S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Aug, 2022

By Camellia Moors

|

A copper mine in Democratic Republic of Congo. Major metals producers reported significant inflationary impacts across their portfolios in the first half of 2022. Source: Per-Anders Pettersson/Getty Images News via Getty Images |

Rising costs for labor, energy and equipment and continued supply chain constraints created a snowball effect of complications for mining companies in the second quarter.

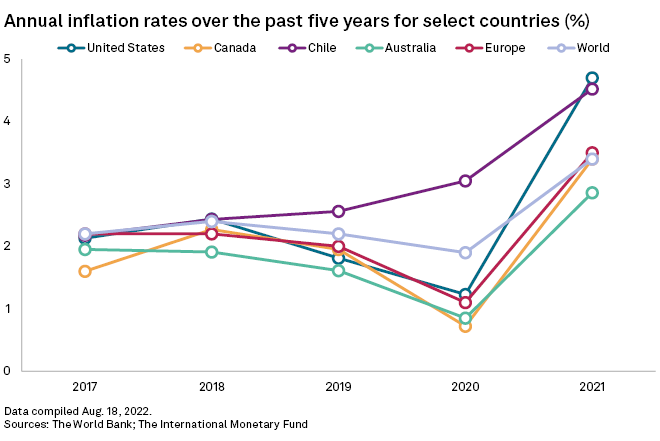

Global inflation in consumer prices is averaging 7.4% in 2022, according to the International Monetary Fund. This has resulted in lower equity valuations of mine developers, some stunted metals prices in response to interest rate hikes intended to curb inflation, and limited debt and equity issuance for new projects.

Some companies implemented cost-cutting measures and shifted earnings guidance in response. And while some mining executives think that inflation has peaked, so have once-soaring metals prices, which cushioned miners from increasing expenses in the early part of the year.

"We expect inflationary impacts on diesel, electricity and contractor costs to continue to increase operating costs for the remainder of the year," Peter Rockandel, president and CEO of base metals producer Lundin Mining Corp., said in the company's second-quarter earnings call.

Energy costs continue to grow

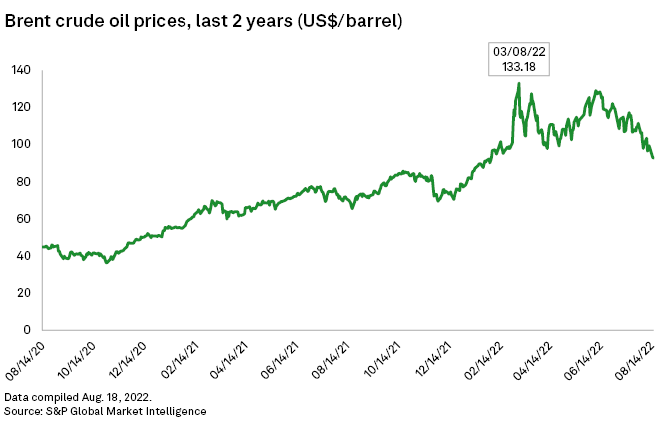

Oil prices have largely been on the rise in 2022 compared to the previous two years with spot prices for Brent crude hitting $133.18 per barrel in early March and remaining above $100/b.

Alberto Zuleta, CEO of South Africa-based gold producer AngloGold Ashanti Ltd., attributed approximately 40% of the company's inflationary impact in the first half of 2022 to rising diesel prices. Teck Resources Ltd. President and CEO Donald Lindsay took that further, saying half of Teck's 14% year-over-year increase in operating costs was driven by diesel cost increases. The change pushed the diversified Canada-based miner to increase its unit cost guidance for the rest of the year for its copper, zinc, steelmaking coal, and bitumen businesses even as the company achieved record profits in the second quarter.

India-based steel producer Tata Steel Ltd. will see cost impacts from rising oil prices for years to come.

"Energy inflation is a concern," Thachat Viswanath Narendran, CEO and managing director of Tata Steel, said in a July 26 earnings call. "If I look at what we are going to spend this year compared to what we were spending maybe two years back, it's about three times [more] simply because of gas prices going up."

In the second quarter, Tata Steel reported a 35% quarter-over-quarter increase and a 147% year-over-year increase in the cost of materials consumed.

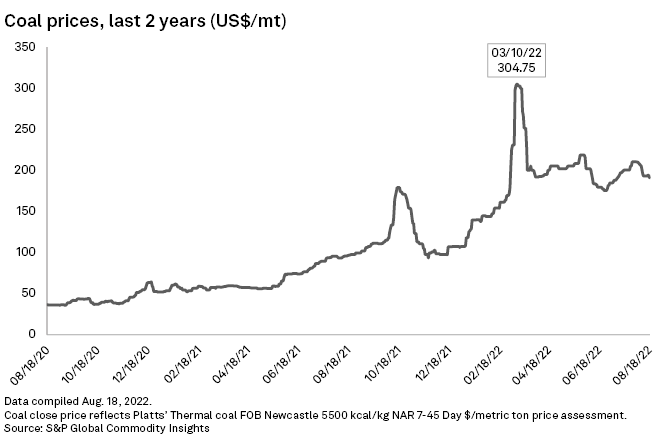

Coal prices have also risen in the past two years, with spikes in 2022 driven largely by European demand in response to supply constraints resulting from the Russia-Ukraine conflict. Thermal coal, used in electricity production, experienced a two-year price peak March 10 at $304.75 per metric ton.

Changing labor, equipment costs

Inflation adjustments created an 8% increase in labor costs in the second quarter, ICL Group Ltd. President and CEO Raviv Zoller said in a July 27 earnings call.

Newmont Corp. President and CEO Thomas Palmer cited an increasingly competitive labor pool combined with inflationary labor pricing as key aspects of the price pressures faced by the company. Newmont's profits fell to $387 million for the quarter, down from $650 million a year earlier, partially in response to these pressures.

Other companies reported that COVID-19 restrictions and outbreaks affected their performance.

Nicolaas Johannes Muller, CEO and executive director of Impala Platinum Holdings Ltd., said in a March earnings call that Impala Platinum is "carrying 7% additional labor" to make up for employee absences related to the virus.

Miners also reported increased prices for machinery and raw materials in the quarter.

Buffered by high metal prices

Metal prices remained high in the second quarter, though they were down from their peaks. The S&P GSCI All Metals Capped Commodity index rose 23.9% from the beginning of 2022 to reach a year-to-date peak of $375.12 on March 7 before steadily dipping over the last five months.

Prices for base metals such as nickel and zinc briefly surged earlier in 2022 amid supply concerns, enabling companies such as BHP Group Ltd. to recoup some of the costs incurred by rising inflation in the first two quarters.

"[BHP's] EBITDA benefited from higher prices for most of our core commodities. ... Copper and nickel prices were up by 9% and 43%, respectively," BHP CFO David Lamont said on a second-quarter earnings call. "In copper, the increase in EBITDA to $8.6 billion was driven by [these] higher realized prices."

Stephen Pearce, finance director and executive director at multinational diversified miner Anglo American PLC, concurred with Lamont's assessment.

"Part of [the] inflationary environment has driven up higher commodity prices, and as we noted last year, that benefits our revenue line quite significantly," Pearce said during Anglo American's half-year earnings call.

Still going up?

Executives expressed dissenting opinions about the future of inflation. Some believe that global inflation rates have peaked, generating confidence in the sector that has reversed some commodities’ monthslong price declines. In the week ended Aug. 12, for example, nickel prices increased 3.7% to $22,963.50/t, copper prices increased 2.8% to $8,085.00/t, and zinc prices went up 2.6% to $3,687.75/t.

"We think that, certainly, the signs are that things seem to be turning, and we've seen some of the key commodities [for example oil, steel-based commodities] starting to move down. So that is a sign that we think might be an indication that inflation may have peaked," Antofagasta PLC CEO Ivan Herrera said in the company's half-year earnings call.

Jonathan Price, executive vice president and CFO of Teck Resources, does not expect a significant abatement in inflationary pressures at least through the end of 2022.

"Inflationary pressures on diesel prices and other key input costs, as well as profit-based compensation and royalties, continue to put upward pressure on our unit cost guidance through 2022," Price said in Teck Resources' second-quarter earnings call.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Susan Dlin contributed to this article.