S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Oct, 2021

By Yuzo Yamaguchi and Marissa Ramos

Mitsubishi UFJ Financial Group Inc. may follow the $8 billion planned sale of its U.S. retail banking arm with divestments at home and in Vietnam as Japan's largest megabank works to cut costs, stabilize risk assets and accelerate digitalization.

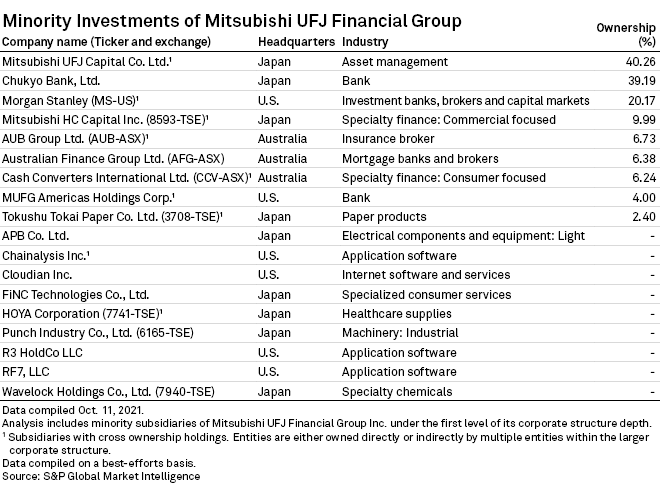

The lender, also known as MUFG, will likely consider selling its at least 39.19% stake in Japanese regional lender The Chukyo Bank Ltd. and its 19.73% interest in Vietnam Joint Stock Commercial Bank for Industry and Trade, or VietinBank, according to four experts who spoke to S&P Global Market Intelligence. The Tokyo-based bank last month agreed to sell its U.S. retail arm to U.S. Bancorp.

"The sale [in the U.S.] probably won't be the end of their divestment program,” said Toyoki Sameshima, a senior analyst at SBI Securities Co. The analyst added that other assets that bring little synergy to the bank could be sold off to free up cash.

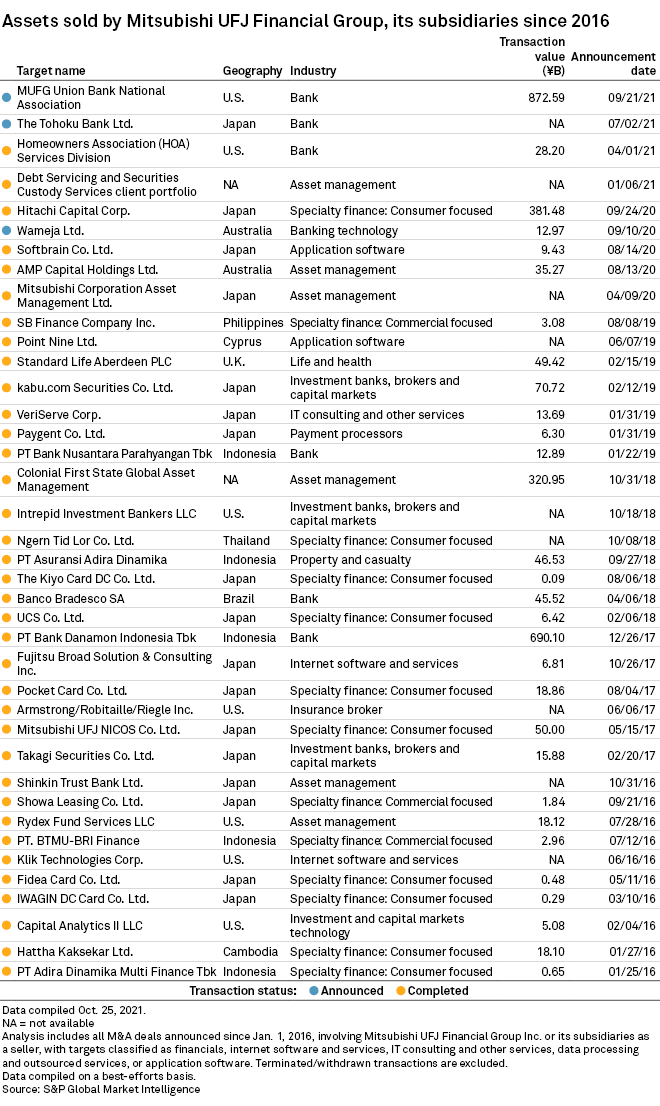

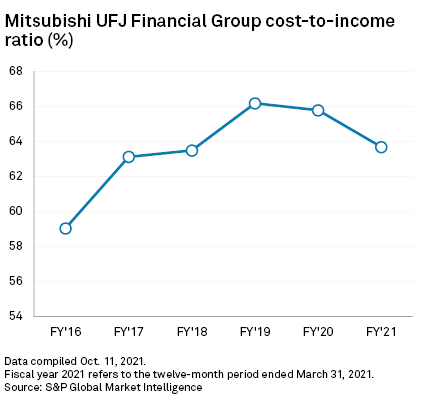

Ditching more noncore assets, potentially including stakes in other regional Japanese lenders, could support MUFG’s three-year plan to cut its cost-to-income ratio and risk-weighted assets, and shift further into digital banking in Japan and overseas markets, including Southeast Asia. The Japanese lender has already struck at least ¥2.745 trillion of asset sales since early 2016, including the recent U.S. deal, as it contends with cost and regulatory capital management requirements, alongside ultralow interest rates and weak loan demand in its home market.

The U.S. sale "won't be the end of our review," an MUFG spokesman said. The bank will continue to assess other operations at home and abroad for possible divestments, the spokesman said, without elaboration.

Asset sales continue

The stake in Chukyo Bank is the megabank's only equity-method investment in regional banks. MUFG's influence over the regional bank, through providing expertise in risk and asset management and being the agent for Chukyo Bank's customers seeking business expansion overseas, does not lead to significant synergy, analysts said.

Chukyo Bank's struggle with weak profitability and rural depopulation has made ownership less attractive for MUFG. In February, it unveiled a plan to reduce its employees by about a third through a voluntary redundancy by the fiscal year ending March 2024, which is a radical action in the Japanese banking sector where most lenders rely on attrition to cut their headcounts.

"I don’t see a strategic reason for MUFG to hold its equity-method stake in Chukyo Bank," said Michael Makdad, an analyst at Morningstar.

A Chukyo Bank spokesman said he was not aware of potential divestment by MUFG.

Meanwhile, MUFG's ownership in other regional banks are all passive investments. The company has at least a 5.77% stake in The Chiba Bank Ltd., an approximately 2.10% stake in The Shizuoka Bank Ltd. and an approximately 1.66% stake in The Hyakugo Bank Ltd.

In recent years, the megabank has been trimming its ownership in regional banks, which have been struggling to stay profitable for years due to rural depopulation. In 2017, MUFG sold its entire 6.85% stake in The Aichi Bank Ltd. and reduced its stake in Hyakugo Bank from 3.98%.

Japanese megabanks will not be "deeply involved" in regional lenders, citing weak profits and synergy outlooks, Yasuyuki Kuratsu, CEO of Research & Pricing Technology, an independent think tank in Japan.

In addition, MUFG may consider disposing of its interest in banks in Vietnam, Morningstar’s Makdad said. Vietnam's economy is expected to recover at a much slower pace than previously thought, hit by recurring waves of the COVID-19 pandemic.

"I didn’t understand the strategic rationale ... unless it leads to something else further down the road, such as being allowed to purchase stakes with more control," Makdad said. Any single foreign investor is allowed to own up to 20% of any commercial bank in Vietnam.

VietinBank could not be reached for comment.

Freeing up cash

Further asset sales will also free up more cash for the megabank to ink new acquisitions to speed up digitalization, the bank's latest focus area, analysts added.

The bank said earlier it plans to shore up its digital offering, marking a shift from mostly brick-and-mortar operations. A recent deal was MUFG taking nearly 5% of Singapore-based ride-sharing company Grab Holdings Inc. for $706 million in 2020. The investment gives the bank access to the growing customer base in Southeast Asia as well as expertise in artificial intelligence of the company, which is also running financial technology payments and lending services.

“I do think it’s possible for MUFG to invest more in digital banking in Southeast Asia following its initial investment in Grab,” Makdad said. “That’s probably likely in the next year or two, based on the trends in the industry.”

As of Oct. 26, US$1 was equivalent to ¥114.23.

Segment