S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jan, 2023

By Avery Chen and Anthony Barich

|

|

Resource nationalism is a dirty word for most Western miners, but it has enabled Indonesia to pull off what some believed unlikely — the creation of a domestic electric vehicle supply chain.

Indonesia's nickel ore bans in 2014 and 2020 have attracted foreign stainless steel, battery and car makers to build a supply chain from nickel mining and smelting to battery and even EV manufacturing. South Korea's Hyundai Motor Co. unit PT Hyundai Motors Indonesia rolled out its first domestically produced EV on March 31, and by 2024 all of the EVs it produces will use batteries and other components made in-country.

Indonesia holds about 22% of global nickel reserves and accounted for 37% of mined production in 2021, according to the United States Geological Survey. Such is Indonesia's influence on nickel markets that prices tanked in 2018 as plans emerged that China's Tsingshan Holding Group Co. Ltd. would build a major battery-grade nickel project in the country and potentially dominate the market. A year later, prices shot back up on news that Indonesia would ban raw ore exports in 2020.

"Lots of projects are breaking ground for battery and precursor material plants, and the planned manufacture of electric vehicles which was always [the government's] ultimate desire," Nickel Industries Ltd. Managing Director Justin Werner told S&P Global Commodity Insights.

Werner called the ore export ban policy "extremely successful," given that "Indonesia is now the world's second-largest steel producer as well as the largest nickel producer."

The policy has also created over 150,000 jobs in Indonesia's nickel industry, Werner said.

"Indonesia aspires to be a major player in the electric vehicle space, but despite early gains, there is much more work required for the country to achieve its ambitious target of having 2.5 million EV users by 2025," ING bank senior economist Nicholas Mapa said in a Nov. 16 note. The Southeast Asian country is still facing challenges of low production capacity and reluctance to shift to EVs, Mapa said.

"The push for EV also moves in line with President [Joko Widodo's] goal to shift away from low-value-added exports to higher-value-added finished export products," said Mapa, who expects the mining sector to benefit most during the initial stages of EV adoption.

The gross domestic product of Indonesia's mining sector is forecast to grow by 3.9% year over year through 2025 as EV requirements boost demand for raw materials such as nickel, bauxite and cobalt, according to ING.

Strong foreign investment flow

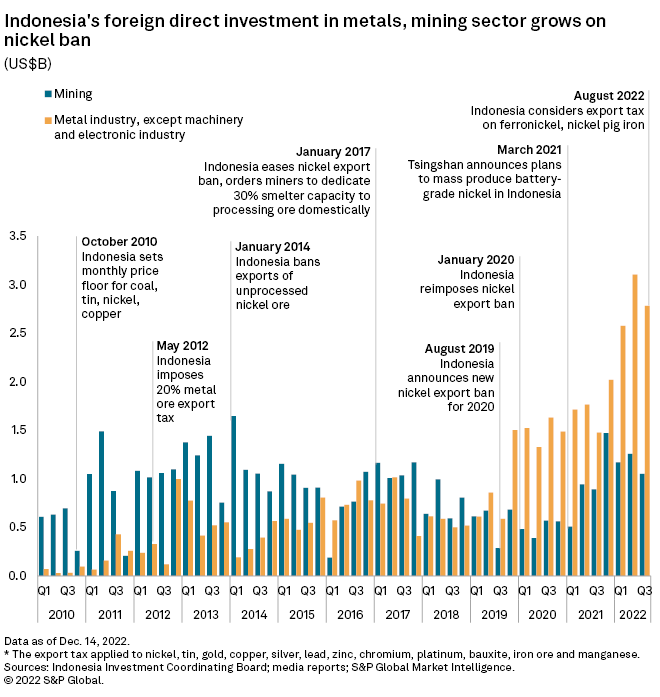

Leveraging rich nickel deposits, Indonesia's resource nationalism policies have successfully lured foreign investment in the metals and mining sector, especially those from China.

In the first three quarters of 2022, foreign direct investment in Indonesia's metals and mining sectors reached $11.9 billion, more than 10% higher than the 2021 total, according to Commodity Insights' calculation based on data from the Indonesia Investment Coordinating Board.

China's CATL has partnered with Indonesian state-owned firms PT Aneka Tambang Tbk and PT Industri Baterai Indonesia to invest $5.97 billion in an integrated battery supply chain.

Companies will likely increase investment in Indonesia longer term, as demand for nickel-rich ternary lithium batteries is expected to grow thanks to their higher energy density features, said Jared Zhu, consulting project manager at the new energy department of Shanghai Metals Market.

Zhu sees Chinese companies shifting more hydrometallurgical production to Indonesia in response to strict environmental controls and slow approval times.

Other countries are playing catch-up.

South Korea's Hyundai Motor set up a $1.1 billion joint venture with LG Energy Solution Ltd. in 2021 to build an EV battery plant in Indonesia, which could power more than 150,000 EVs per year once it starts mass production in 2024.

Japanese carmaker Toyota Motor Corp. plans to invest 27.1 trillion Indonesian rupiah in the next five years to produce EVs in the Southeast Asian country.

France's Eramet SA is studying a hydrometallurgical project with German chemical company BASF SE to produce battery-grade nickel and cobalt using laterite ore extracted from the Weda Bay mine, Eramet's joint venture with Tsingshan and state-owned PT Aneka Tambang Tbk.

Representatives of U.S. automaker Tesla Inc. recently visited Nickel Industries' Hengjaya mine, Werner said.

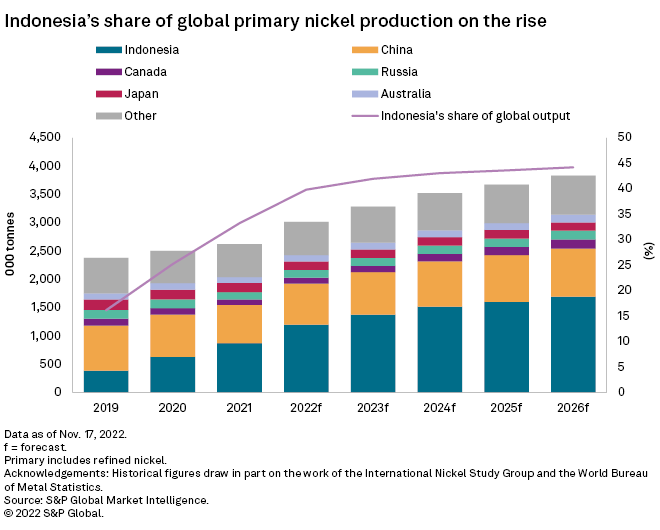

Commodity Insights' Metals and Mining Research team expects Indonesia's share of global primary nickel production to reach 44.2% in 2026, driving a surplus at that point.

ESG concerns of 'dirty nickel'

A central question about Indonesia's role in the future of EVs is whether it will follow through on its 2021 pledge at the U.N.'s COP26 climate conference in Scotland to phase out coal use by 2040. Indonesia's nickel producers have traditionally relied on coal-fired power, leading to concerns about "dirty nickel" coming out of the country, PAC Partners analyst Phil Carter told Commodity Insights.

Tesla reportedly moved ahead in August on a $5 billion deal to source Indonesian battery materials over objections from environmental groups.

"The intensifying competition for nickel among EV makers, however, may have pushed Tesla to consider using nickel products made in Indonesia, despite the country's nickel plants typically being powered by carbon-intensive coal energy," said Jason Sappor, senior analyst at Commodity Insights.

While Indonesia's nickel laterite ore requires high capital and power to convert to battery material, the country's industry and government are aware of the EV supply chain's environmental, social and governance requirements and "know they need to change," Carter said.

Vale SA unit PT Vale Indonesia Tbk has committed to a 33% cut in Scope 1 and Scope 2 emissions by 2030 on the way to net-zero by 2050, amid plans to more than quadruple the nickel it is involved in producing in the country from 80,000 tonnes now to 333,000 tonnes within three years.

Nickel Industries, meanwhile, is poised to become a top-10 global producer by mid-2023 with an annual production target of 130,000 t, Werner said. In August, the company secured a 200 MW-peak plus 20 MWh battery solar project to power its Hengjaya, Ranger and Oracle processing operations.

As of Dec. 16, US$1 was equivalent to 15,616.55 Indonesian rupiah.