumers' deposit accounts. While the fees have somewhat recovered in more recent quarters, overdraft revenue was still down 27% from pre-pandemic levels as of the 2021 third quarter, the most recent data available.

"The pandemic has had a very significant effect because it heightened the awareness that a whole group of people — particularly the frontline workers who couldn't stop working — had pretty constrained finances and were often subject to overdraft," said Corey Stone, senior advisor for the Financial Health Network, in an interview. A June 2021 report from the Financial Health Network, a nonprofit that produces research on unbanked and underbanked households, found that in 2020, low- to moderate-income households were 1.8x more likely to report having overdrafted, compared to higher-income households. Black households were 1.9x more likely to overdraft than white households, and Latino households were 1.4x more likely than white households to overdraft.

For banks, the shifting landscape will have financial repercussions. Bank of America said its latest change, along with other changes in recent years, will reduce its overdraft fee revenue by 97% from 2009 levels. Bank of America's service charges, which include fees beyond overdrafts, will be flat to down 5% in 2022 and 2023, wrote Ken Usdin, an analyst with Jefferies LLC, in a Jan. 11 note. Usdin estimated Wells Fargo would still see 3% year-over-year growth in its deposit-related fees in 2022 as growth in commercial-related fees offset the decline in fees on consumer accounts.

Community banks tend to be more reliant on overdraft revenue than larger banks, making it more likely smaller banks will take longer to adjust their practices. But with the large banks slashing fees and fintechs gaining market share with low- or zero-overdraft products, change could come quickly.

"Don't be surprised if [Bank of America's announcement] unleashes a parade of similar announcements in the weeks ahead," said Greg McBride, chief financial analyst for Bankrate, in a statement.

While overdrafts hit financially vulnerable households hardest, the product does provide a service — short-term credit — to cash-strapped consumers. Lobbyist groups representing banks and credit unions on Jan. 13 sent the CFPB a letter expressing concern over the latest overdraft report, noting that some consumers use and value the product.

As banks sunset their overdraft products, there will likely be alternative products that grow in popularity to meet demand, Baker said. He tabbed earned wage access as a likely beneficiary. Under an earned wage access product, consumers pay a nominal fee of $1 to $2 to gain early access to their forthcoming paycheck. Currently, nonbanks are the largest players in the space, Baker said.

"But there's no reason banks can't do it," Baker said. "There is very little or no credit risk for the provider."