Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Dec, 2022

| Rio Tinto Group's Simandou iron ore project, Guinea, pictured in 2011. Rio Tinto and other global mining companies increasingly embed environmental, social and governance metrics into executive compensation structures. Source: Rio Tinto Group |

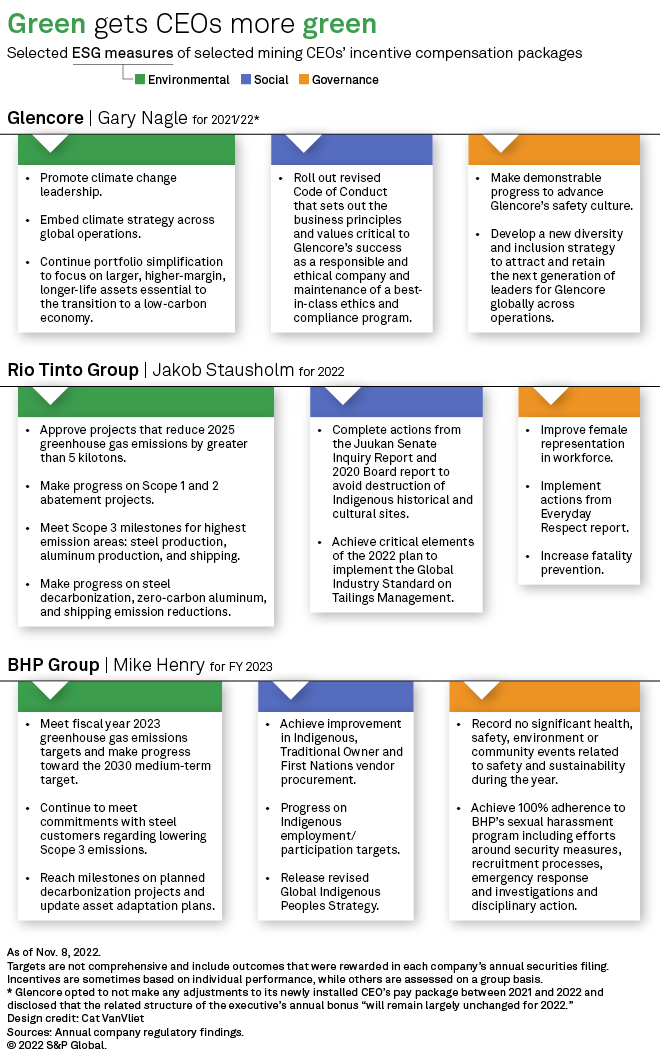

Mining companies are dangling extra cash in front of their CEOs if the executives can meet climate goals and make progress on other environmental, social and governance challenges.

Whether it is reducing emissions, keeping people safe, or resolving social and cultural problems created in the past, ESG measures are tied to the compensation of executives across the largest mining companies, an S&P Global Commodity Insights review of annual securities filings found. By connecting ESG targets to executive pay, company boards hope to improve metrics that are increasingly important to shareholders.

Employee safety concerns and high greenhouse gas emissions are both common issues among miners and relatively easy issues to benchmark and set targets against, Cohen said. About 72% of the mining companies in the study's sample linked ESG metrics to executive pay.

"When it comes to ESG issues, companies in the mining industry often find themselves under the negative spotlight," Cohen told Commodity Insights. "Perhaps because of this scrutiny, we find that companies in industries such as mining, which are susceptible to higher environmental impact, are more likely to incorporate ESG metrics in executive compensation."

Financial performance remains a much more significant portion of mining executives' incentive packages. However, ESG metrics are increasingly used as modifiers to that year-end payout.

"You have to get started somewhere to get awareness and get strategies to build [an ESG] culture starting from the top," said Wiclif Ma, an associate client partner with consultancy Korn Ferry who specializes in executive compensation packages for companies, including large miners.

Company boards, which set executive pay, have a fiduciary responsibility to consider issues that could be financially material to the firm. Increasingly, institutional investors are looking to nontraditional data metrics such as climate risk. The idea is that the right incentives can get executives to focus on areas they may not otherwise spend much time on, Cohen said.

"When you think of ESG information as financially material information — which it's increasingly being recognized as such, especially by large institutional investors — then these models are very much compatible with traditional models," Cohen said. "At the end of the day, the goal is to incentive executives to consider information that is material to the firm's underlying performance."

The number of S&P 500 companies that linked executive compensation to some form of ESG performance swelled from 66% in 2020 to 73% in 2021, think tank The Conference Board said Nov. 2. Those with compensation-linked goals specifically aimed at reducing greenhouse gas emissions nearly doubled over that same period, going from 10% to 19%, it said.

Many larger mining companies can be counted among those using executive compensation to help meet corporate climate goals. The metals and mining sector produced about 19.1% of the world's combined Scope 1 and Scope 2 greenhouse gas emissions in 2020, with emissions from coal plants making up much of the total, according to S&P Global Trucost Environmental Profile data.

Commodity Insights examined the executive incentives of the three largest publicly traded mining companies by market capitalization and found they have all added ESG targets to their CEO compensation packages. The companies, Rio Tinto, Glencore and BHP, did not respond to requests for comments elaborating on their executive compensation strategies.

Exactly how companies design incentives to hit ESG targets varies widely.

Glencore PLC CEO Gary Nagle's compensation is tied to promoting climate change leadership, embedding climate strategy across global operations and focusing the company's portfolio on assets more associated with the energy transition, nickel rather than coal, for instance, according to the company's annual report. Overall, making progress toward Glencore's 2035 climate targets accounted for about 15% of the CEO's bonus in 2021, which totaled $2.1 million in addition to his $1.1 million base salary.

Those goals are relatively vague compared to the more specific goals of Rio Tinto Group and BHP Group Ltd. laid out in their own filings. About 2.5% of Rio Tinto CEO Jakob Stausholm's short-term incentive plan bonus, for example, will depend on if he can approve and deliver projects that reduce Rio Tinto's 2025 greenhouse gas emissions by more than 5 kilotons.

BHP CEO Mike Henry can earn up to 120% of his 2023 fiscal year base salary of $1.75 million through the company's cash and deferred plan. About 25% of the plan is tied to his performance on health, environment and sustainability measures, with hitting climate change goals, including specific 2023 reduction targets, making up 10% of his incentivized activities.

Rio targets past mistakes in compensation packages

Corporate boards are also using executive compensation structures to push CEOs to fix past wrongs committed by their companies. Rio Tinto started explicitly incorporating ESG metrics into its executive short-term incentive plans in 2020, though some safety measures had previously been incorporated alongside financial goals. In 2021, the company modified the policy to allocate half of the ESG component of its short-term incentives to specific metrics such as hitting annual greenhouse gas emission reduction goals and addressing headline-making missteps by the company.

"It is not about money only," Korn Ferry's Ma said of the message that company boards hope to broadcast to stakeholders. "It is about doing something better than money, showing the world that you are socially responsible for something."

In May 2020, Rio Tinto destroyed rock shelters in an area that was a sacred site for the Puutu Kunti Kurrama and Pinikura peoples in the Juukan Gorge. The shelters held deep cultural and archaeological value as the only known inland site in Australia that evidenced continuous human occupation for over 46,000 years. In its latest annual report, the company acknowledged a need to ensure that the lessons learned from the incident are embedded in management processes and culture.

Now, if Stausholm is to collect his maximum compensation, he must complete actions directed by a Juukan Senate Inquiry Report and a report from the board on the incident aimed at avoiding the destruction of Indigenous historical and cultural sites. The company target is to complete at least 90% of those actions, and doing so is worth up to 2.5% of Stausholm's short-term incentive bonus. That bonus is capped at 200% of Stausholm's base salary, which in 2021 was £1.15 million.

"You have to get in agreement with the CEO: these are the strategic priorities that the organization will value," Ma said.

The board is also incentivizing Stausholm to take actions recommended by a report finding rampant bullying, sexual harassment and racism at the company's mining operations. According to the 2022 report, almost half of Rio Tinto employees said they experienced bullying, while 28.2% of women and 6.7% of men said they experienced sexual harassment at work.

In response to the report's findings, in 2021, a downward discretion of 5% was applied to Stausholm's short-term incentive plan, reducing the executive's payout by about £75,000 to £1.4 million. Addressing those findings makes up 2.5% of Stausholm's short-term incentive plan for 2022.

Overall, ESG metrics make up 35.0% of Stausholm's 2022 short-term incentive package, with the board heavily weighting the ESG portion of the compensation structure toward safety and fatality prevention.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.