S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Aug, 2022

By Kip Keen and Anthony Barich

| Mining executives said proposed new taxes in Chile would make the country's copper industry less competitive and potentially lower production from its mines. Source: robas/E+ via Getty Images |

Mining CEOs warned in investor calls in August that Chile must temper a proposed tax increase on copper production or risk an exodus of mining investment.

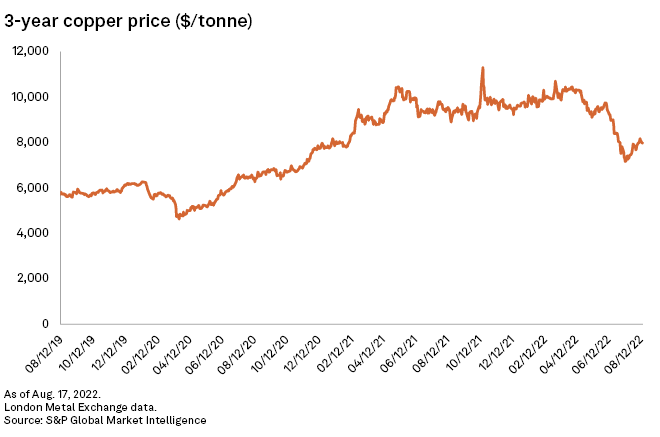

Chile's new government introduced tax reforms earlier this year that include an ad valorem tax, meaning a tax based on the value of mined copper, of 1% to 2% on companies producing 50,000-200,000 tonnes of copper per year and up to 4% on companies with production over 200,000 tonnes. Miners producing more than 50,000 tonnes annually would also be subject to a 2% to 32% tax on operating profits, using a sliding scale of copper prices between $2 and $5 per pound.

Fears over Chile's tax reform and its impact on the mining sector come amid a broader shift left in South American politics. Peruvians elected a leftist government last year and Colombians did the same this year. Both new administrations have taken tough policy positions against the mining industry, including proposals for stiffer taxes. With global demand for copper expected to increase as the energy transition takes hold, Chile could reap the benefits from its copper resources — but not if mining companies exit.

"Certainly it's going to hinder investment and potentially hurt mining volumes," said BTG Pactual mining analyst César Pérez-Novoa, who suggested a better-designed tax would target only operating profits and not gross sales through the ad valorem tax. "Things are changing here a lot. And when mining companies build everything into their operating assumptions, they may say, 'Well, maybe it's better if I do X-project in Canada or Peru.'"

|

Multiple mining executives tied investment decisions to Chile's tax reform on second-quarter earnings calls, including Freeport-McMoRan Inc., Antofagasta PLC and BHP Group Ltd., all of which have major operations in Chile. The country accounted for about 27.3% of global copper output in 2020, according to S&P Global Commodity Insights data.

"We're not going to trigger any big capital investments until we've got clarity on what the fiscal terms are, because we have to understand how well these projects will compete against other options in the [company's] portfolio," BHP CEO Mike Henry told analysts Aug. 16.

Henry lauded the "good level of engagement with industry" in Chile on the proposed changes but warned future investment could be at risk without regulatory stability.

The mining sector has been making the case to the government that "ongoing grade decline, which is a natural feature of copper mining, means that there has to be ongoing reinvestment in the industry just to stand still, let alone grow," which Henry told media on a same-day call. "If there's stable fiscal terms there and certainty provided for everybody, I think there's a big opportunity for the nation of Chile to yet unlock."

Antofagasta CEO Ivan Arriagada said the planned reforms would bring total tax rates on some miners to over 50%, making investments in projects "much more challenging" and hurting the "competitiveness of the industry locally." Arriagada, like other executives, said Antofagasta would wait to see what tax reforms may come before forging ahead with some of its investments in Chile.

"It's very important ... to keep the effective tax rate at a level in which these projects remain attractive," Arriagada said on an Aug. 11 earnings call.

The proposed tax reforms must still pass Chile's Congress, and they face fierce lobbying efforts, including from the mining sector. Pérez-Novoa said there is no set timeline for the reforms and expects discussions over them to accelerate after a Sept. 4 vote on a new Chilean constitution, which includes reforms to strengthen

A spokesperson for Canadian-headquartered Teck Resources Ltd. said in an email that the company was "closely following the discussion" and supported "a path forward that will contribute to the continued competitiveness, sustainability and growth" in Chile's copper mining sector. Teck's assets in Chile include the Quebrada Blanca phase 2 copper project.

Some analysts expect Chile to dull the bite of tax reforms over industry fears. While mining investment in Chile would "plummet" if current tax and constitutional reforms go ahead, Chile has often peddled back tough reforms aimed at miners, Paradigm Capital mining analyst David Davidson said in an email.

"While there will inevitably be some tax and royalty increases, most are hopeful they won't be that draconian," Davidson said. "Fingers crossed that will be the case."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.